January 10, 2024

SF: January 2024 Market Stats

By Compass

Dramatically improving economic indicators suggest a brighter 2024 housing market:

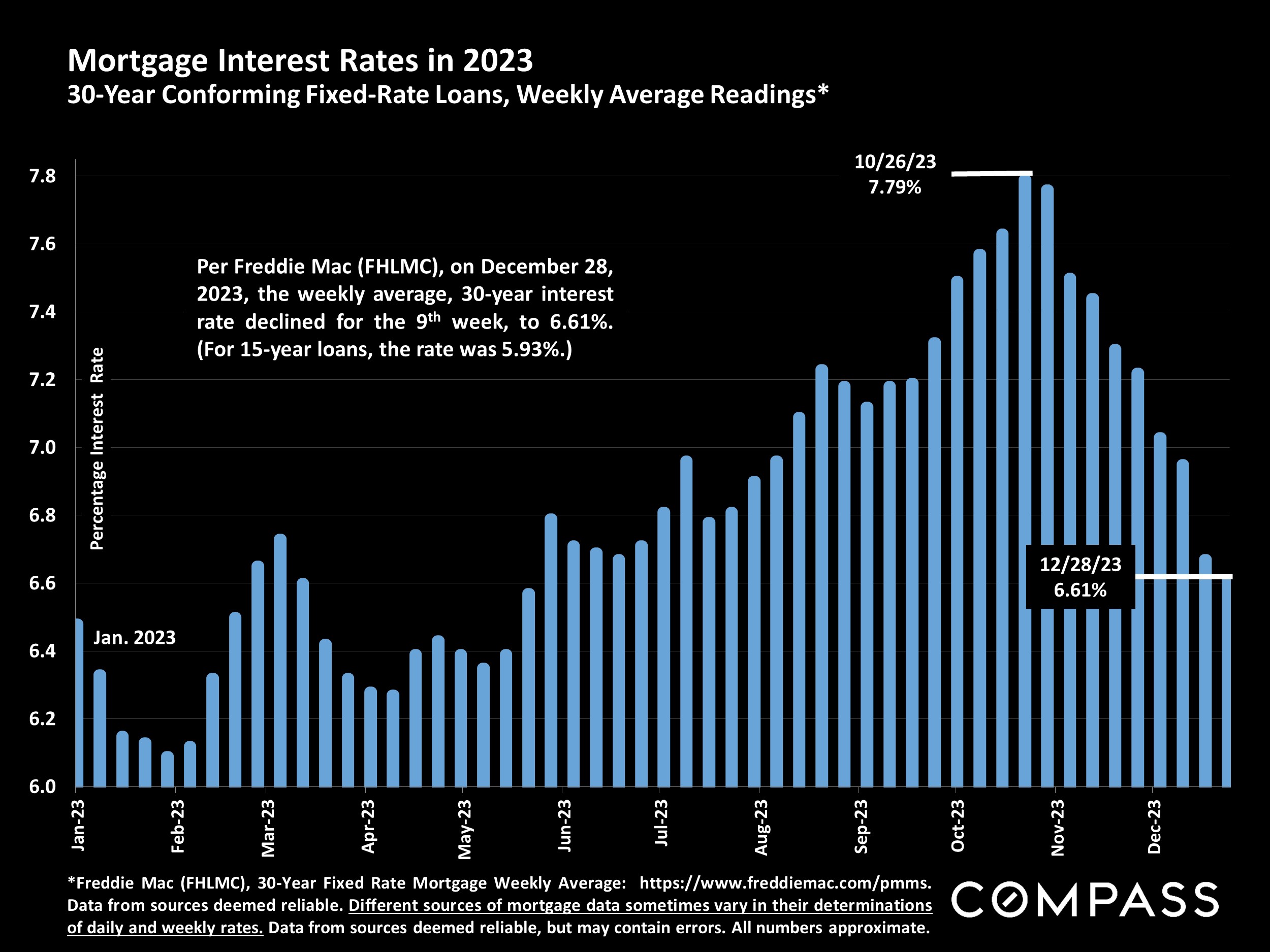

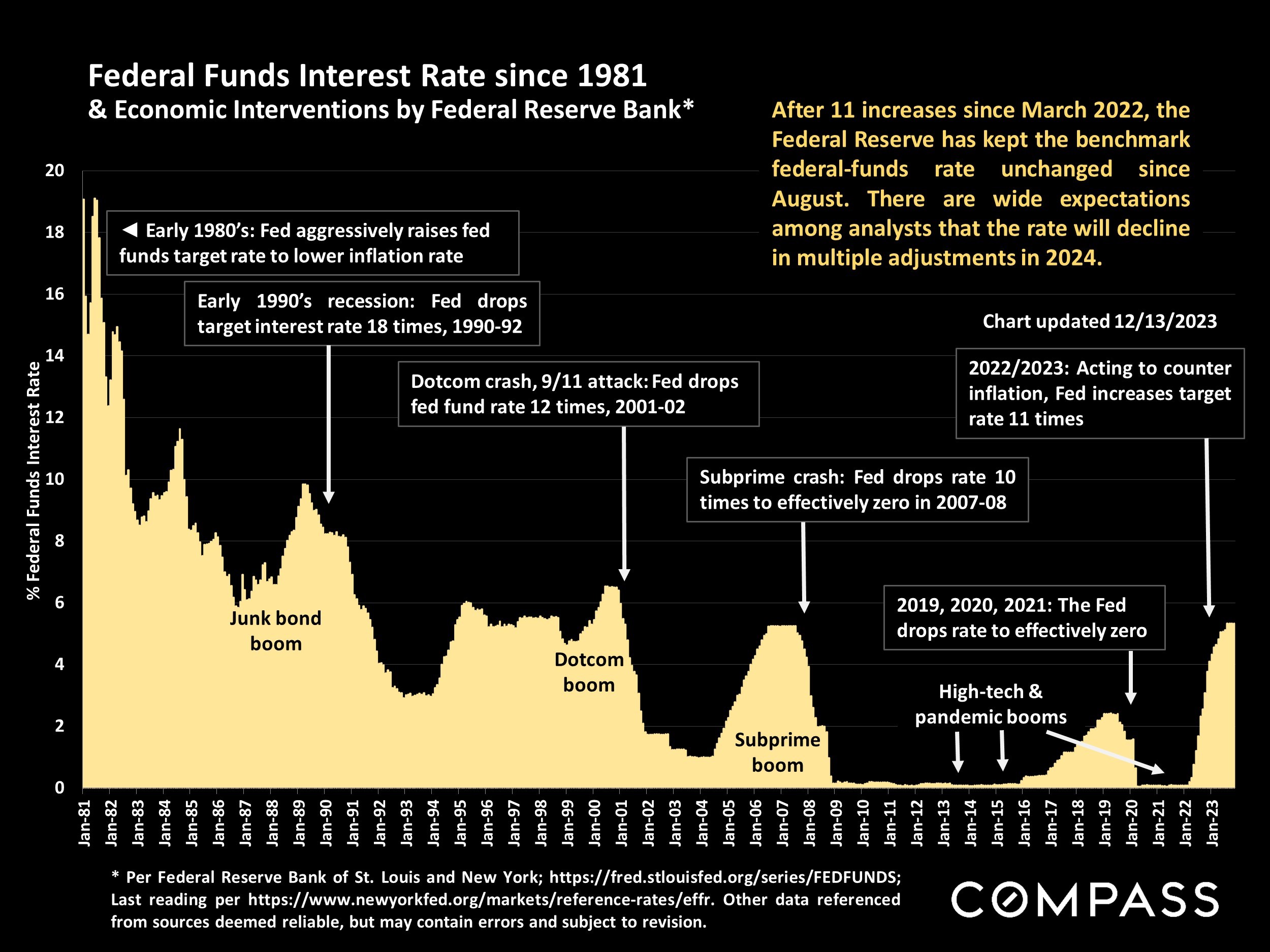

In the last 2 months of 2023, the average, weekly, 30-year mortgage interest rate dropped from 7.79% to 6.61%. With the fall in inflation this past year, the Fed is widely expected to begin dropping its benchmark rate, probably in multiple steps, in 2024. The consensus forecast among analysts is for further declines in mortgage interest rates.

After its end-of-year rally, the S&P Index was up 25% and the Nasdaq was up 45% in 2023 (though it ticked down in early 2024). This plays a major role in the Bay Area household wealth.

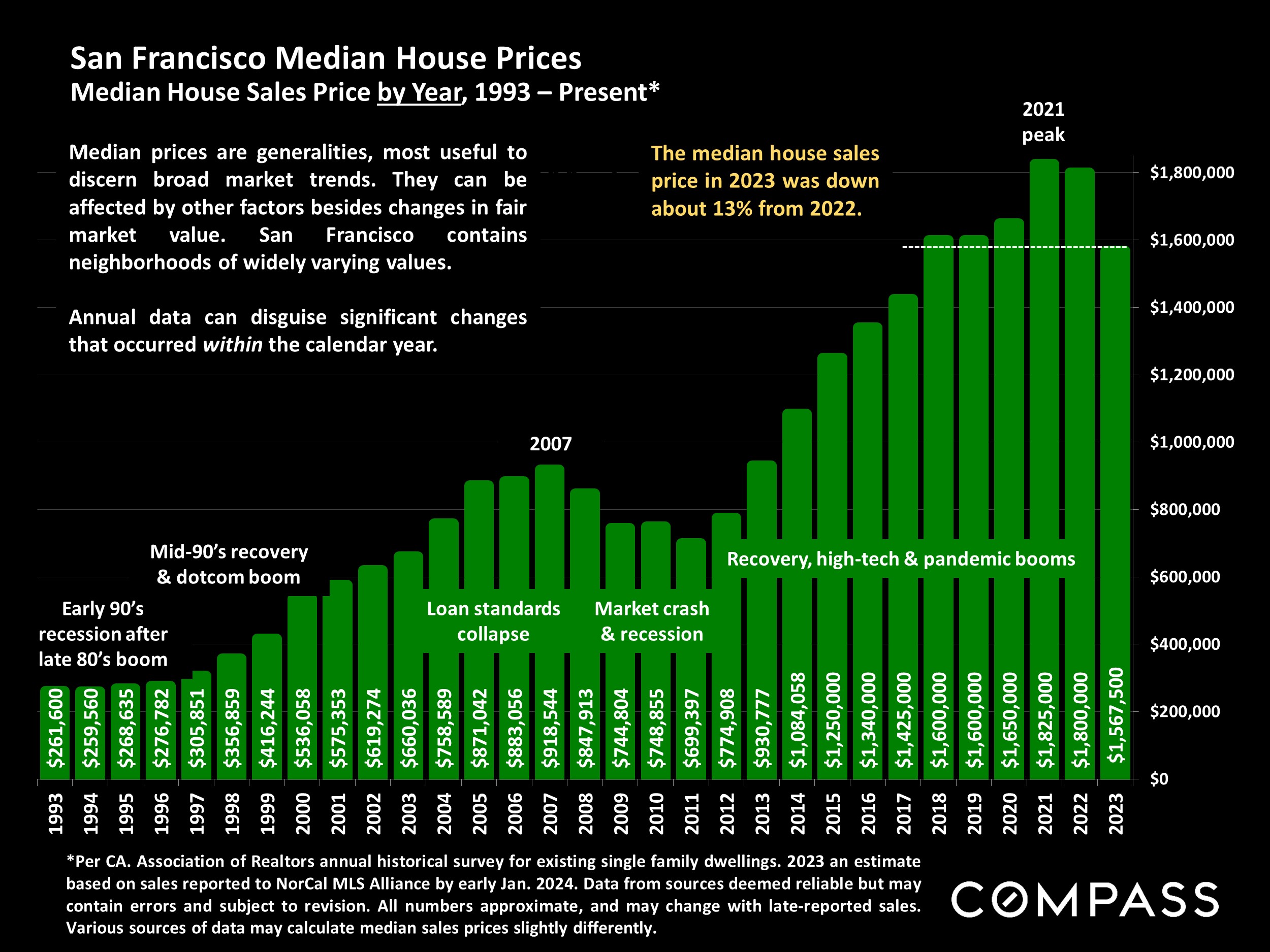

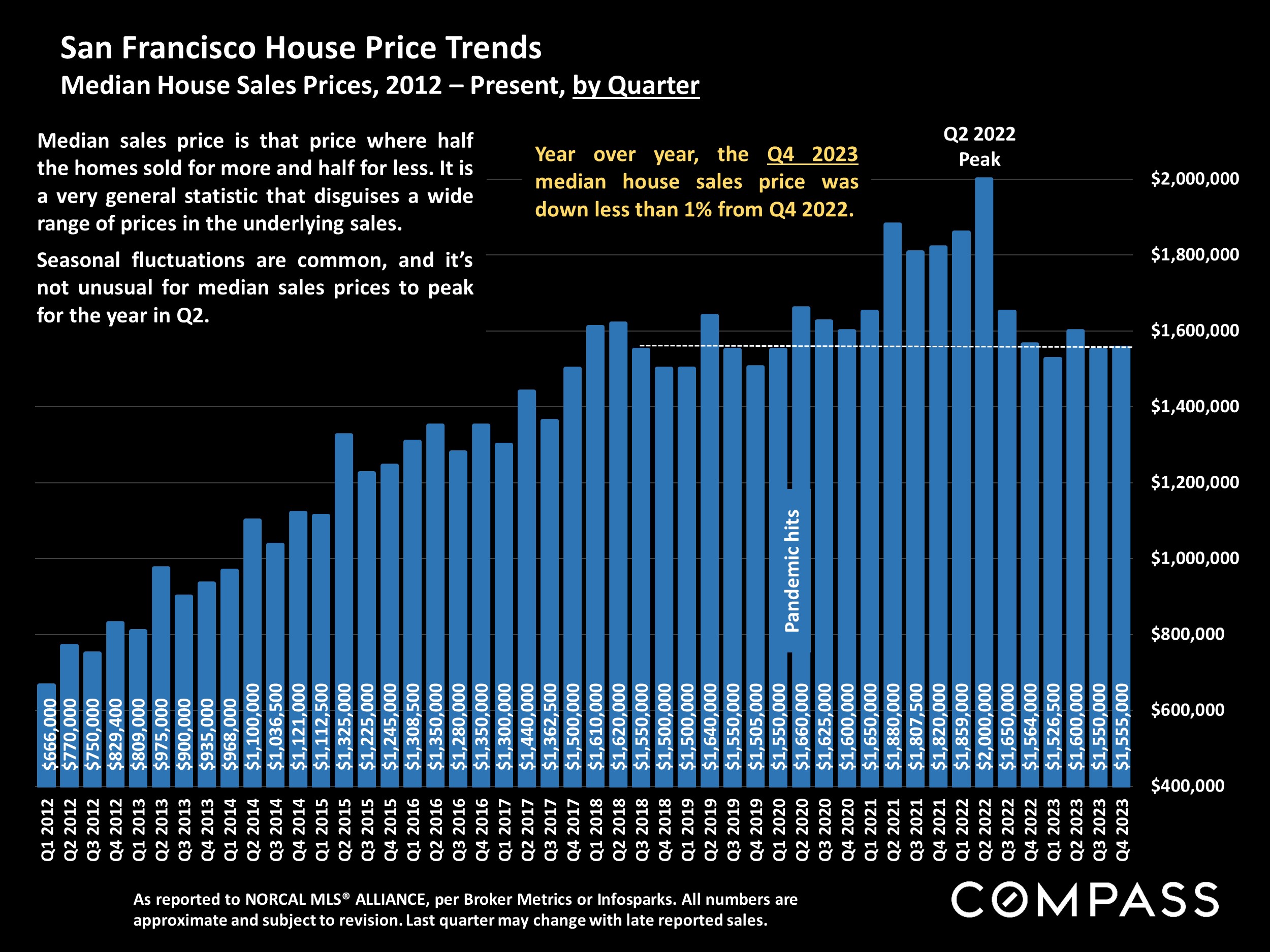

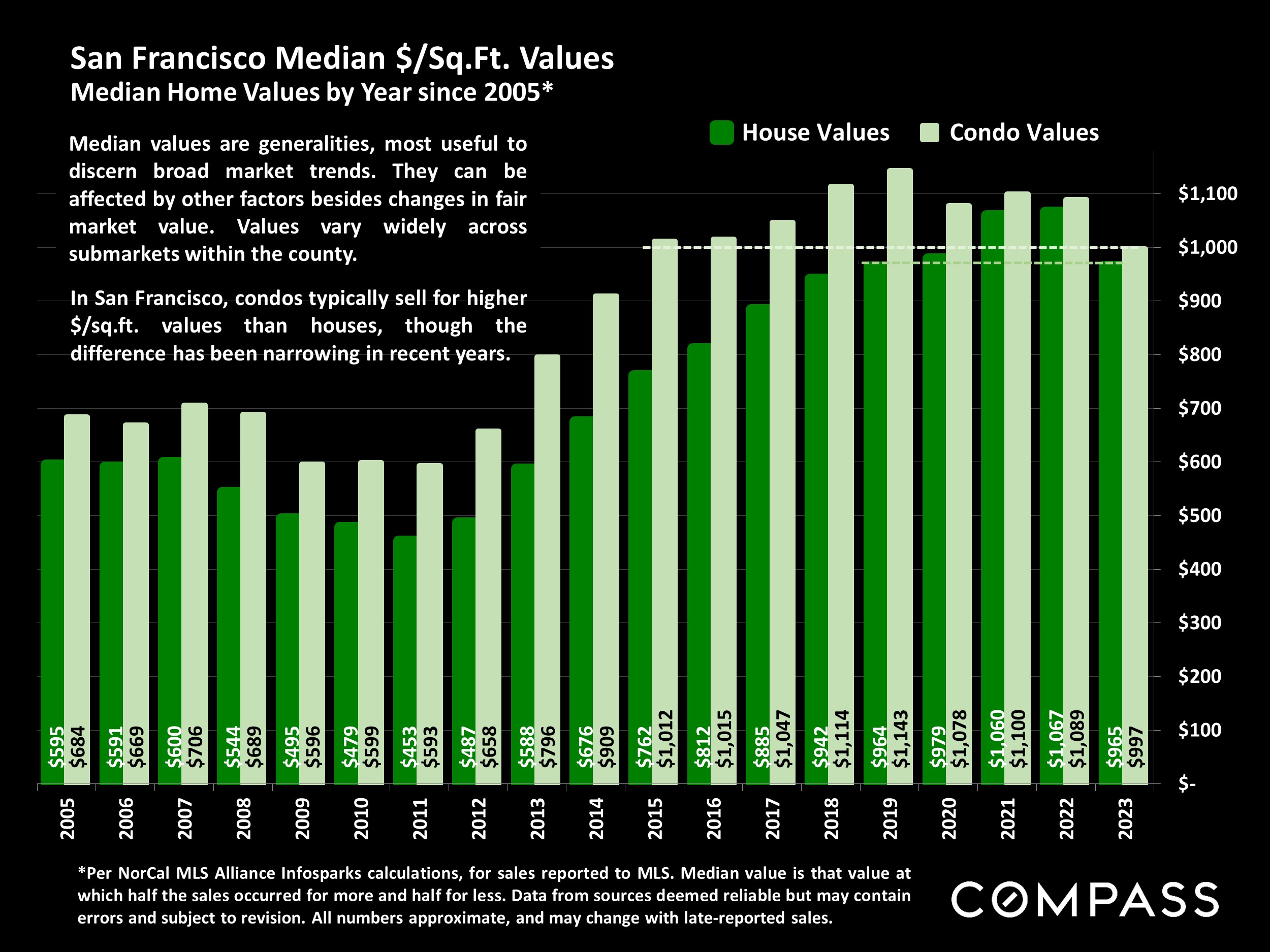

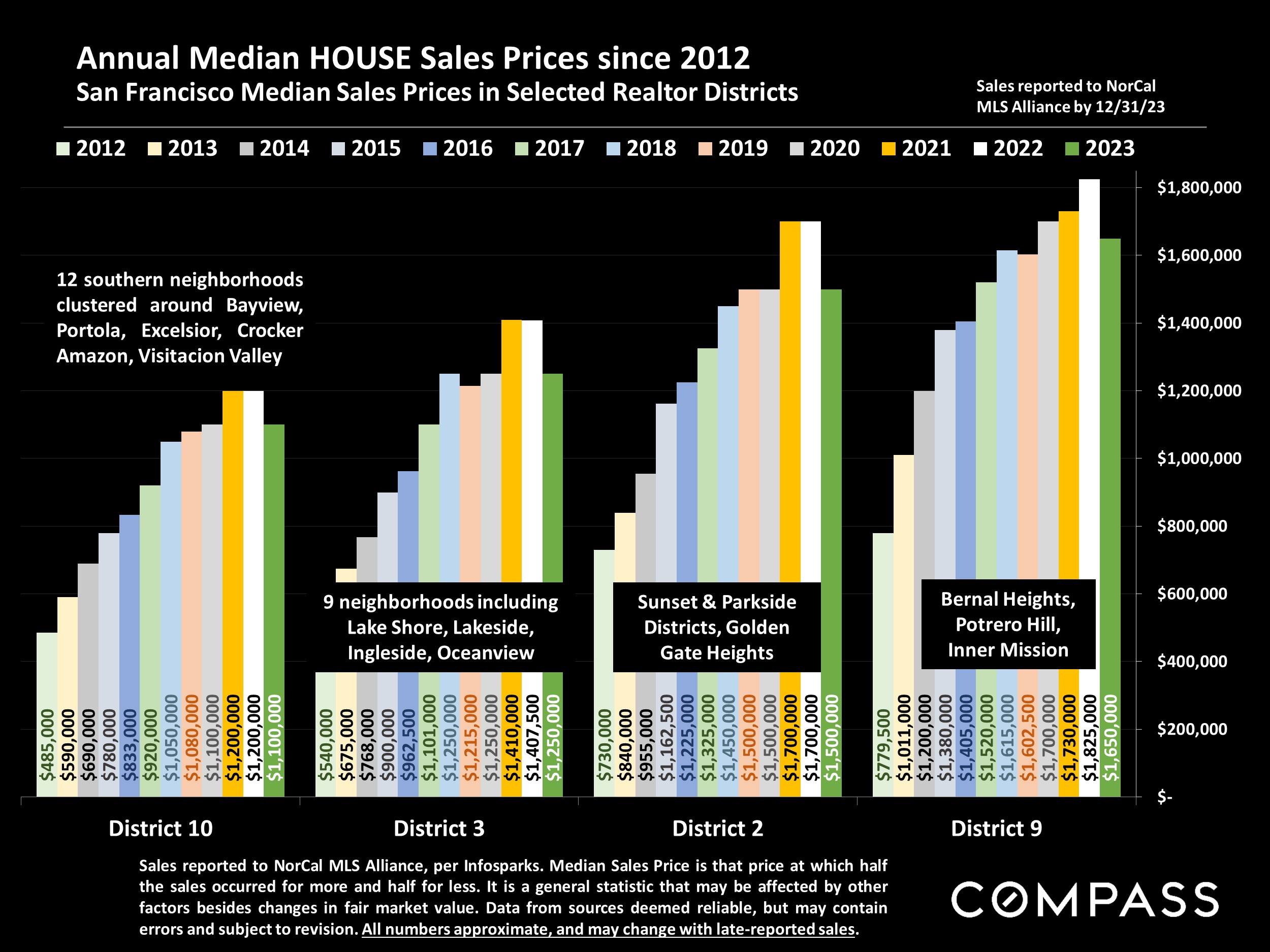

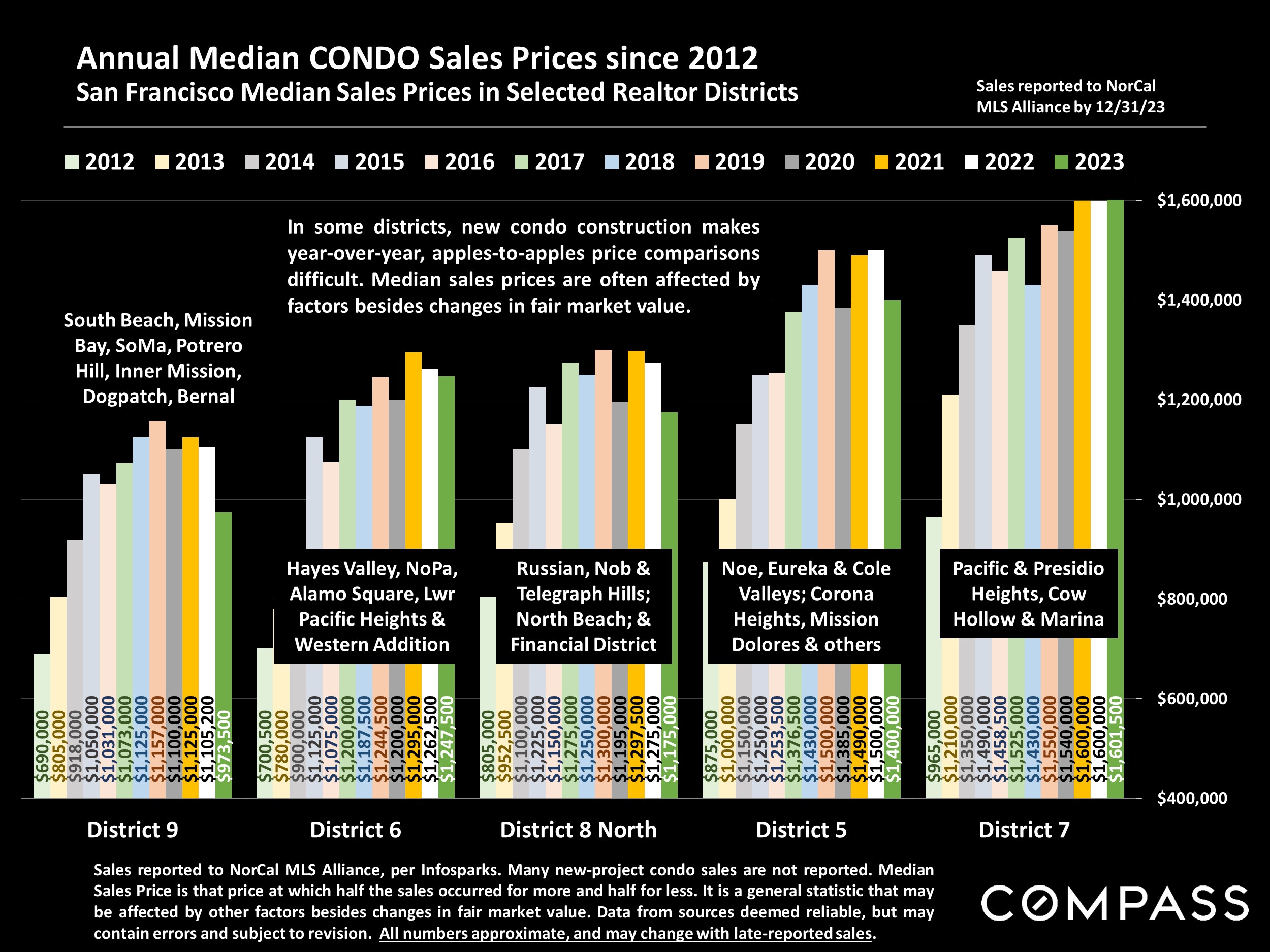

On an annual basis, the 2023 median house sales price was down 4% from 2022 (the peak of the market), while on a quarterly basis, the Q4 price was up 4% year-over-year.

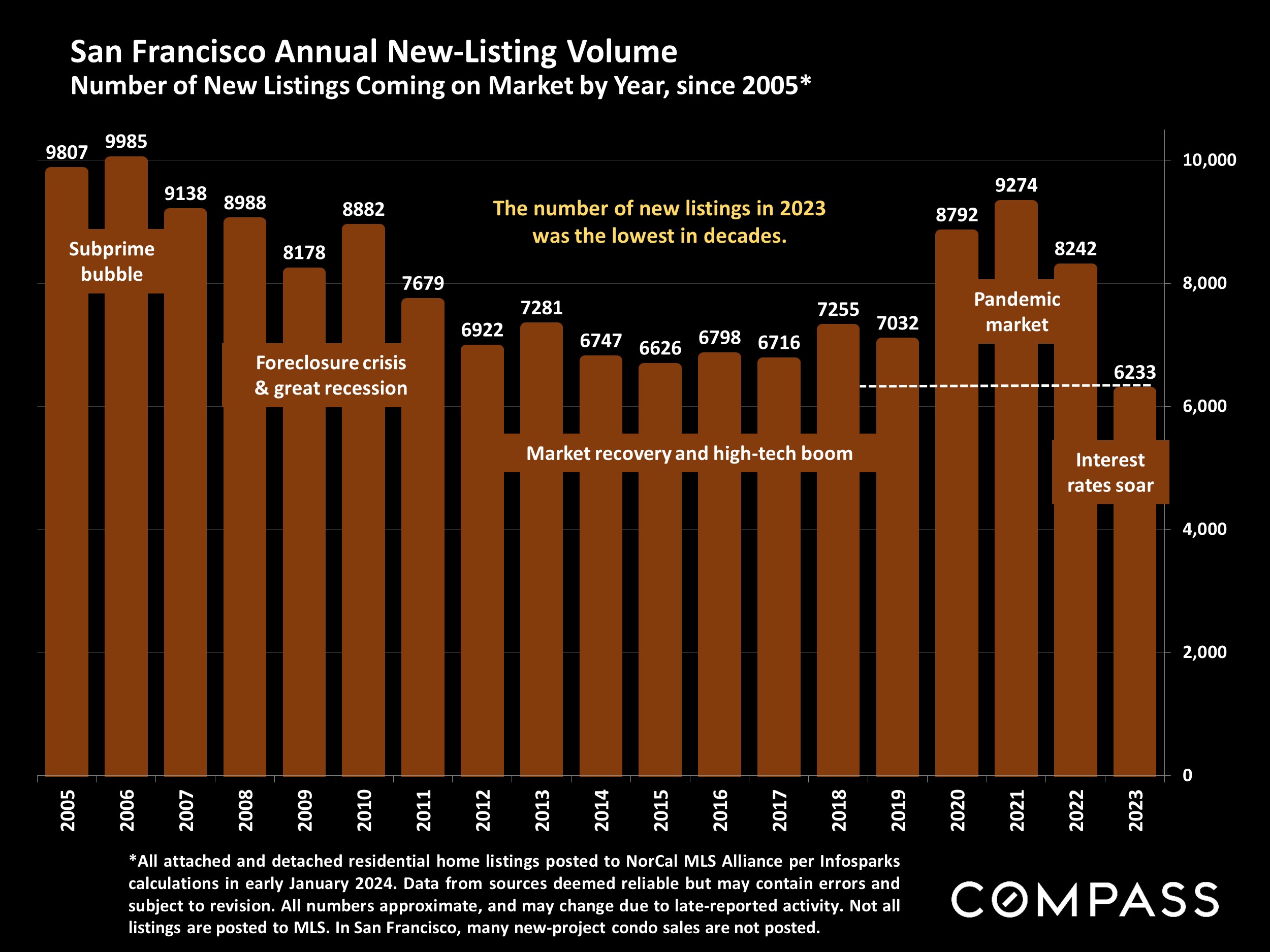

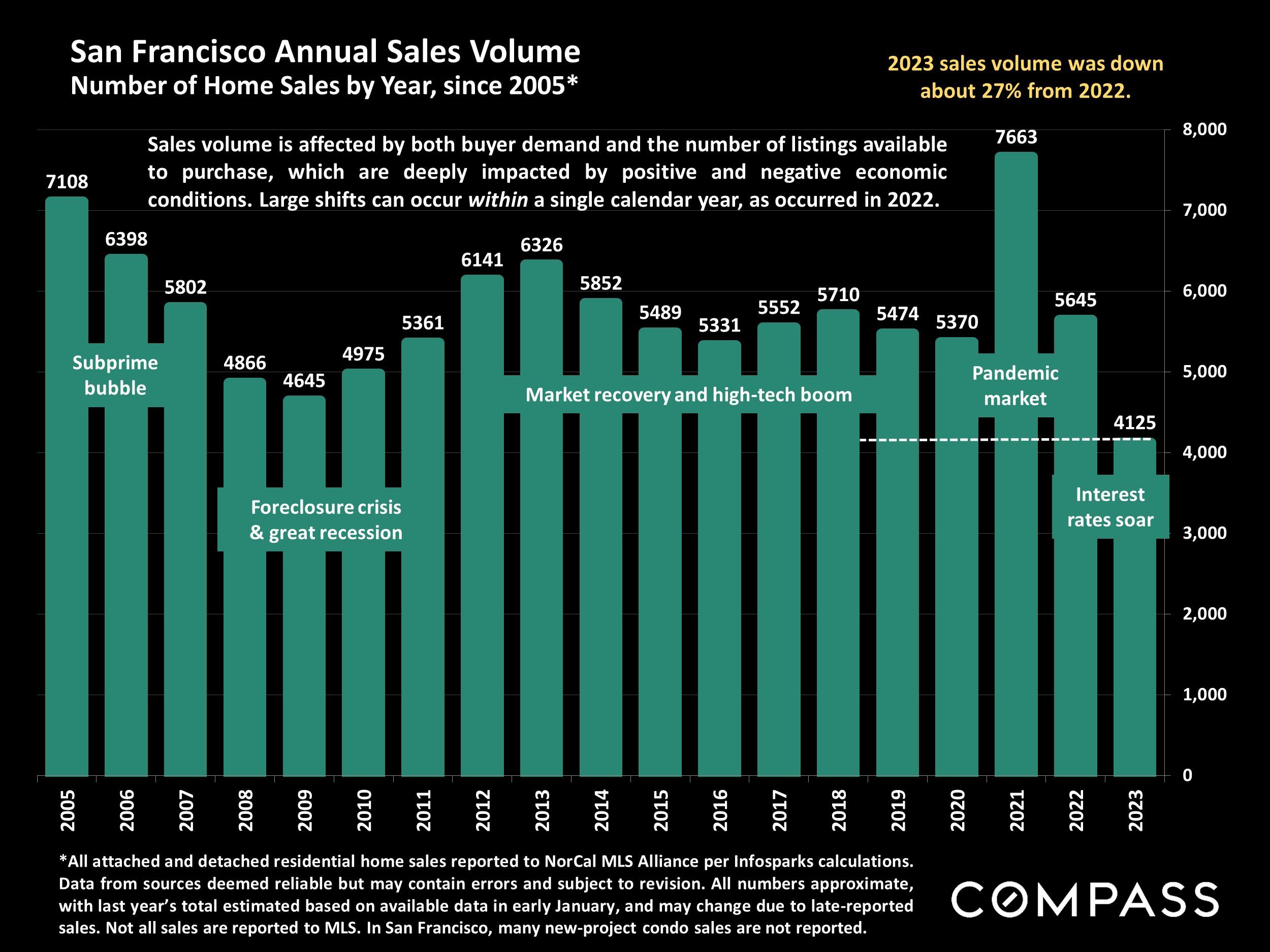

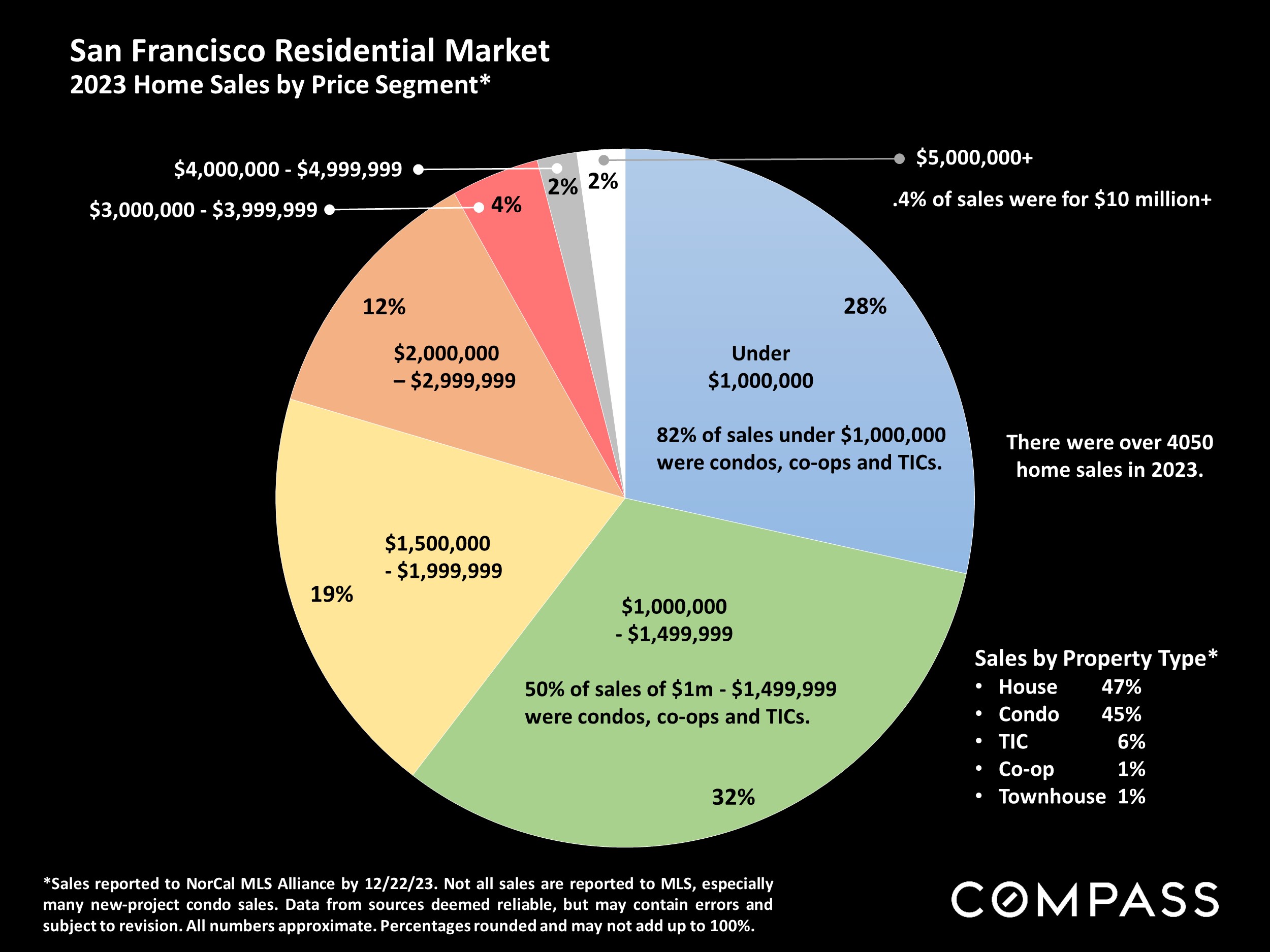

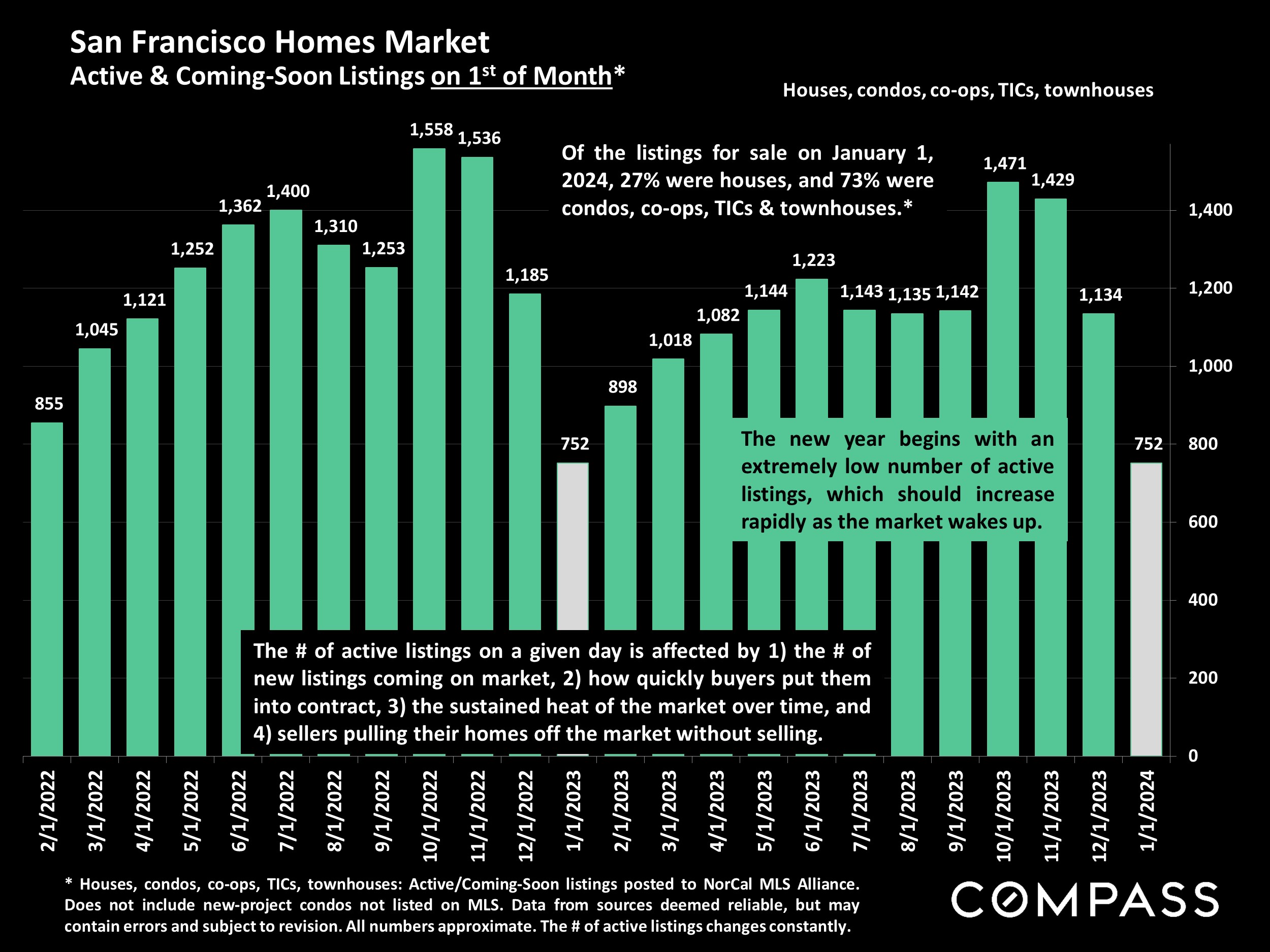

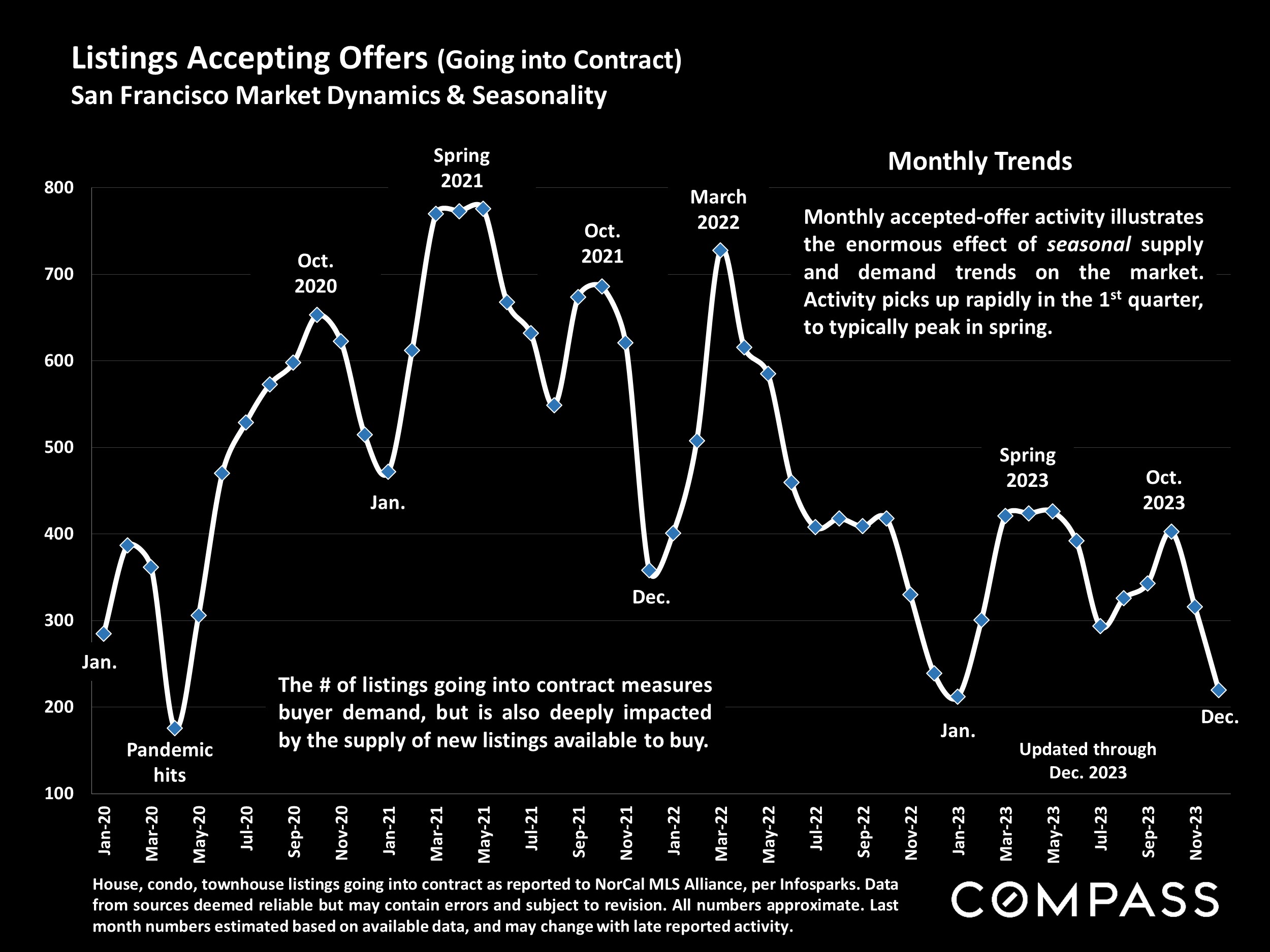

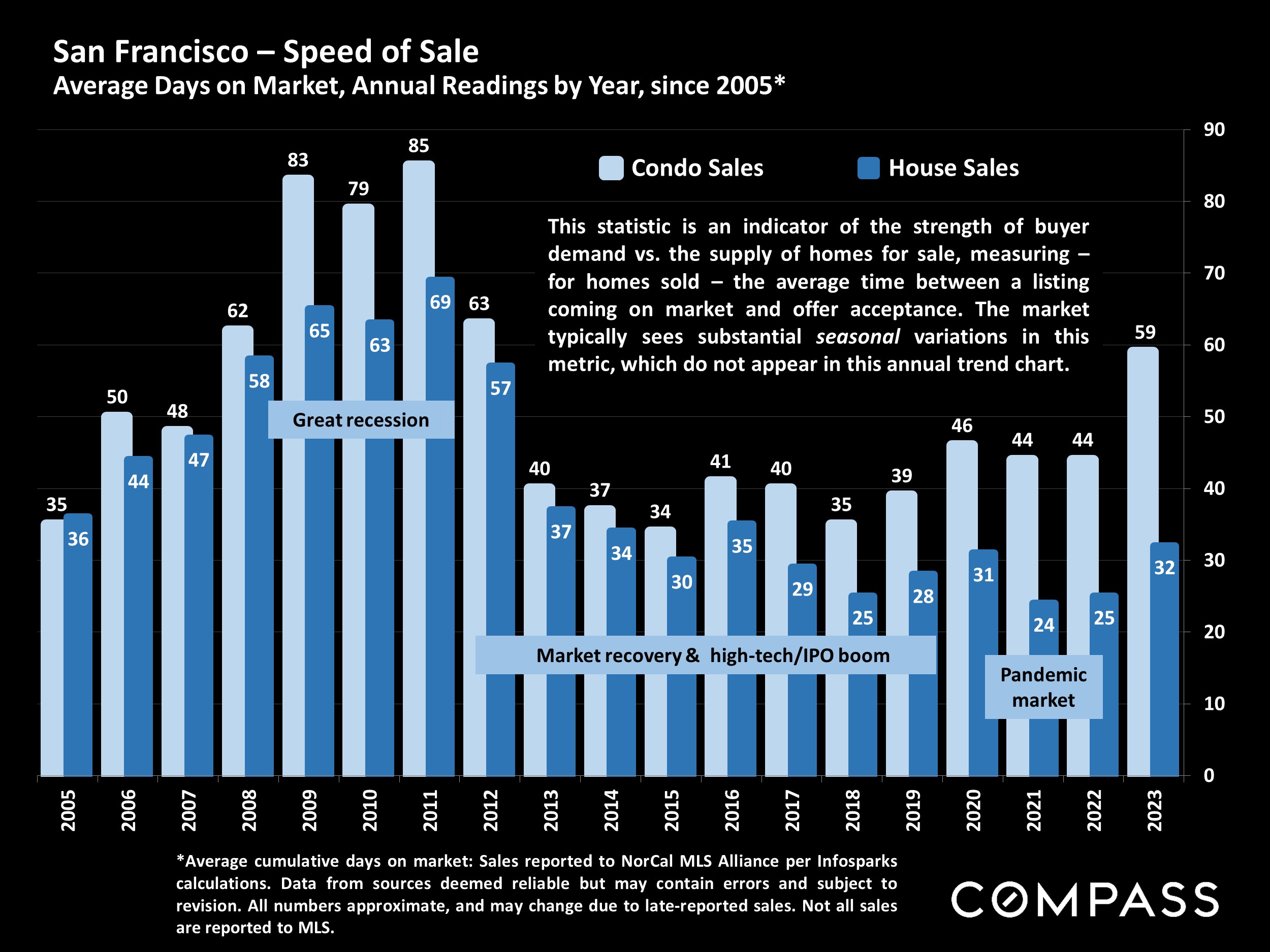

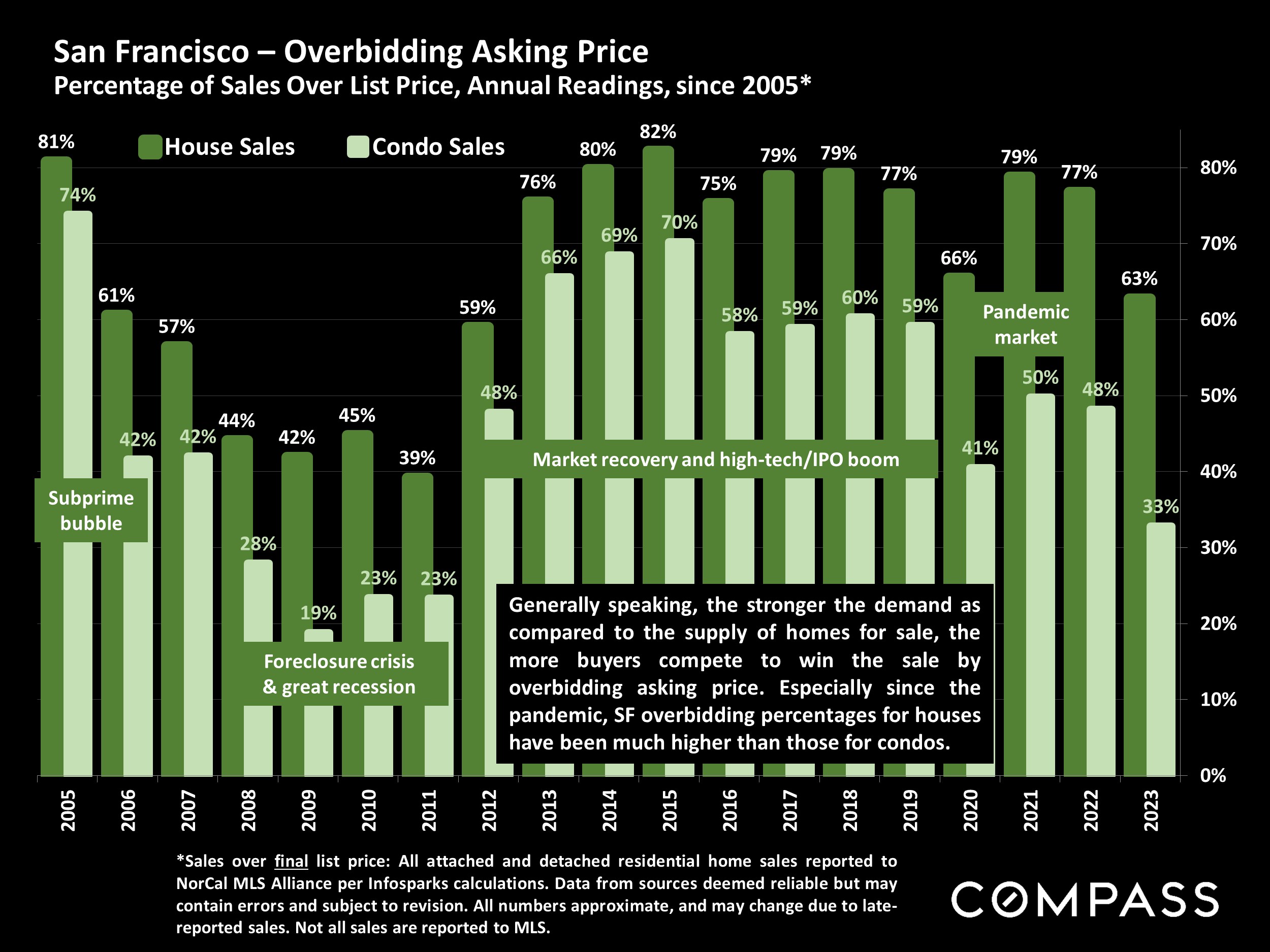

The 2023 market was characterized by high-interest rates, financial market uncertainty, negative media "doom-loop" narratives (terribly overdone), social/economic issues pertaining to the downtown district, and a low supply of new listings in most neighborhoods - generally much lower for houses than for condos. Total sales volume plunged, while for many prospective sellers, the motivation to move was reduced by the mortgage lock-in effect. With interest rates falling, media coverage turning more positive, Al companies expanding downtown, and economic conditions and consumer confidence rebounding, the direction is trending positive for San Francisco real estate.

Note: As often seen in recent years, the complex economic, political, and social factors affecting interest rates, inflation, consumer confidence, and housing and financial markets can change quickly in unexpected ways. Forecasts and predictions are best guesses based on the interpretation of recent economic data and trends.

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact