August 11, 2023

SF: August 2023 Market Stats

By Compass

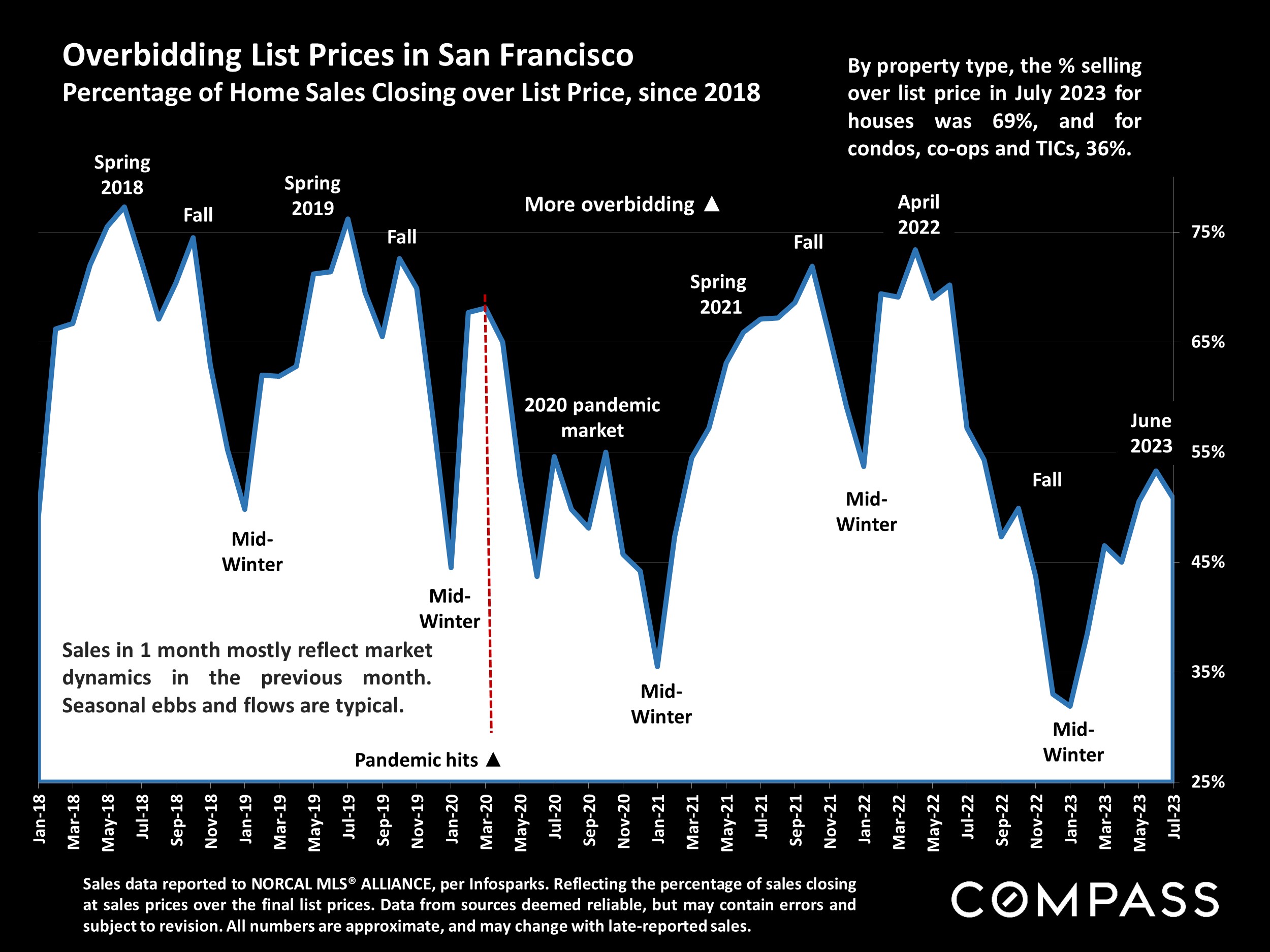

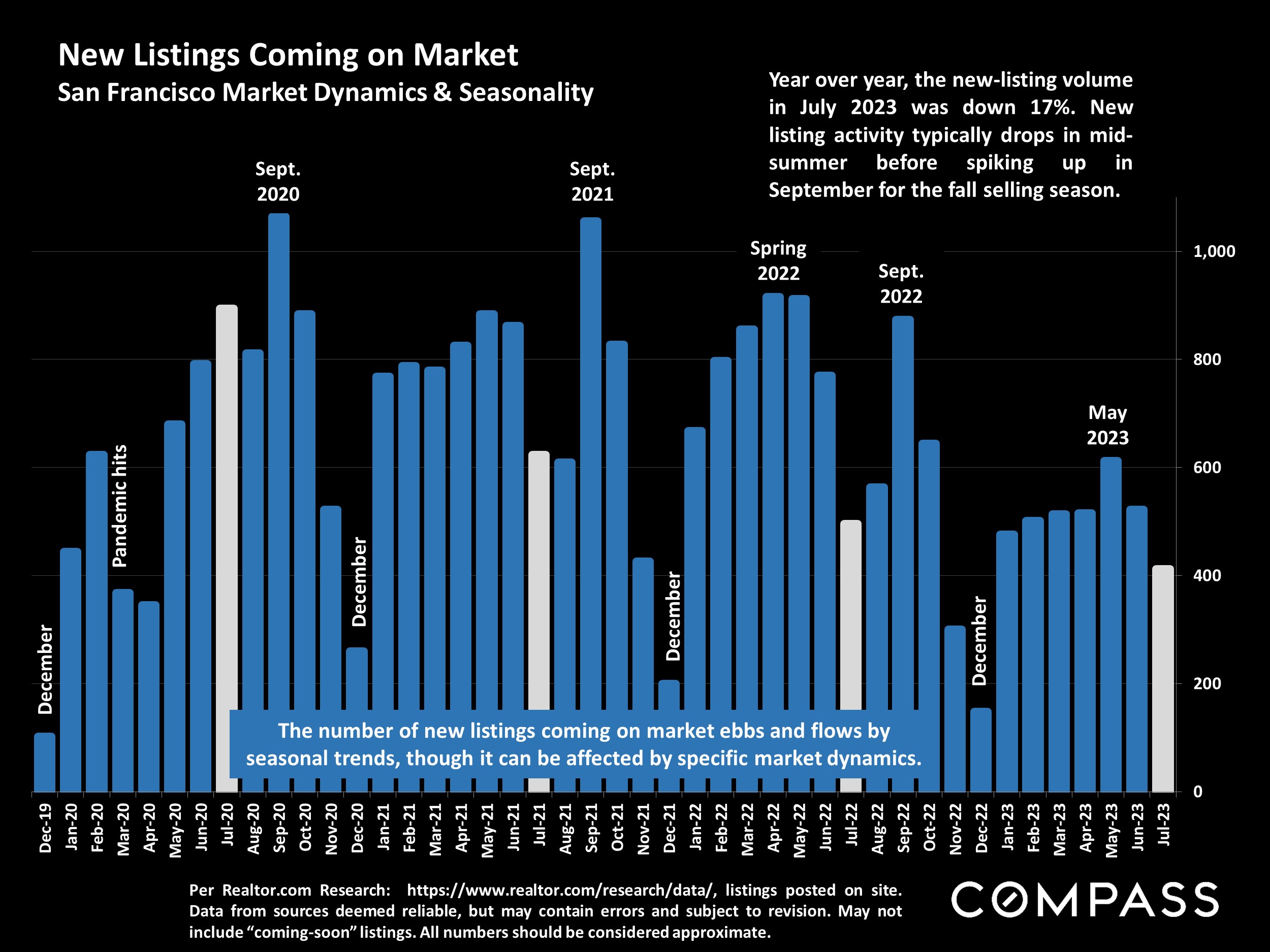

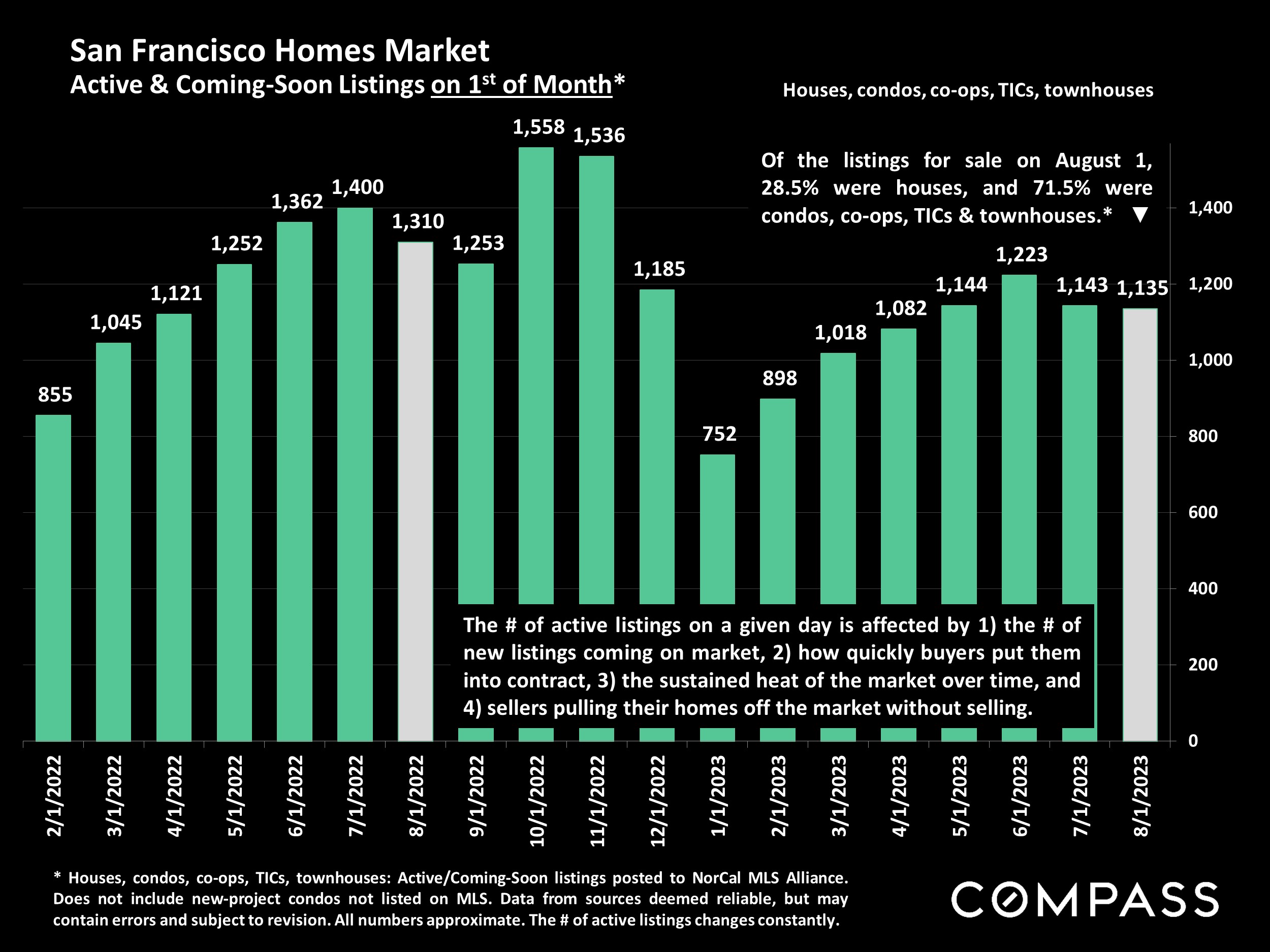

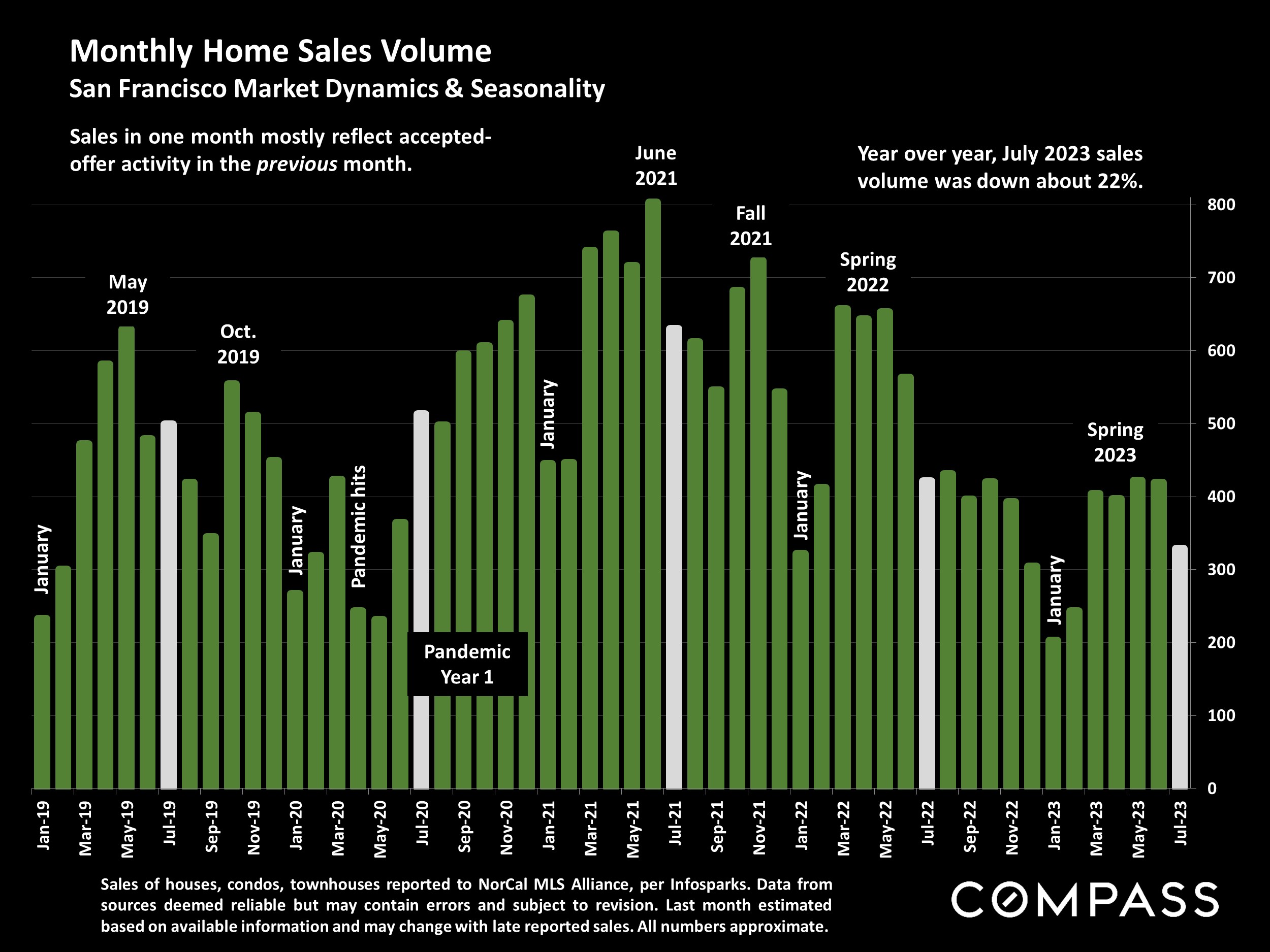

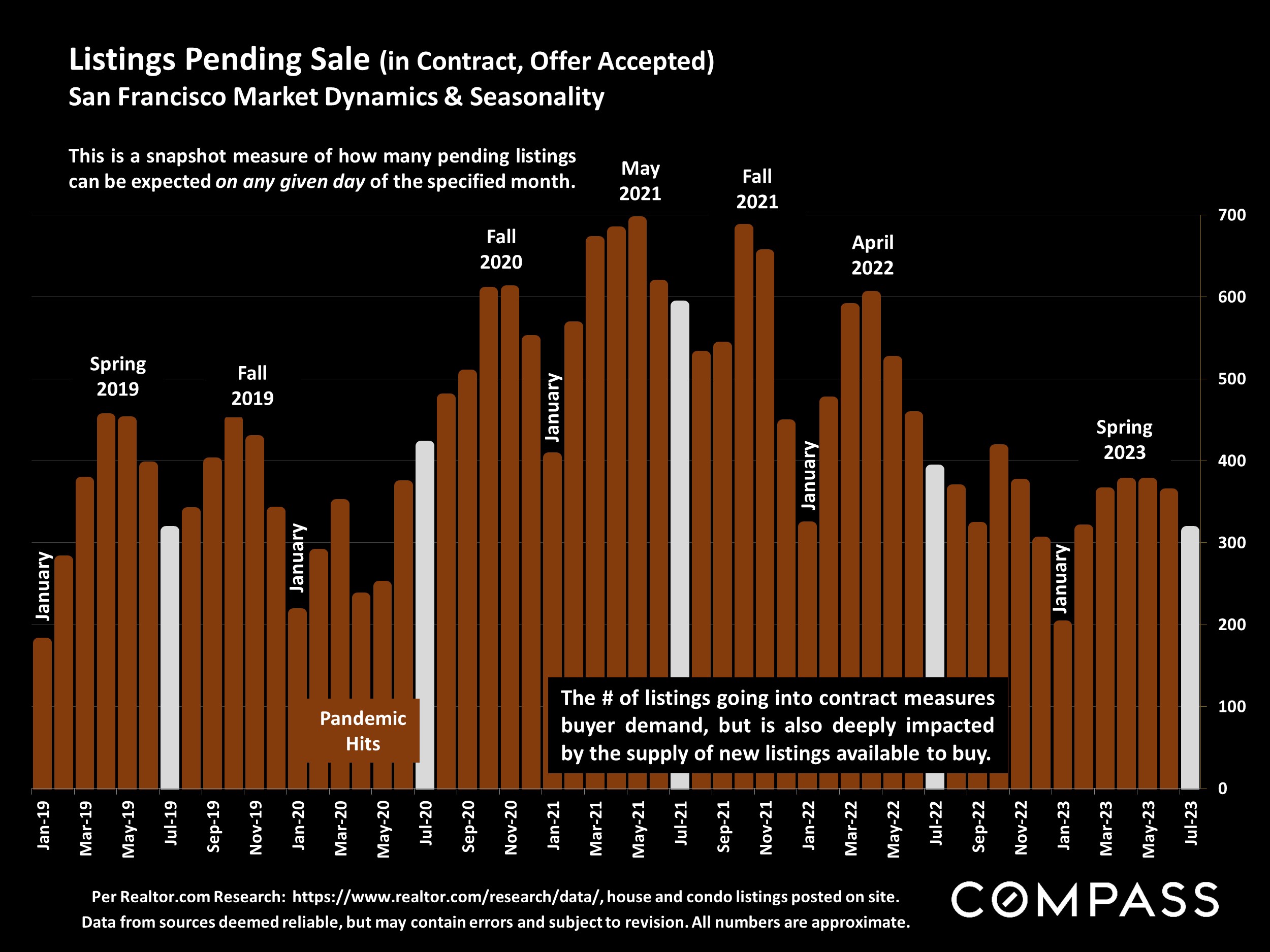

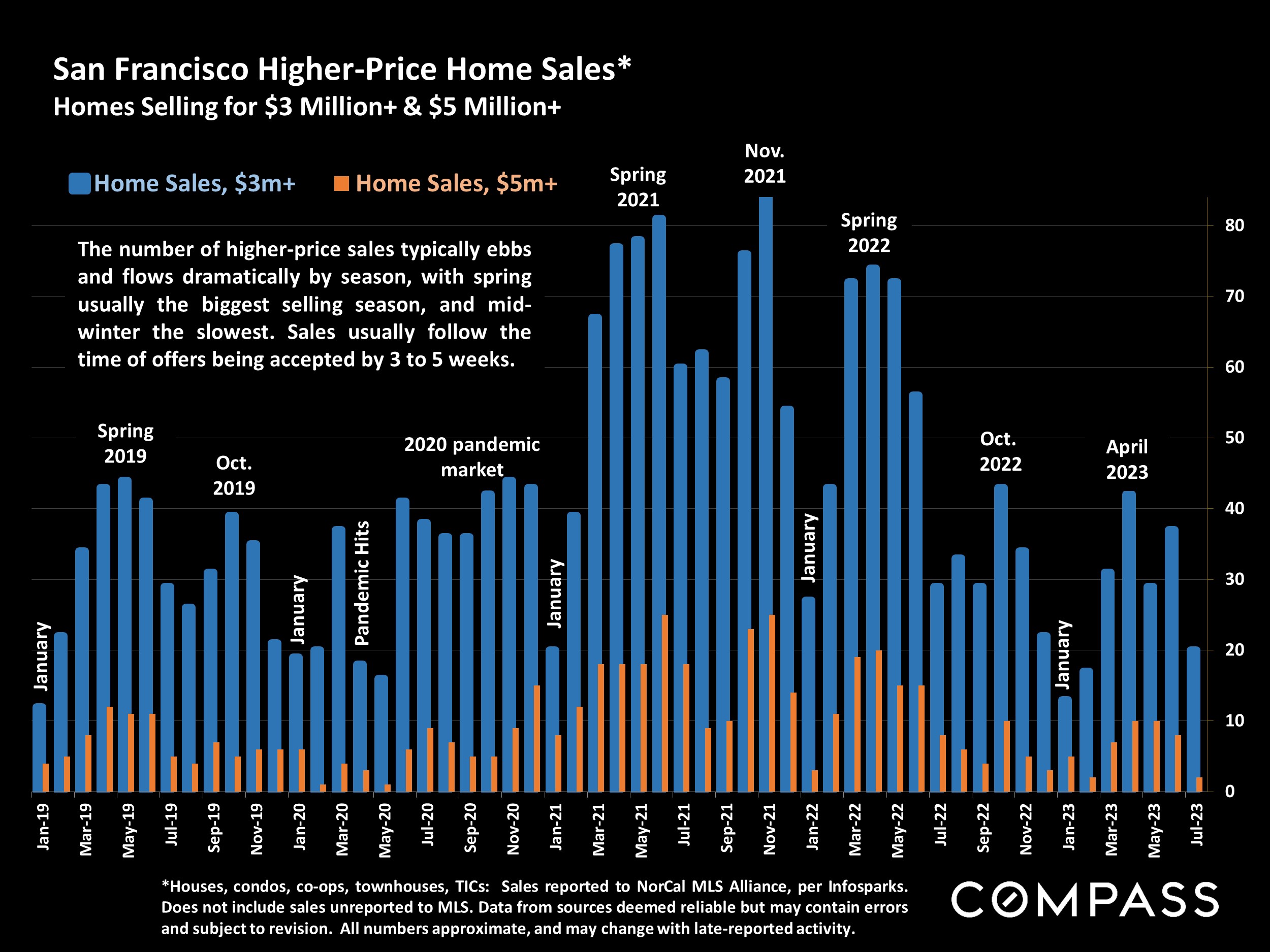

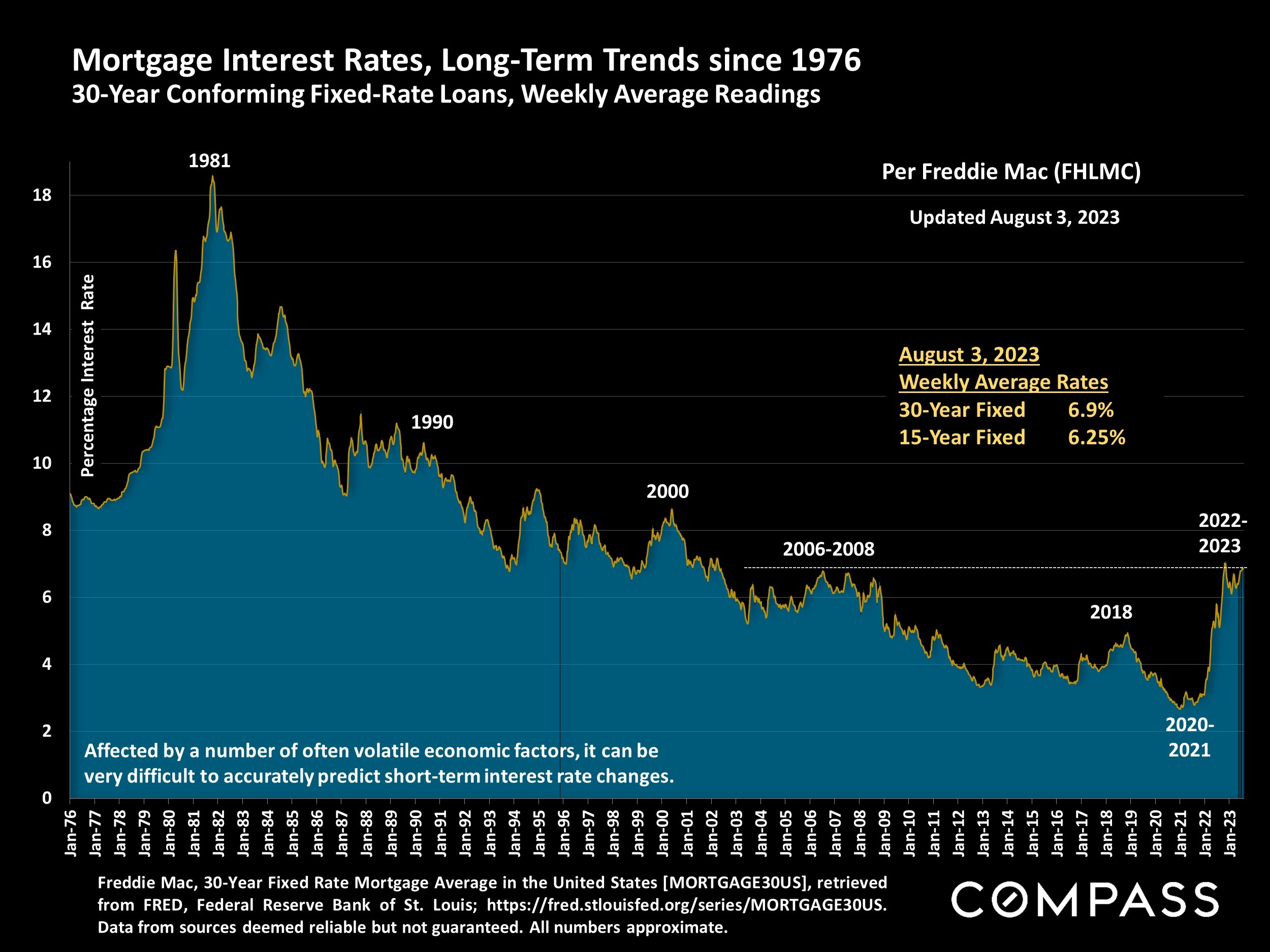

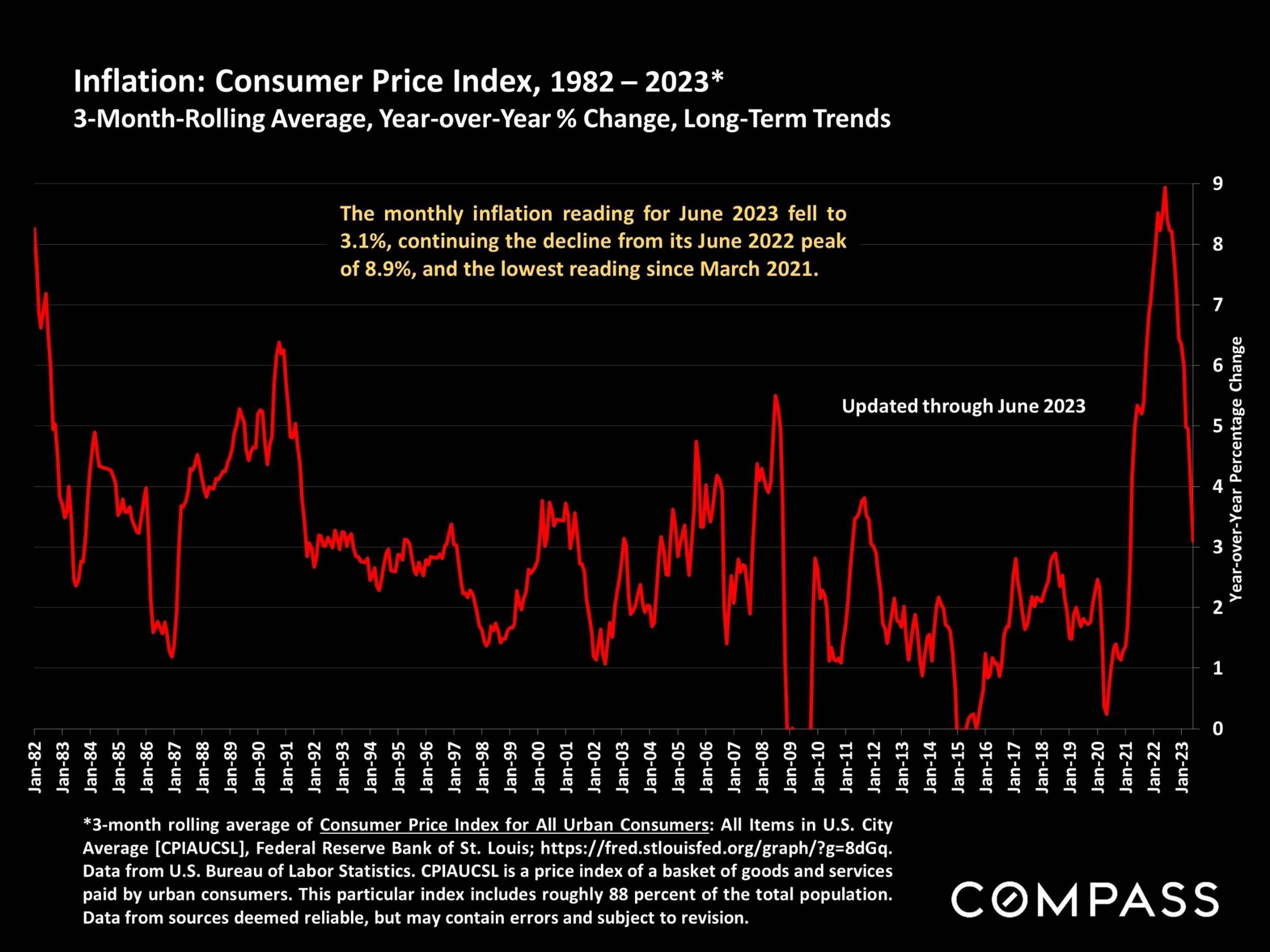

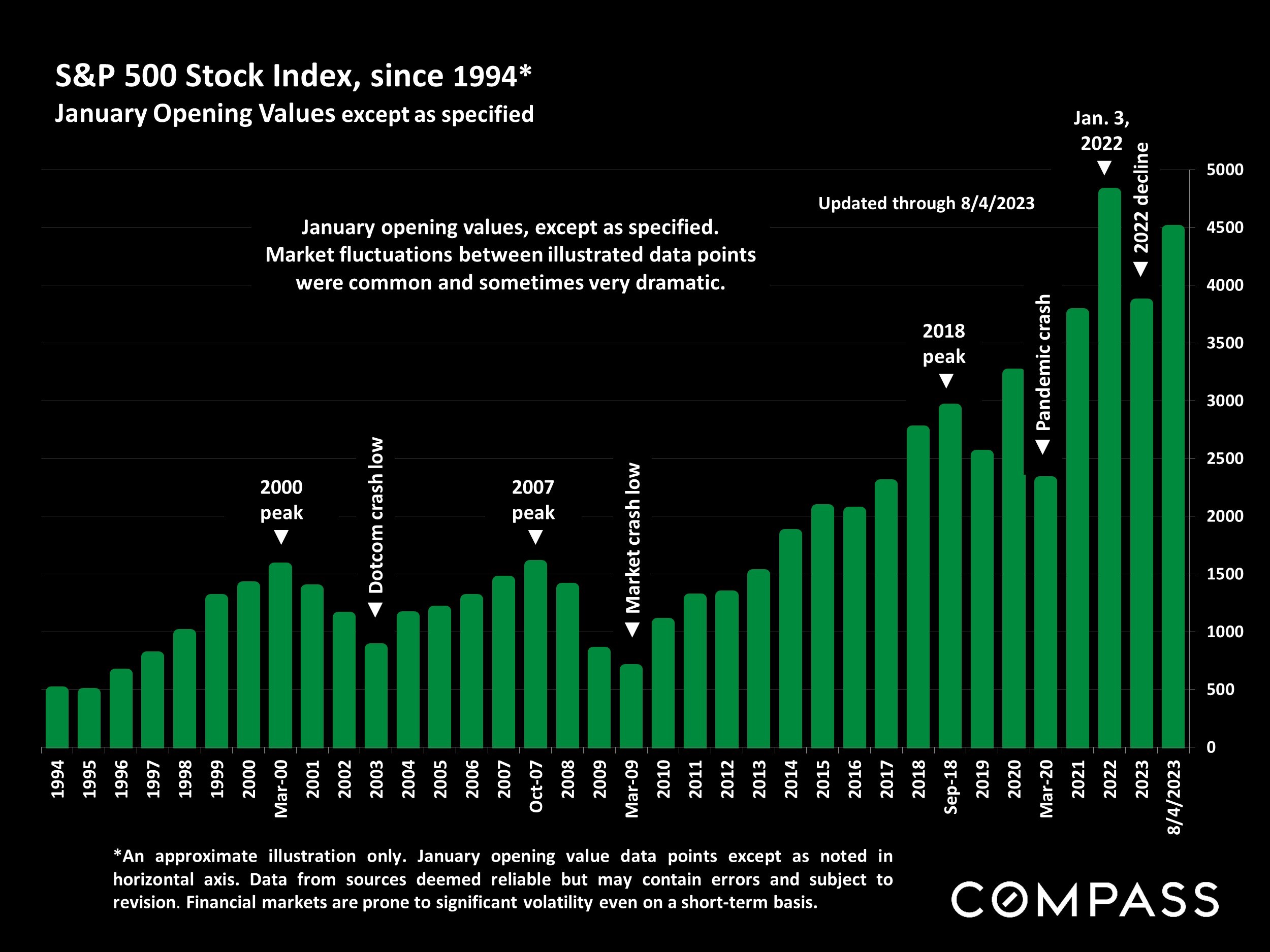

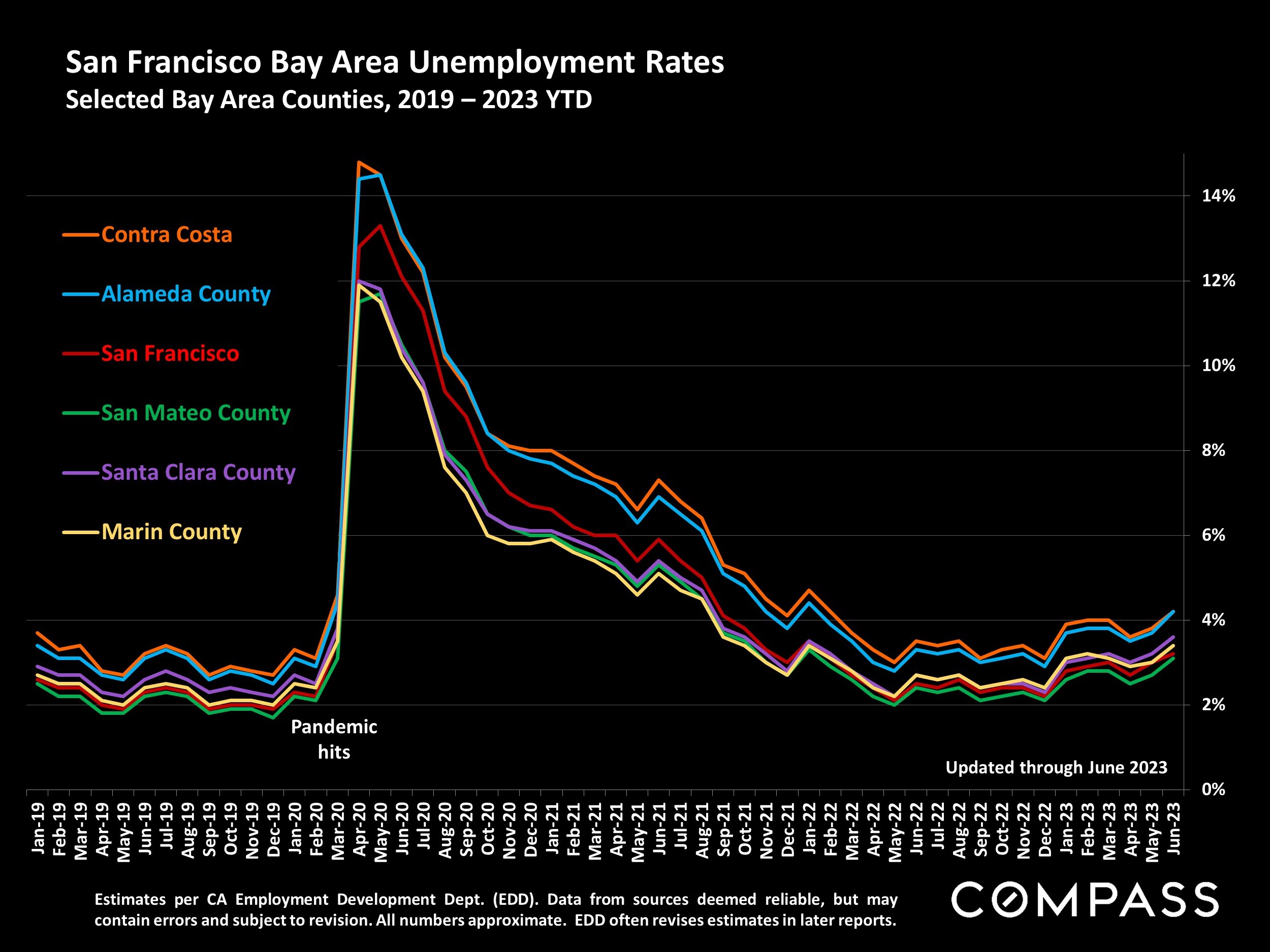

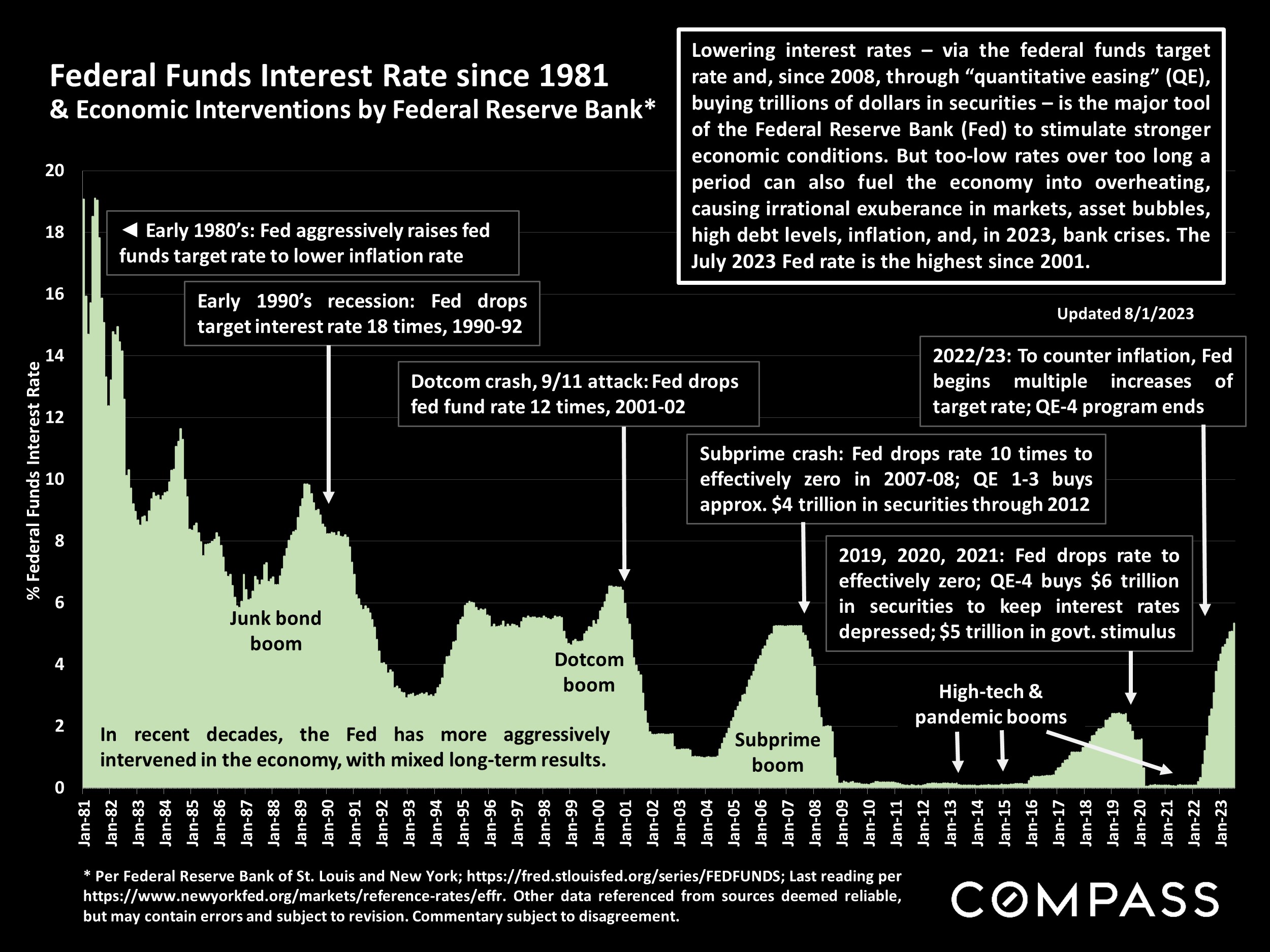

Generally speaking, the market slowed in July, a common seasonal trend, and August is usually one of the quietest months of the year - though last year, a sudden, but short-lived drop in interest rates kindled buyer demand in August. Underlying economic dynamics - interest rates, inflation, financial markets, employment - remain on the same general tracks as in recent months.

The Consumer Confidence Index jumped in July, hitting its best reading since October 2021: The Index is now about halfway between its historic low in June 2022 and the pre-pandemic reading in February 2020.*

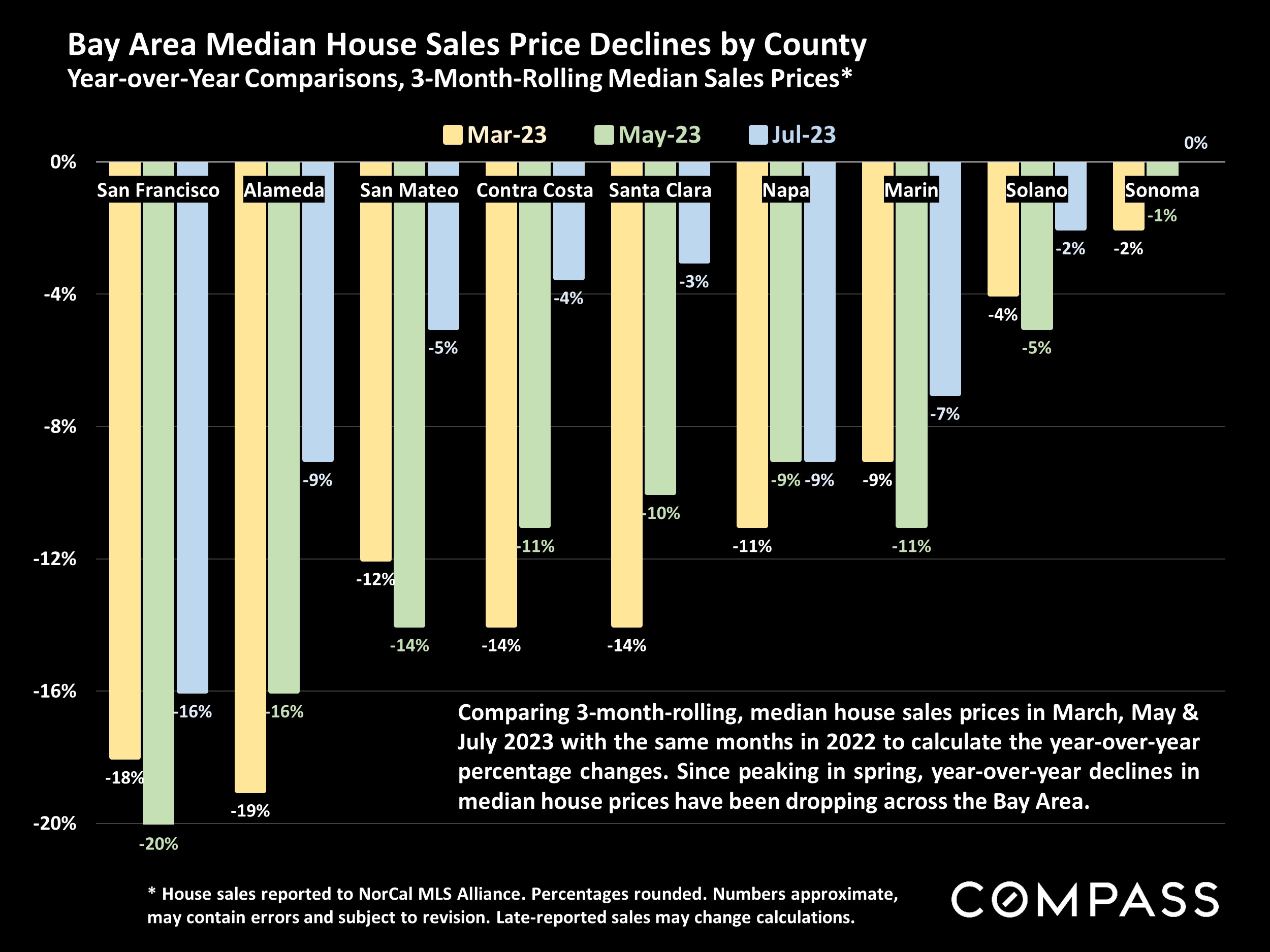

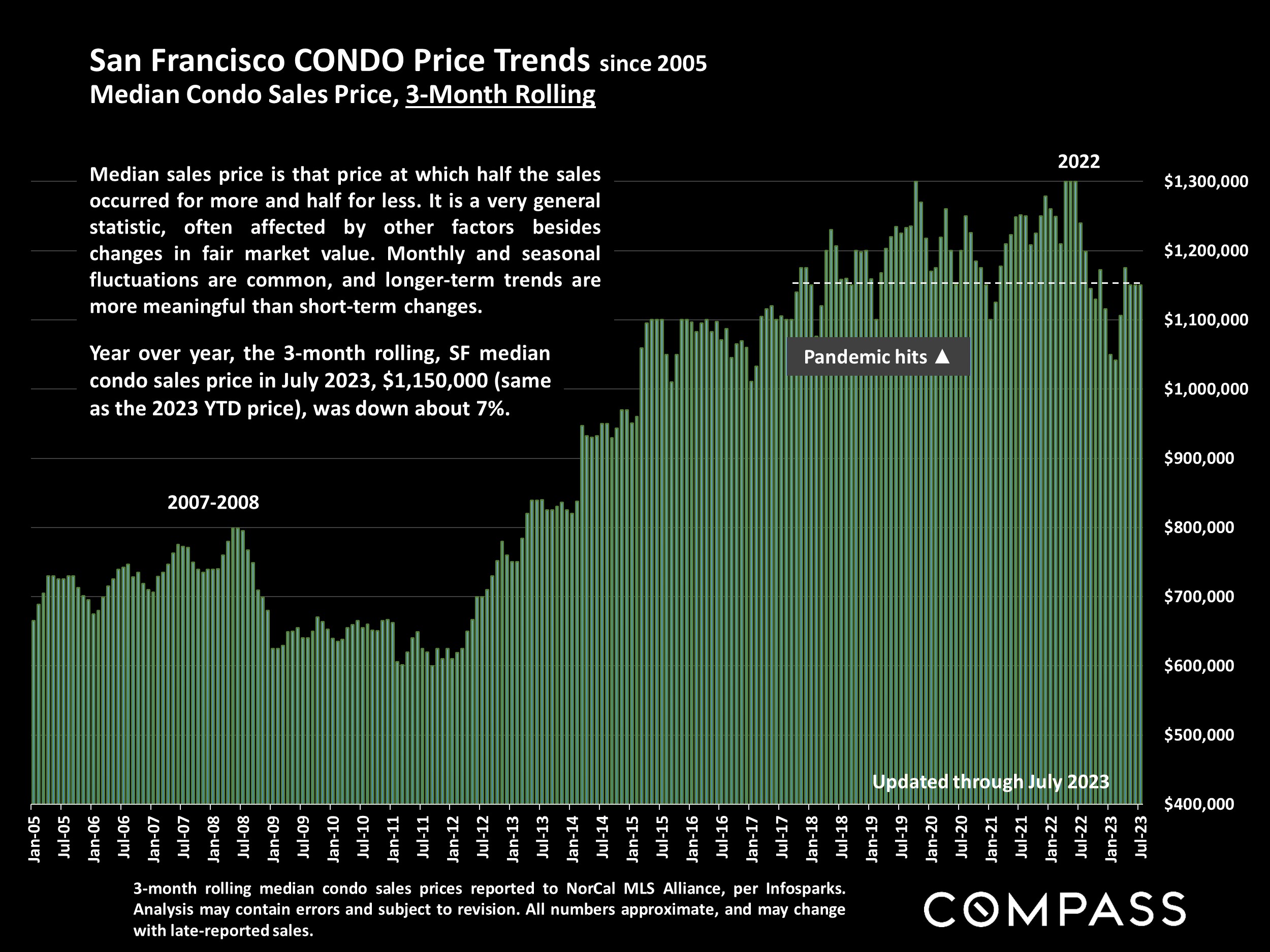

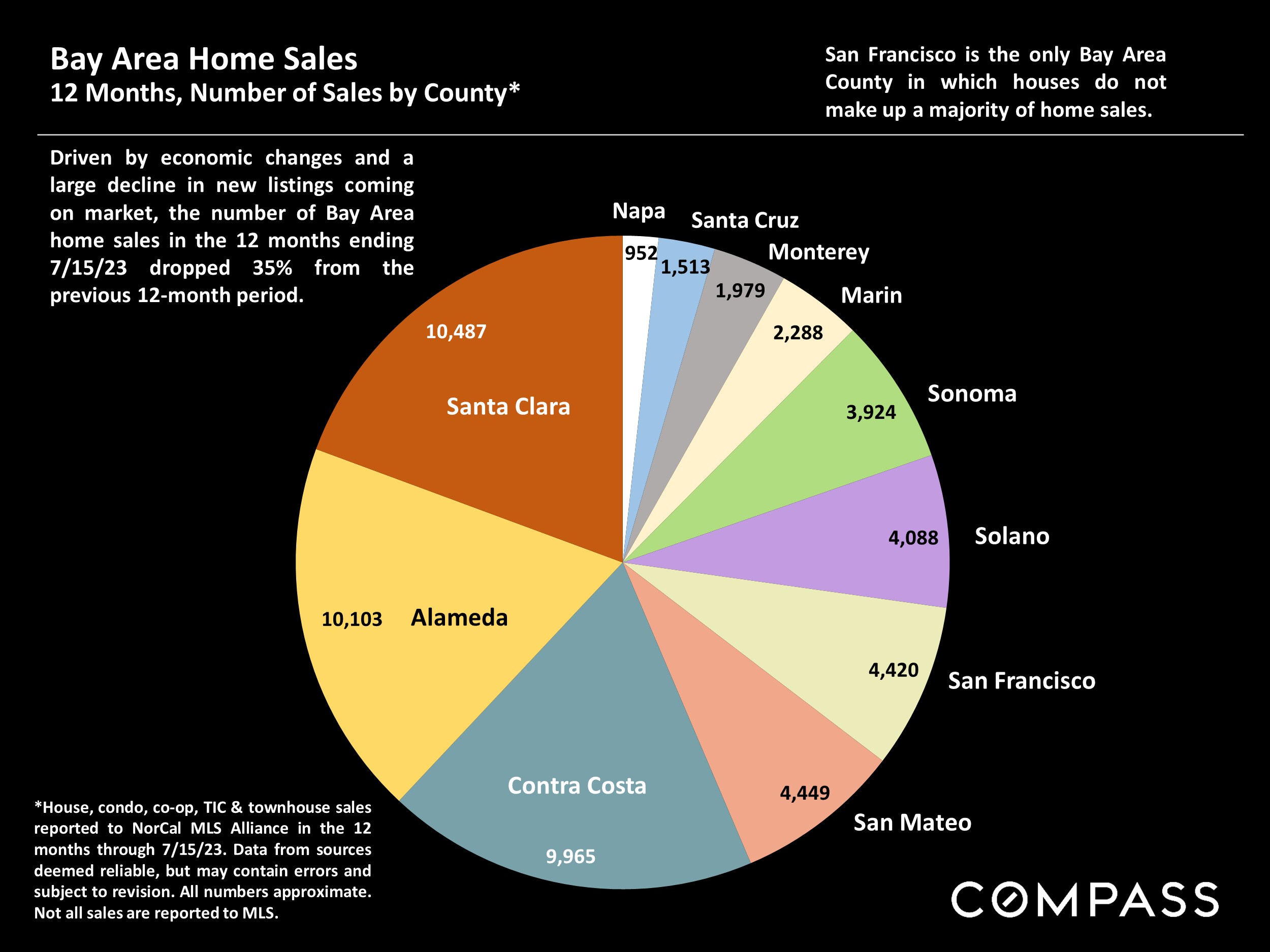

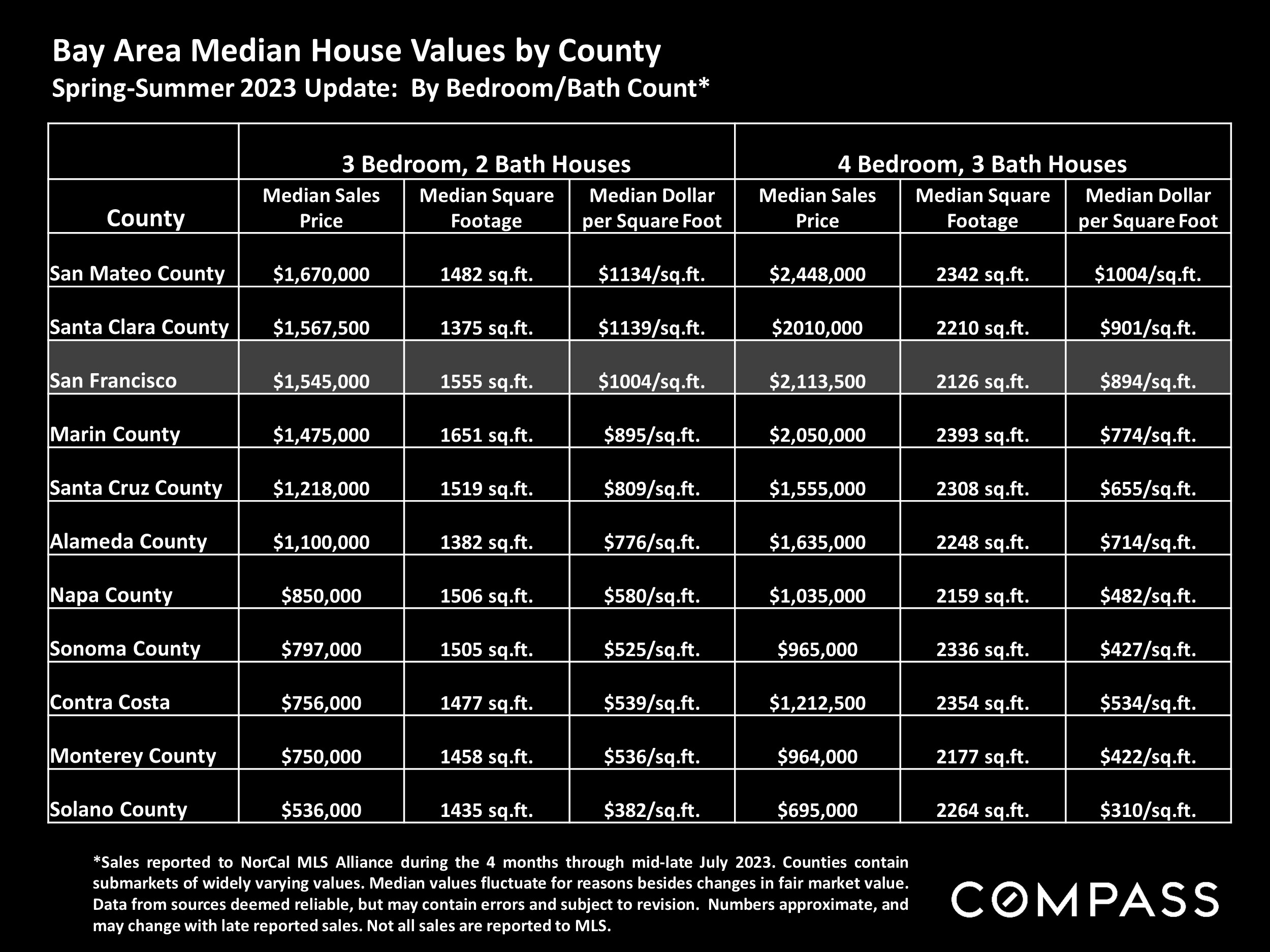

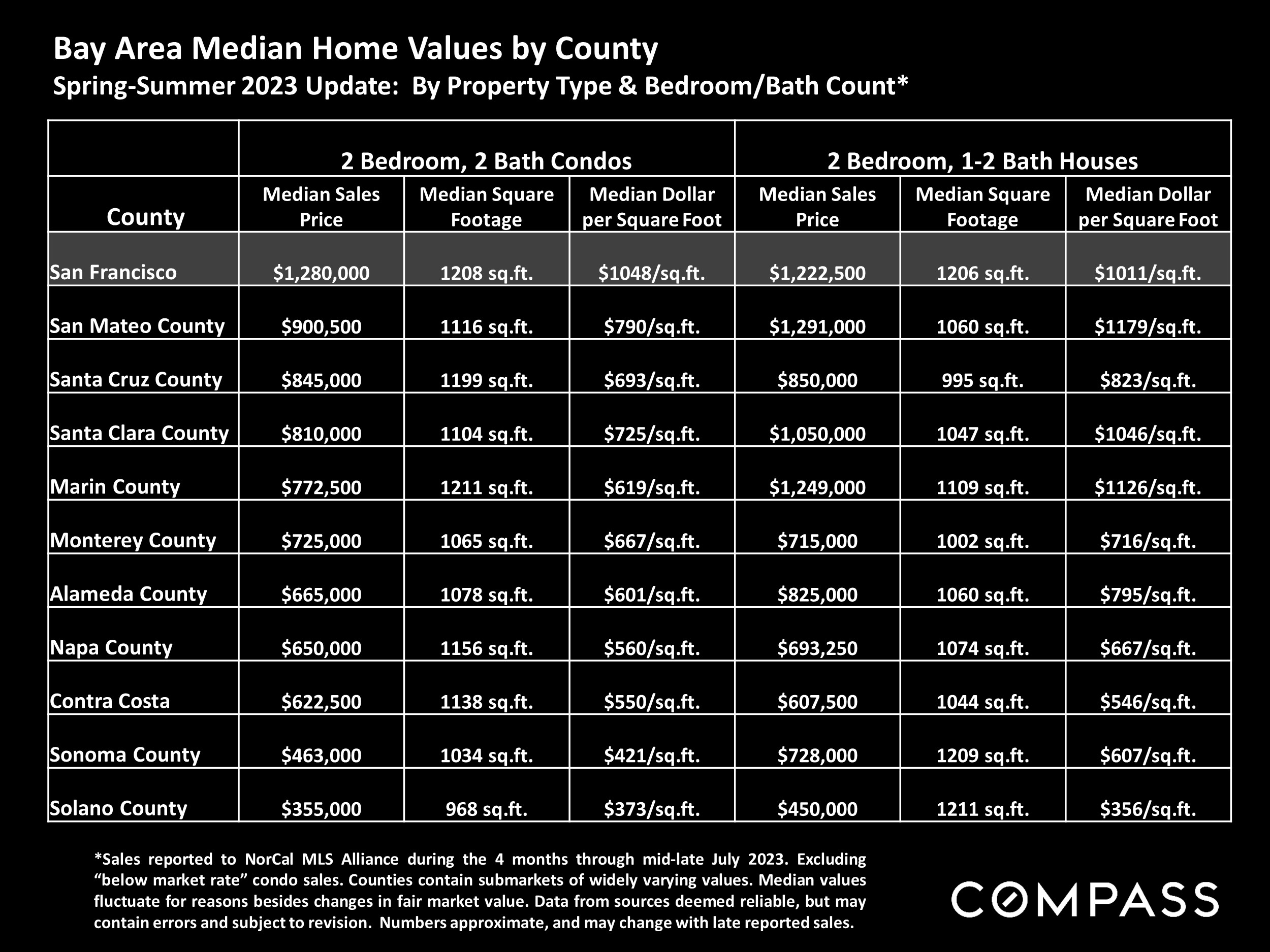

Across Bay Area counties, the year-over-year (y-o-y), 3-month-rolling, median home sales price declines that commonly began in the second half of 2022 and peaked in spring have begun to drop. Based on current trends, they will probably continue to dwindle, and perhaps disappear, in the second half of the year.

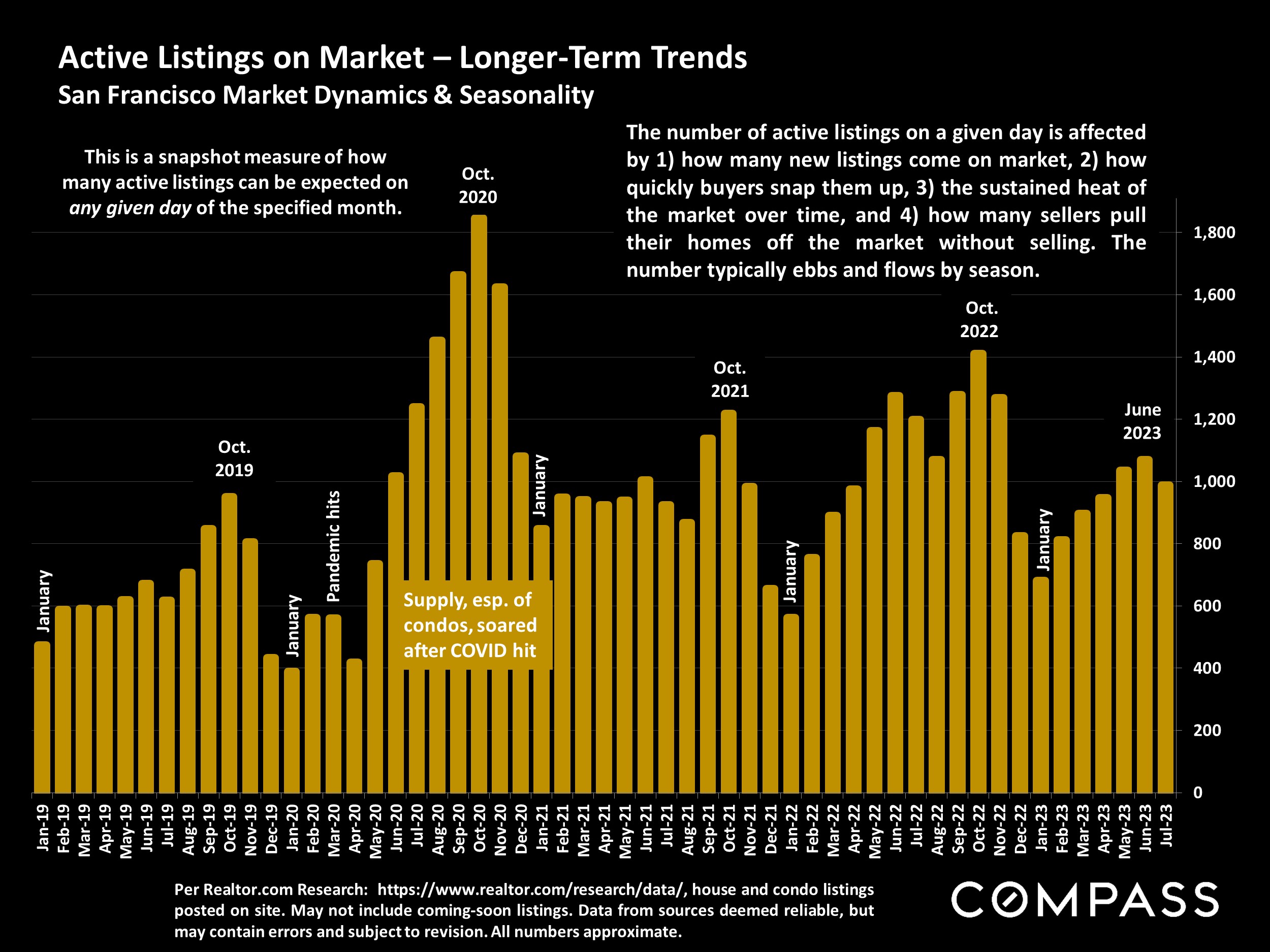

The number of homes coming on the market in the 7 counties of the San Francisco & San Jose Metro Areas during the past 12 months dropped 32% from the previous 12-month period: 22,000 fewer properties were put up for sale. ** Along with the recovery in buyer demand and improvements in the general economy, this has been a defining factor in 2023's market conditions.

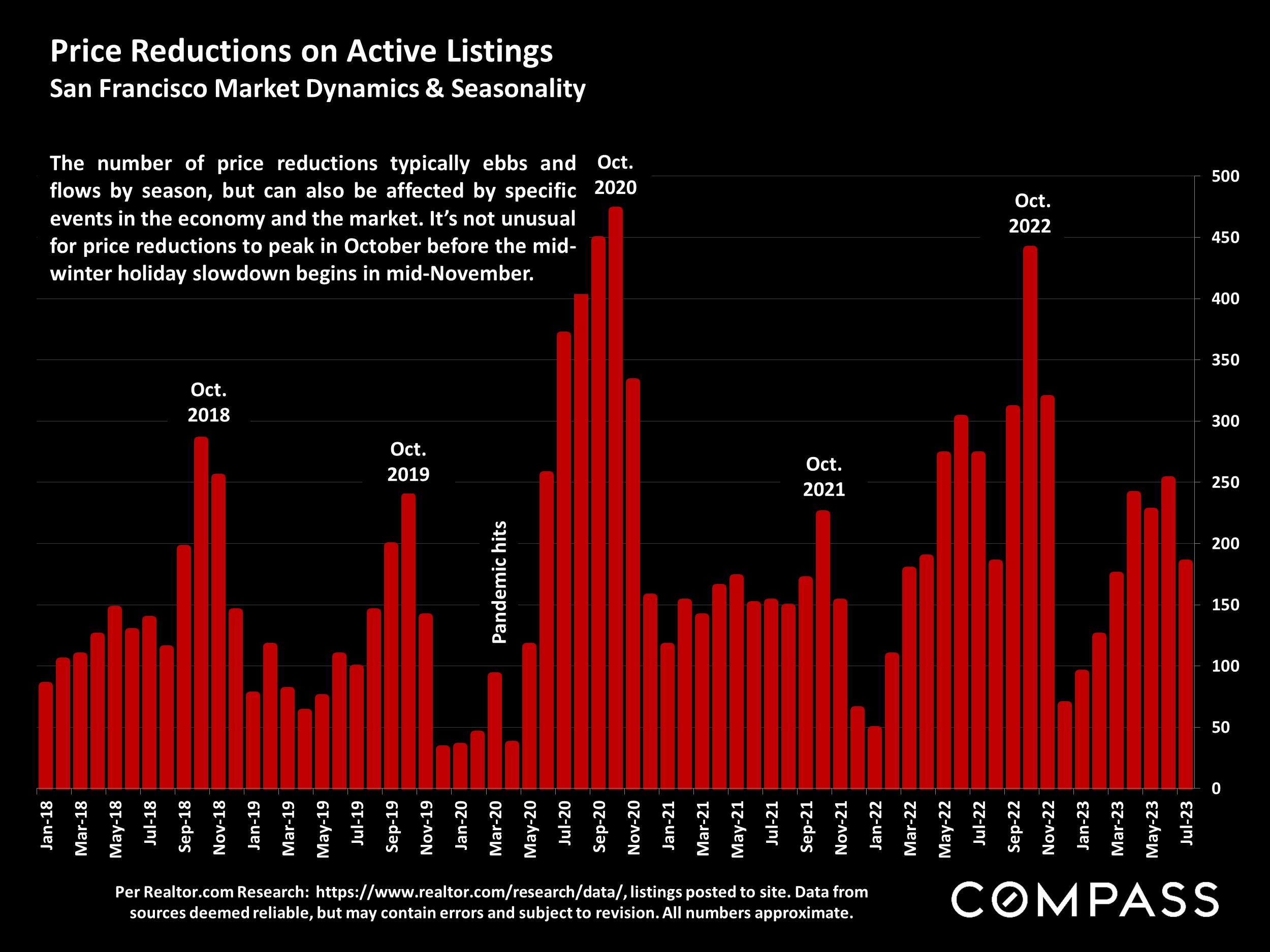

It is not unusual to see a substantial autumn spike up in SF listing and sales activity after Labor Day, lasting through late October or early November, before the market subsides for the big, midwinter holiday slowdown, which typically lasts until early in the new year.

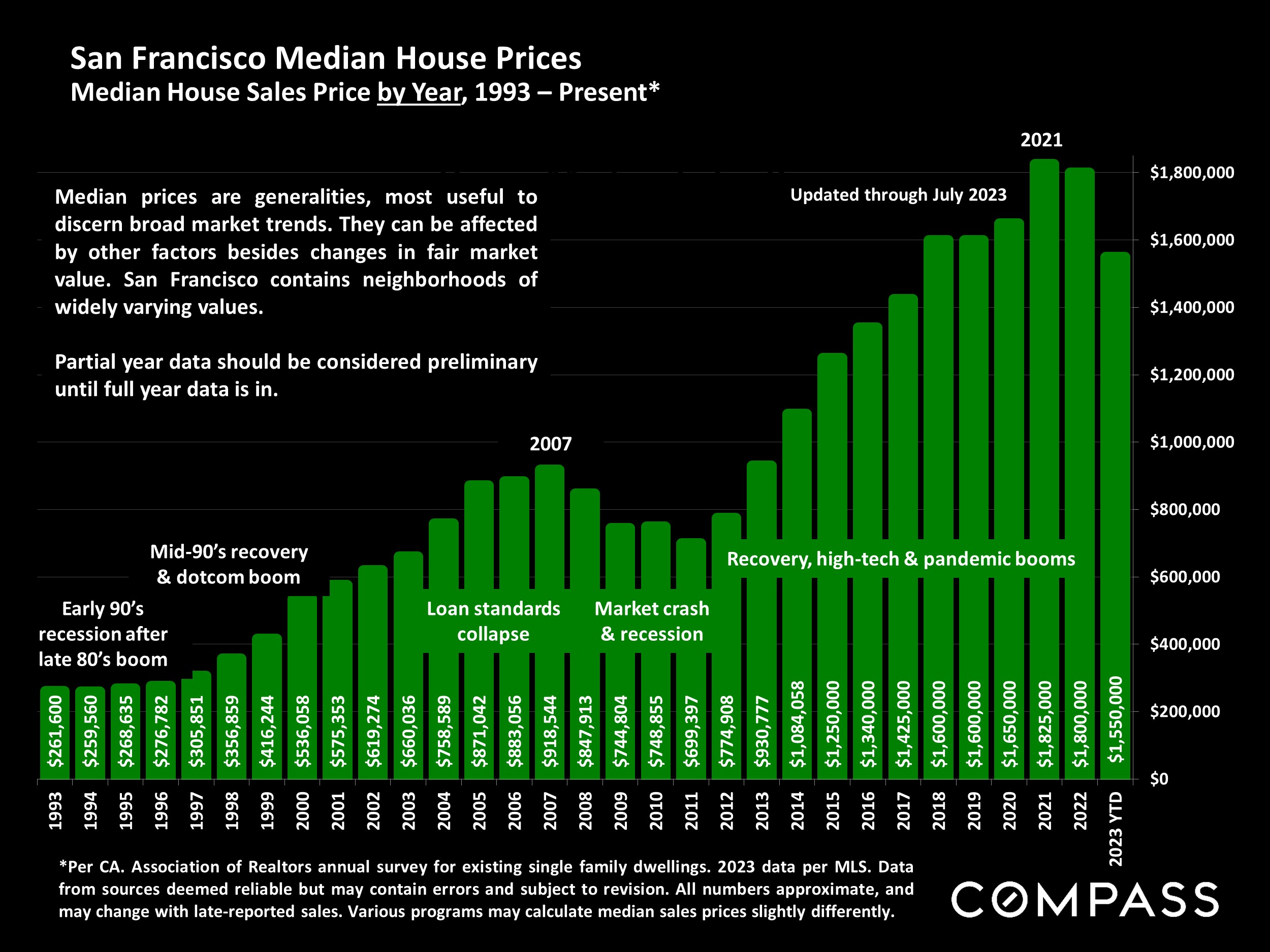

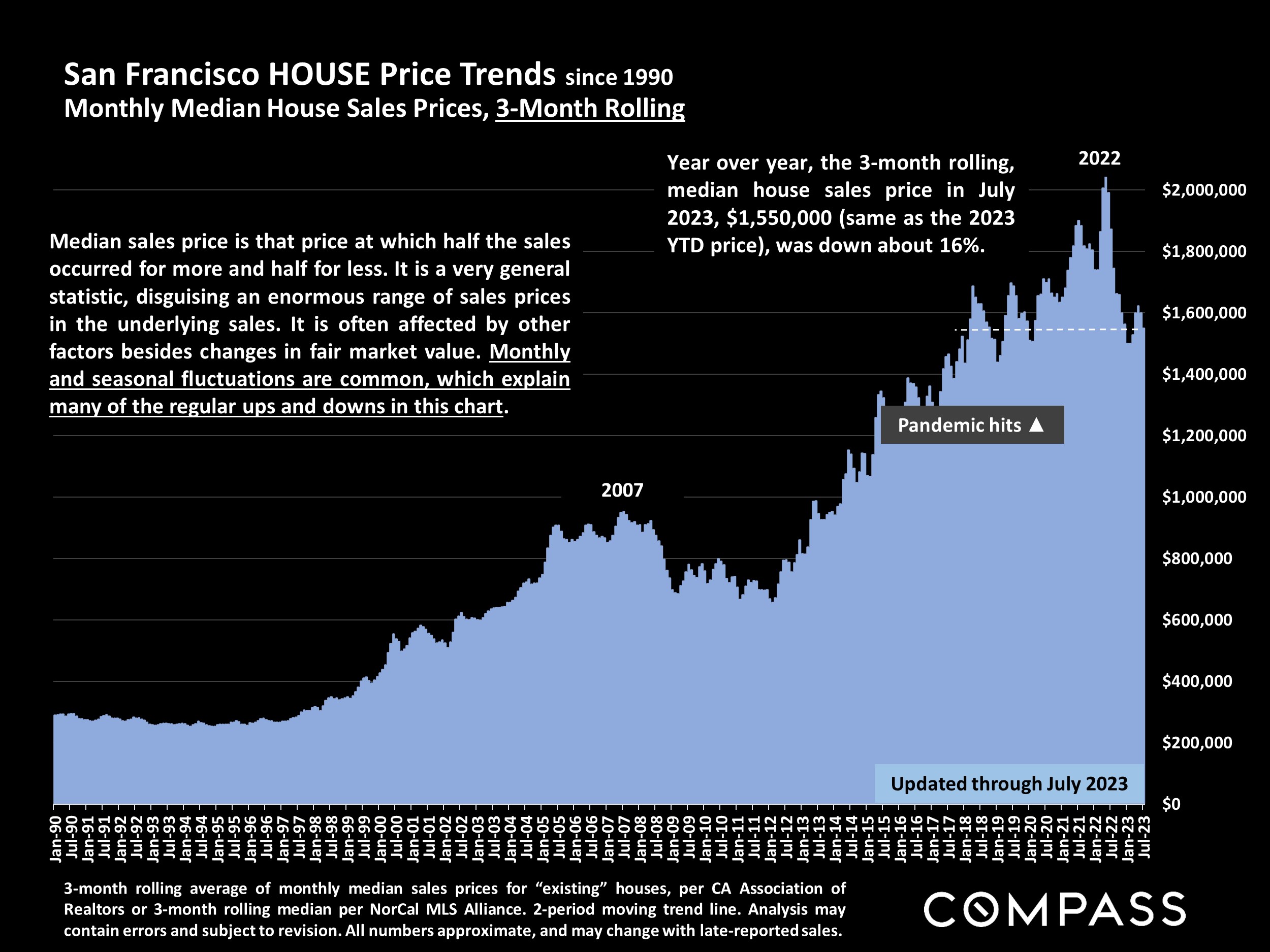

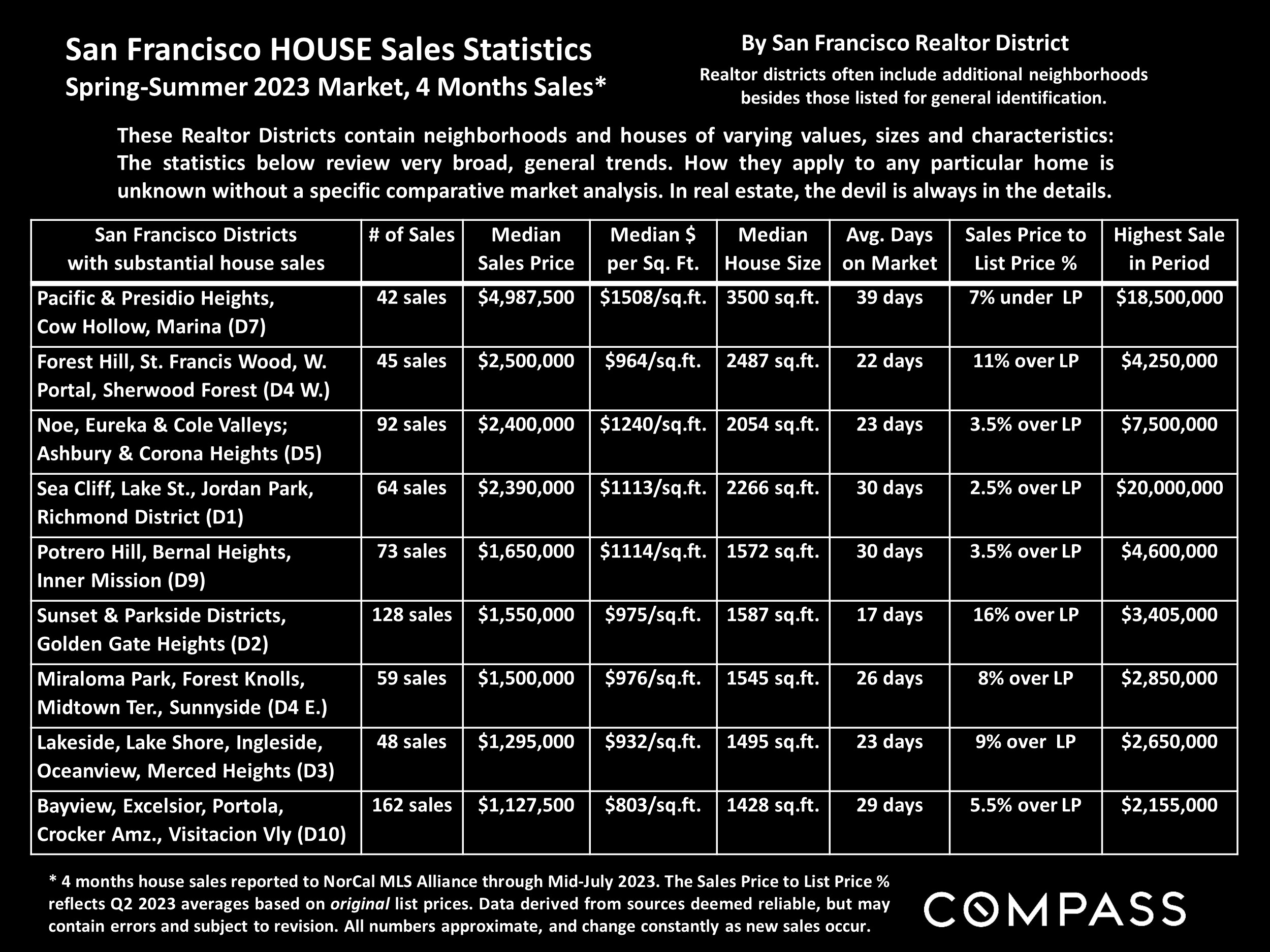

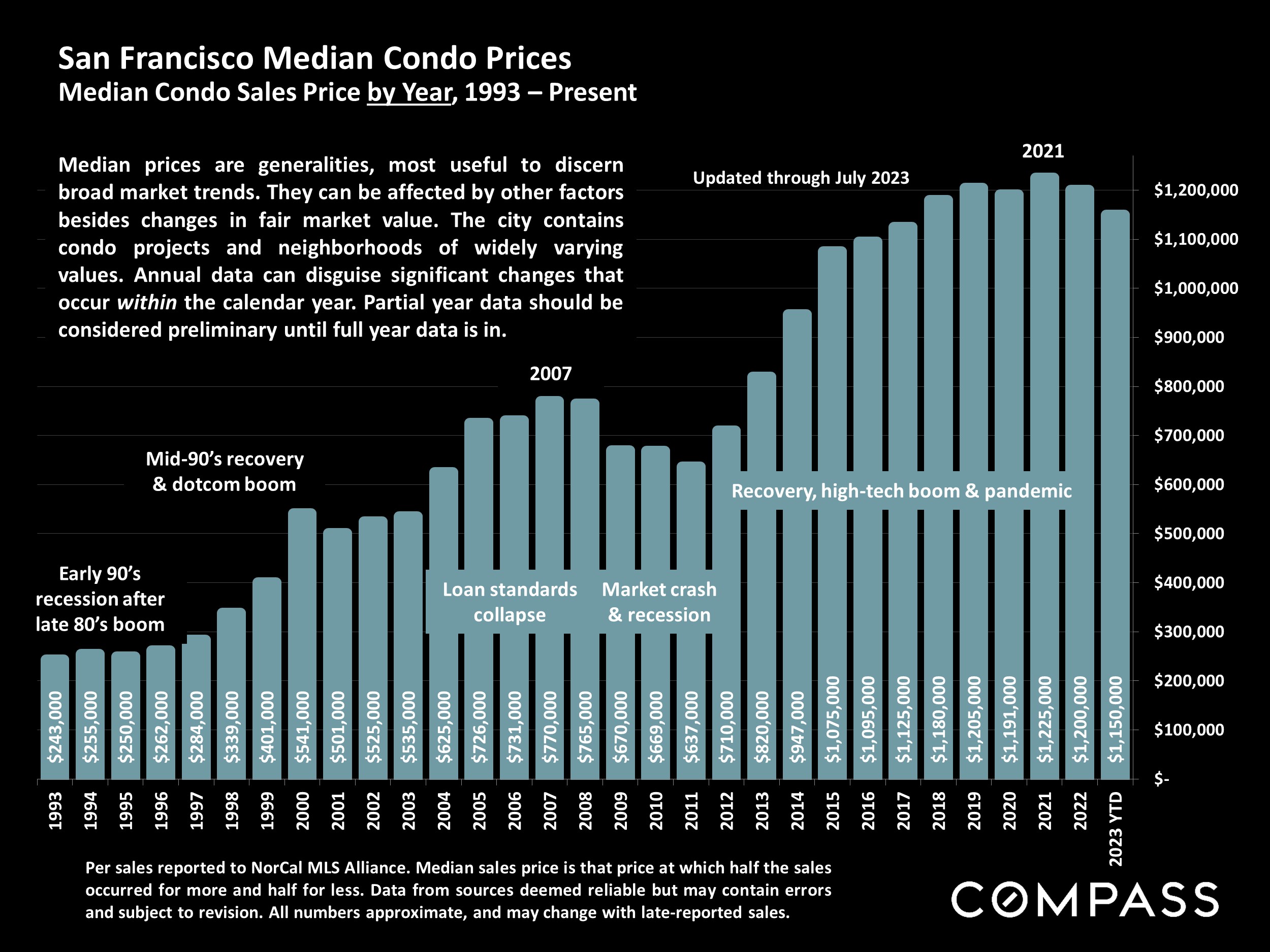

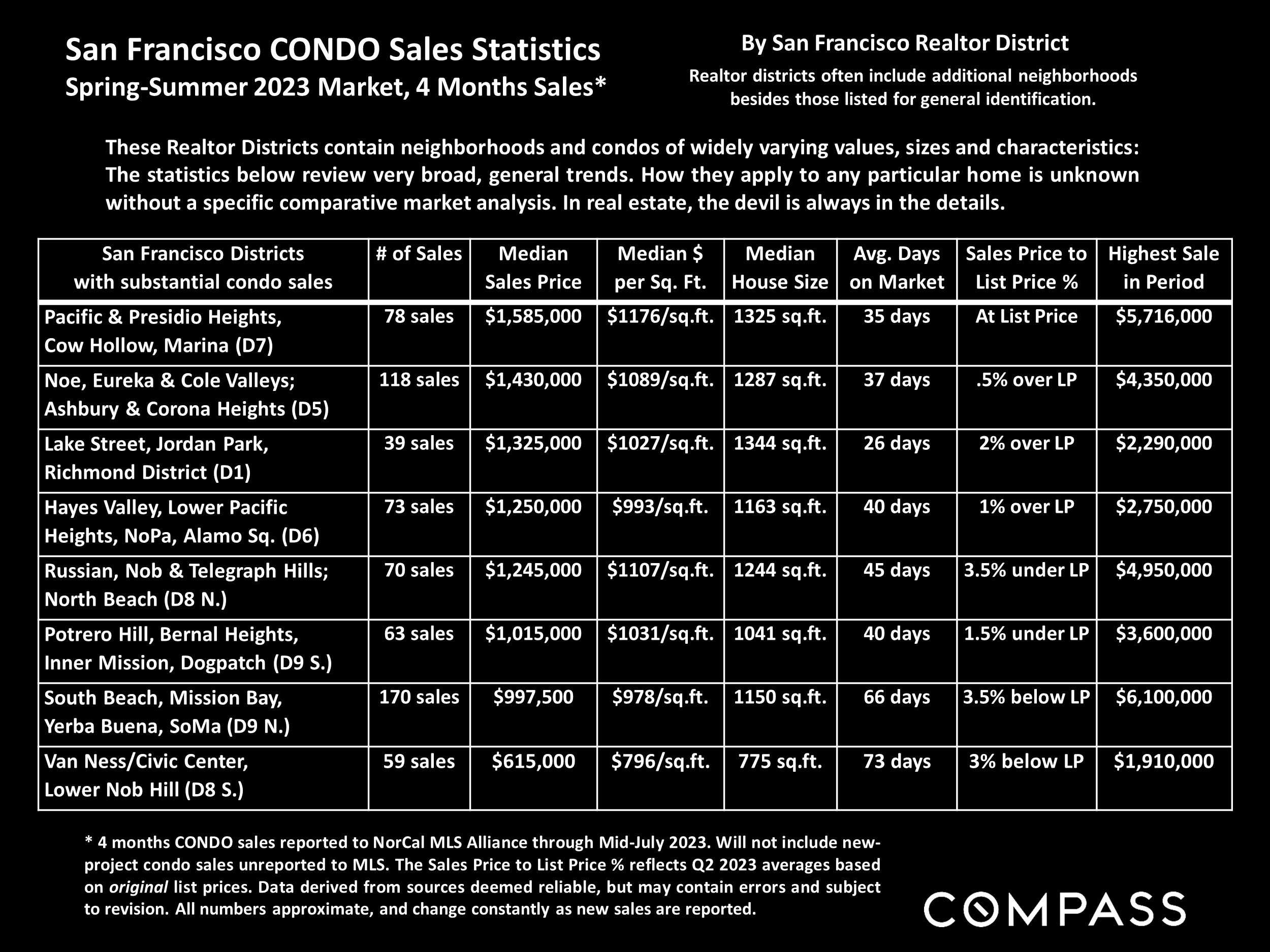

Included are charts reviewing both annual home prices for a broad review of appreciation trends, and then 3-month-rolling prices for insight into shorter-term changes. This report also includes a review of home prices and market dynamics of districts within the city.

*University of Michigan Consumer Sentiment Index

**Per Realtor.com research data library for U.S. metro areas.

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact