December 11, 2023

Marin: December 2023 Market Stats

By Compass

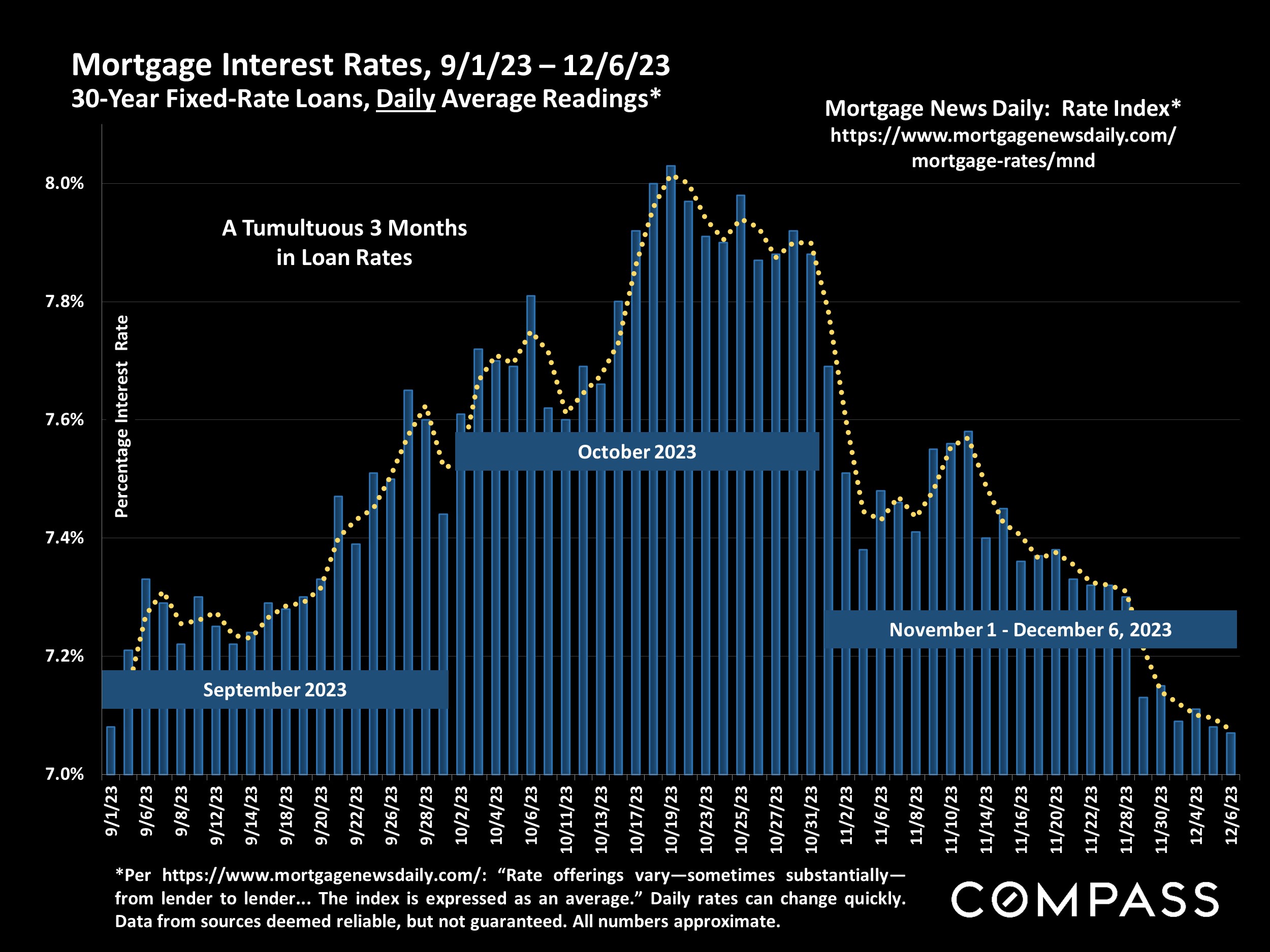

"For the sixth straight week, mortgage rates trended down, as new data indicates that inflationary pressures are receding. The combination of continued economic strength, lower inflation, and lower mortgage rates should likely bring more potential homebuyers into the market." Freddie Mac (FHLMC)

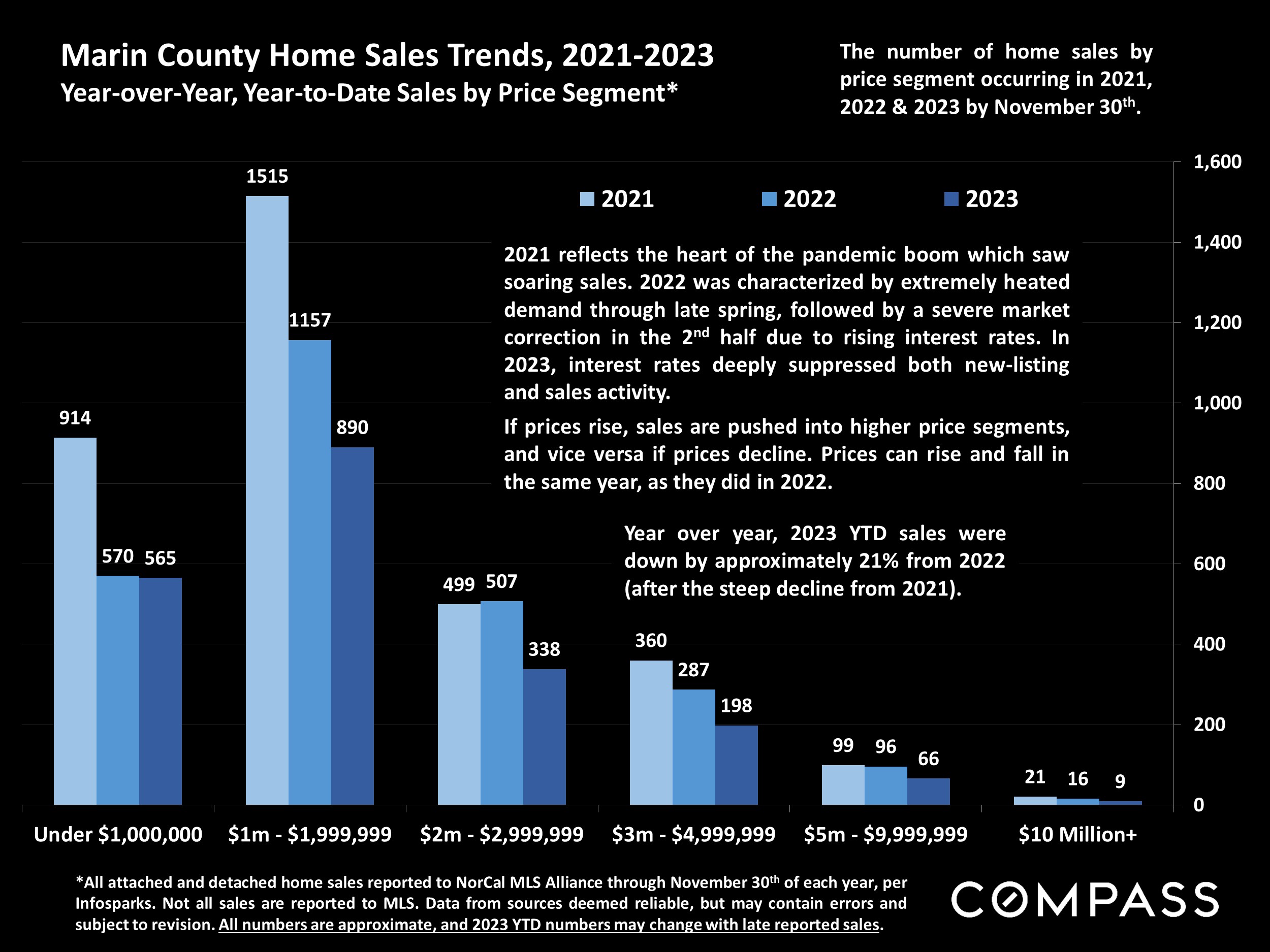

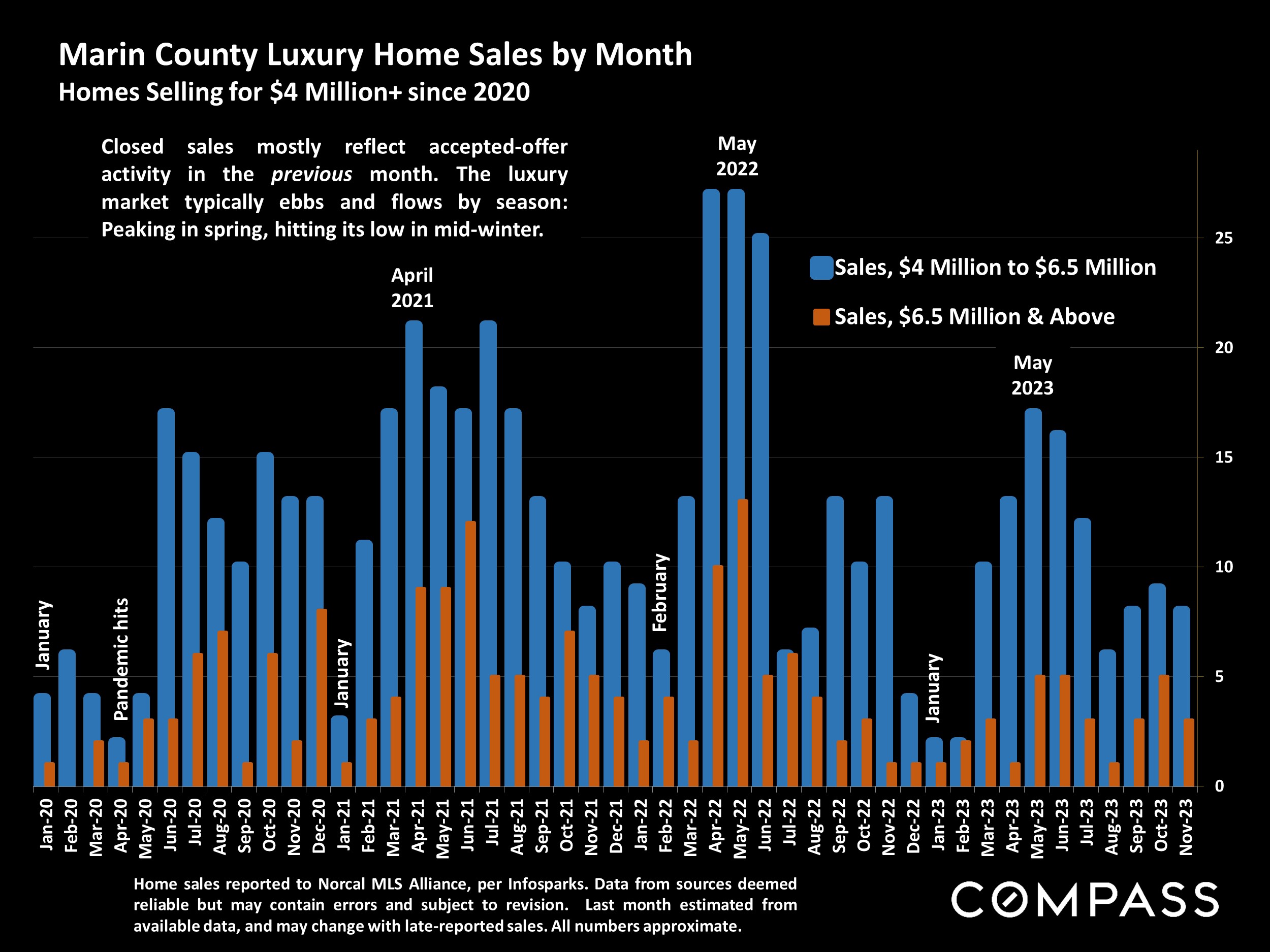

Stock and bond markets - which greatly impact household wealth, consumer confidence, and interest rates - were generally characterized by deep pessimism in October, but with significant changes in economic indicators such as inflation, and a continued pause in benchmark rate increases by the Fed, financial markets abruptly shifted to enthusiastic optimism in November. That translated into a dramatic plunge in mortgage rates, which has caused mortgage applications to increase over recent weeks.

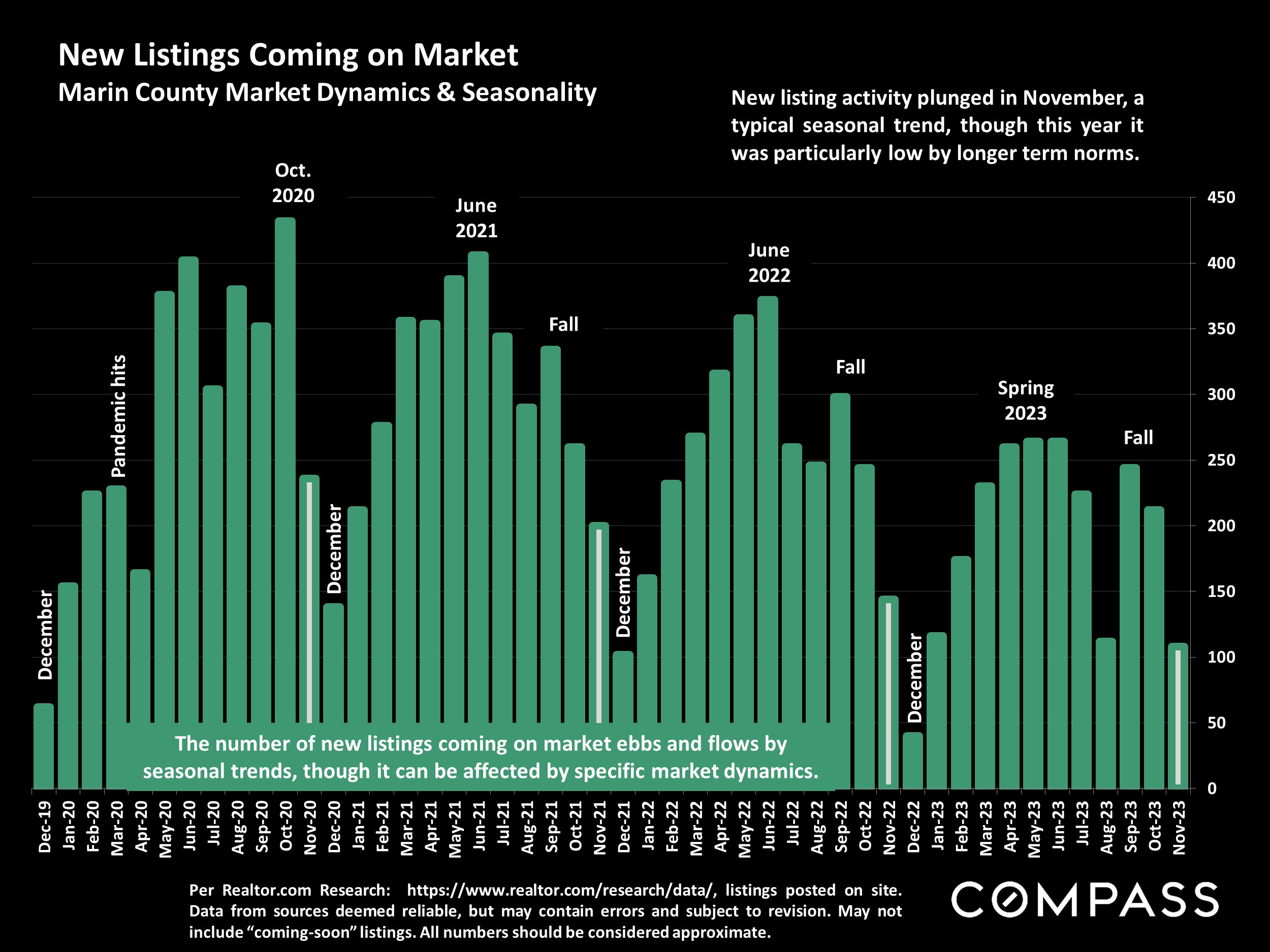

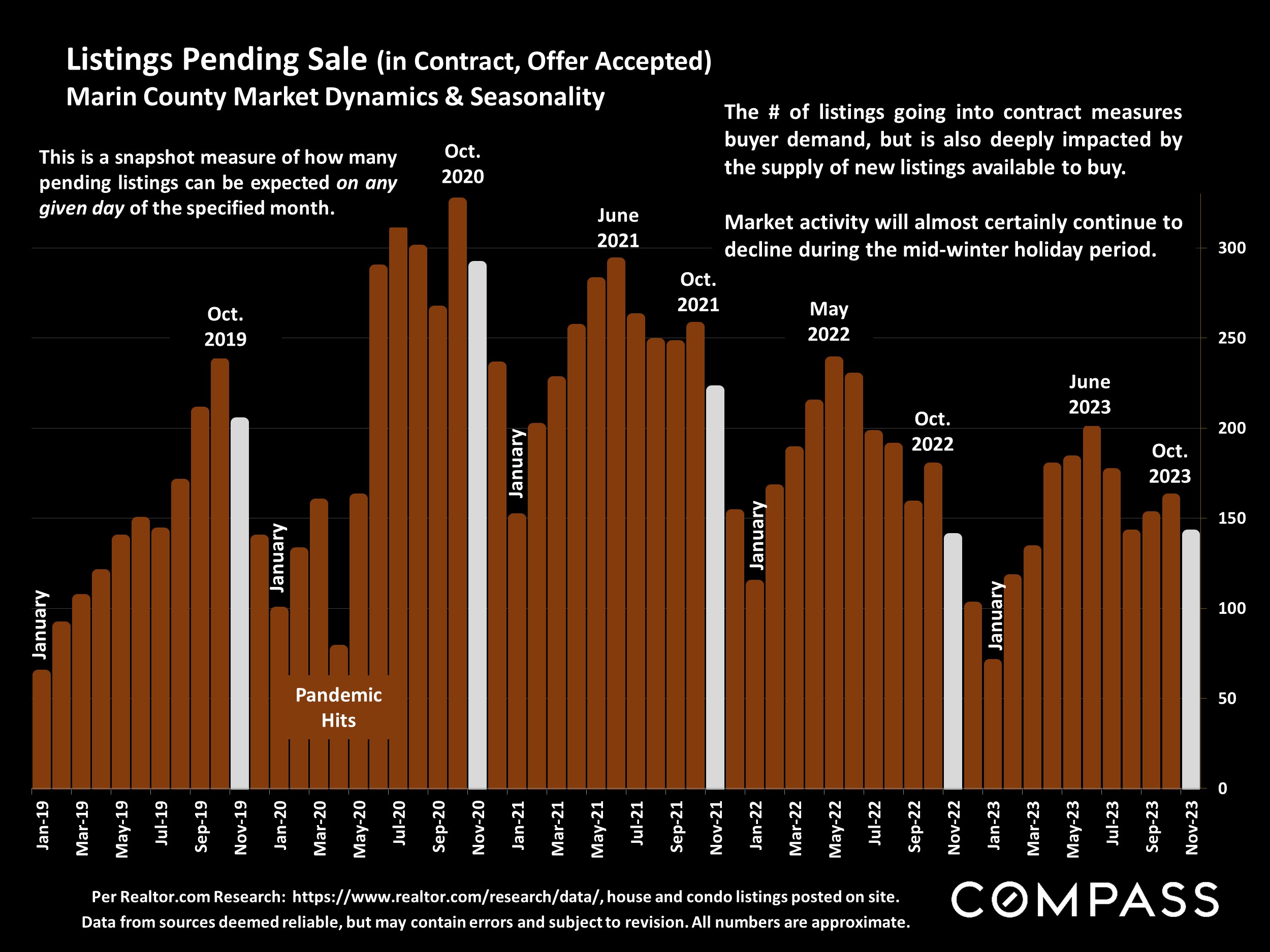

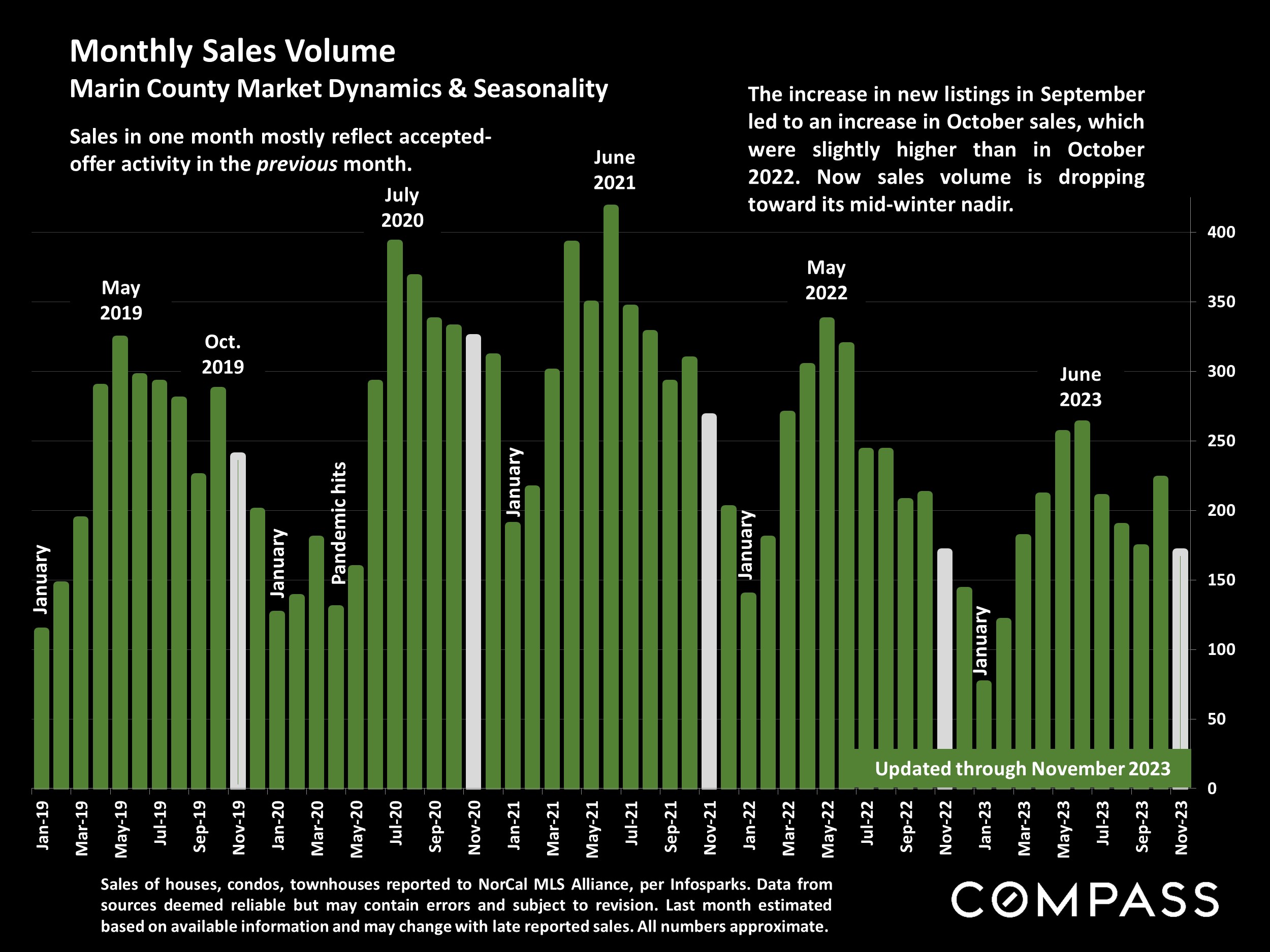

Since the homebuying process usually takes 30 to 60 days, from loan qualification and making an offer to a closed sale, sales might see a bounce in December, or - since the midwinter holiday period typically sees the annual low point in new listing (and thus sales) activity - more likely in early 2024 (subject to these positive trends continuing).

In January 2023, buyer demand saw a substantial rebound due to a similar drop in interest rates in late 2022.

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact