April 4, 2025

SF: March 2025 Market Stats

By Compass

March 2025 Report

With Market Data Through February

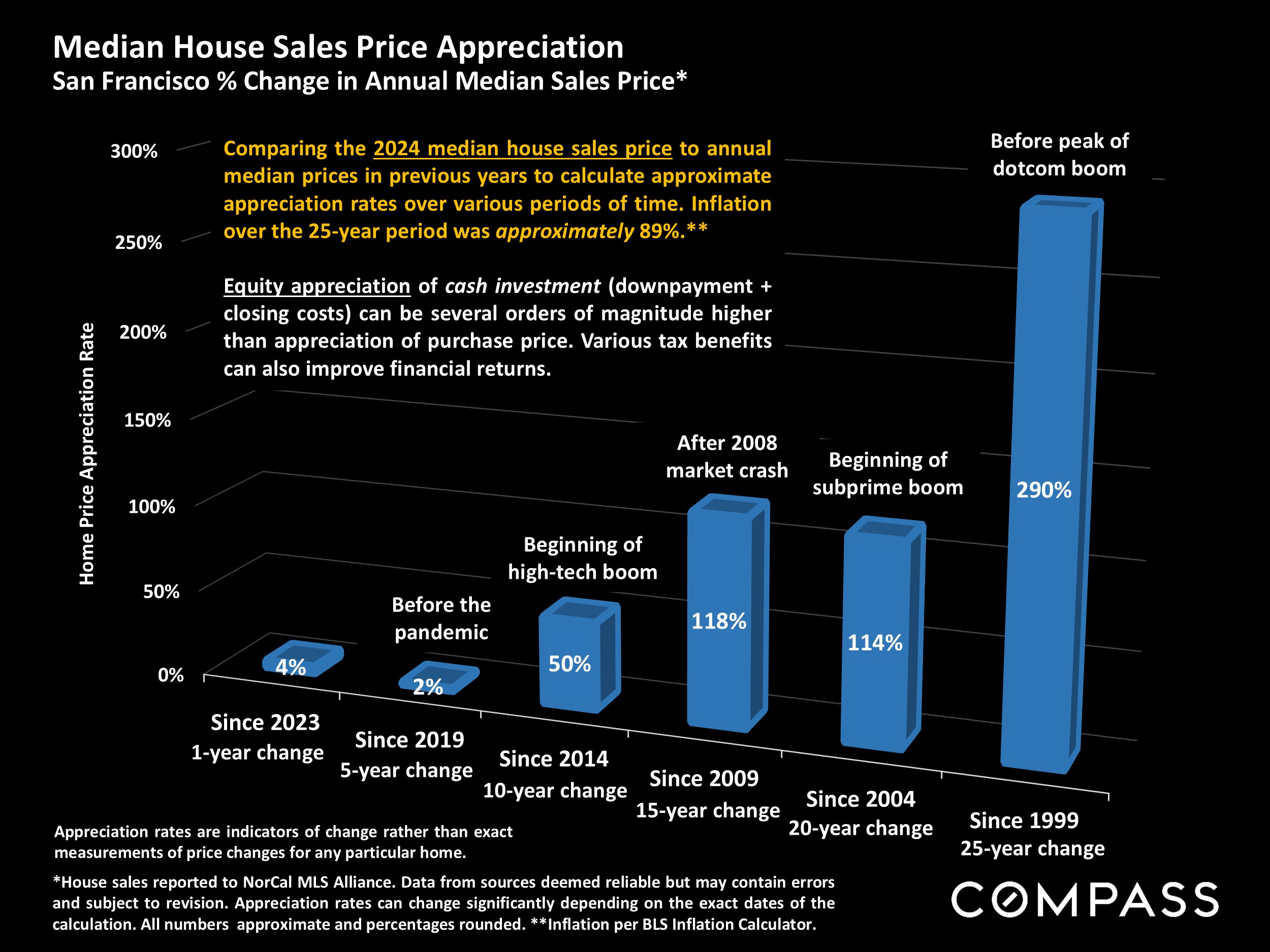

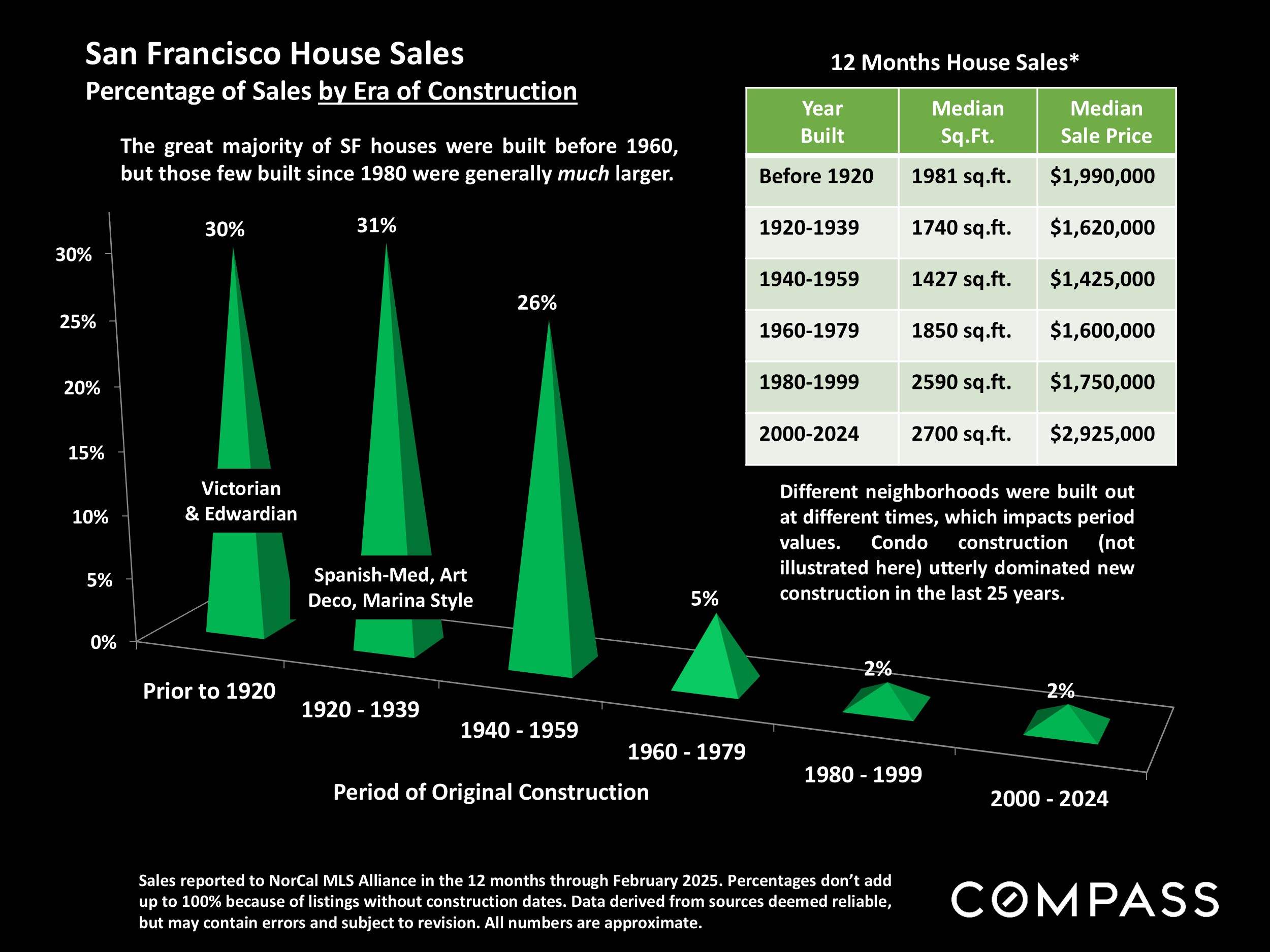

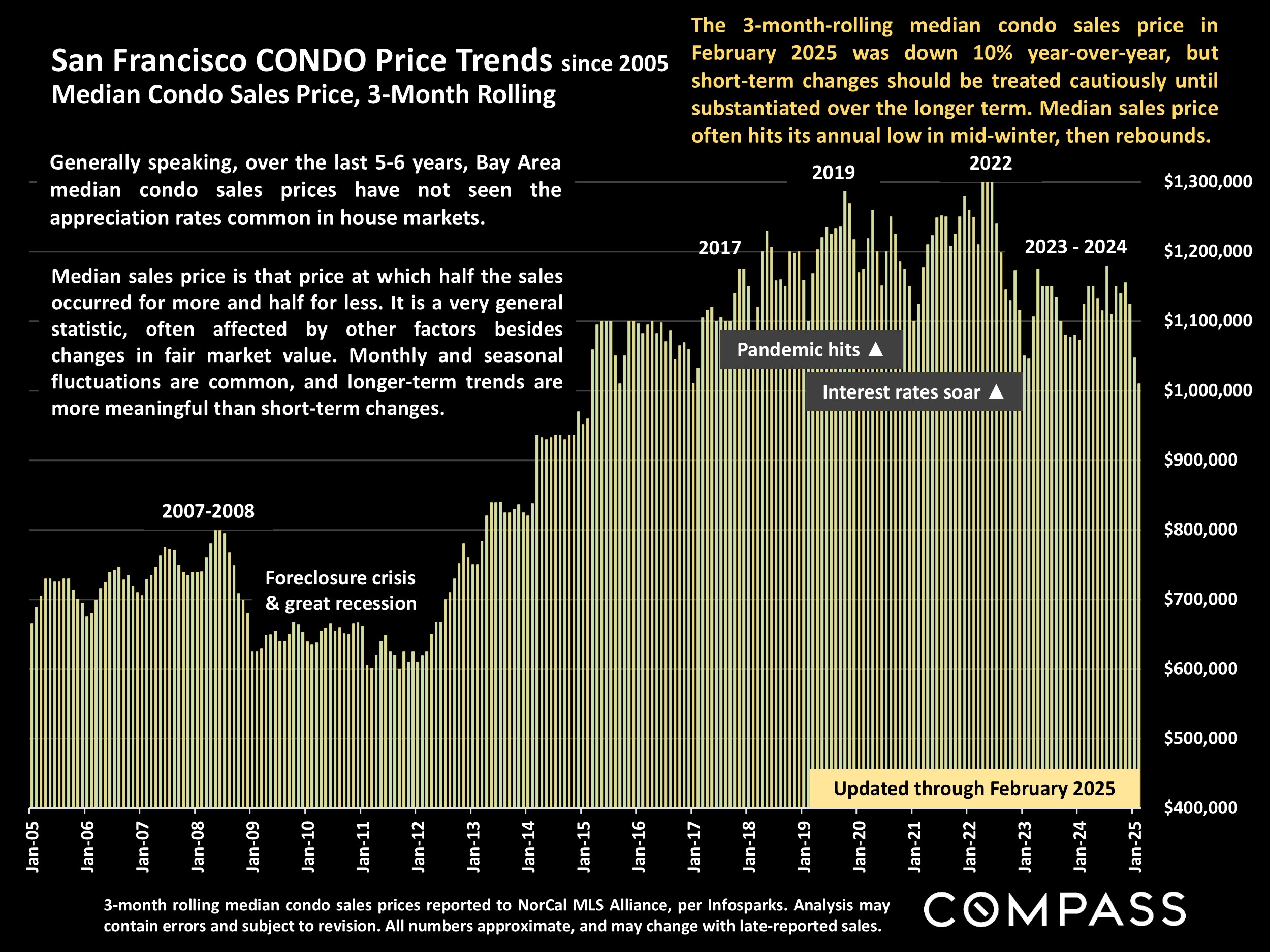

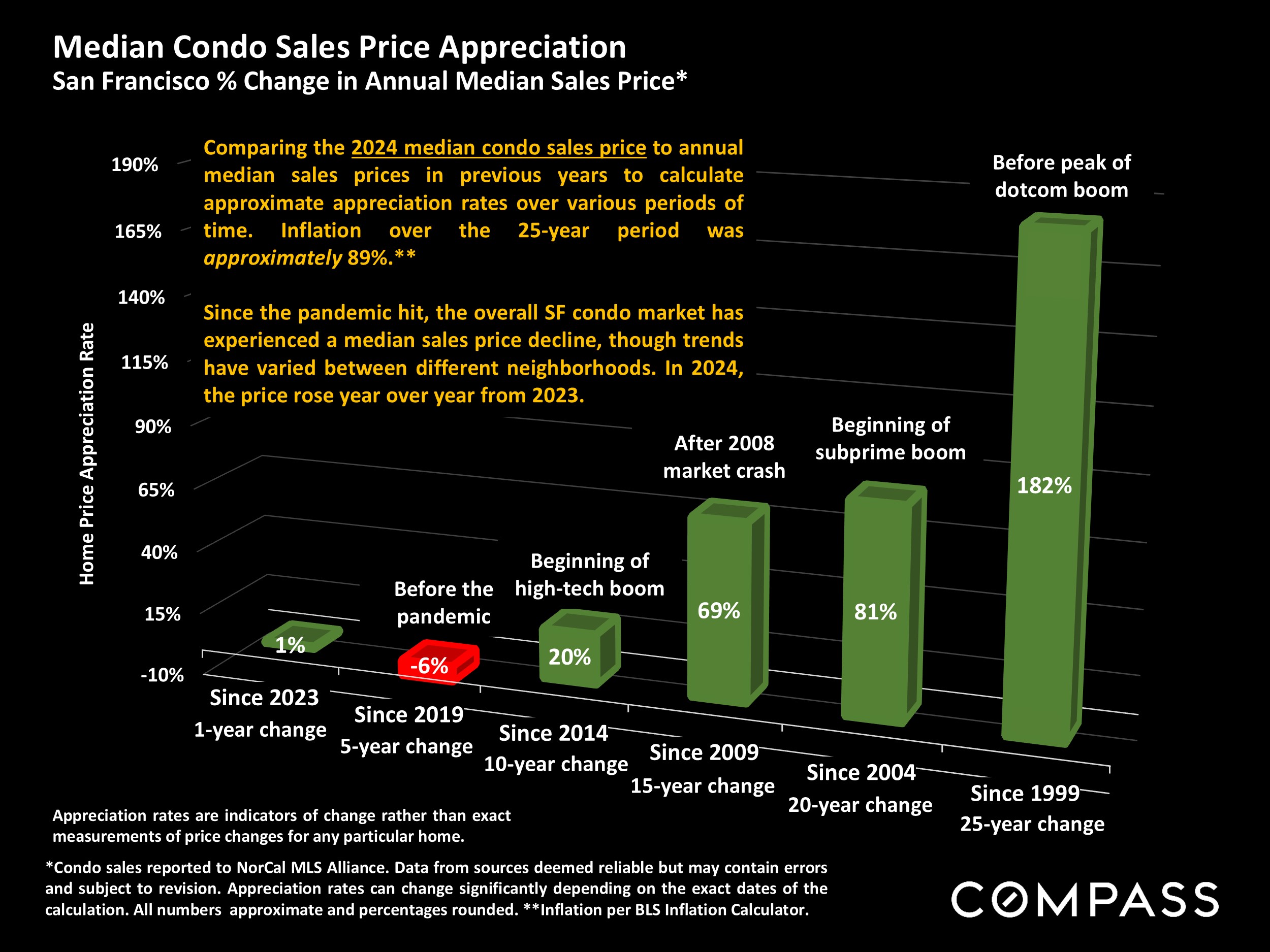

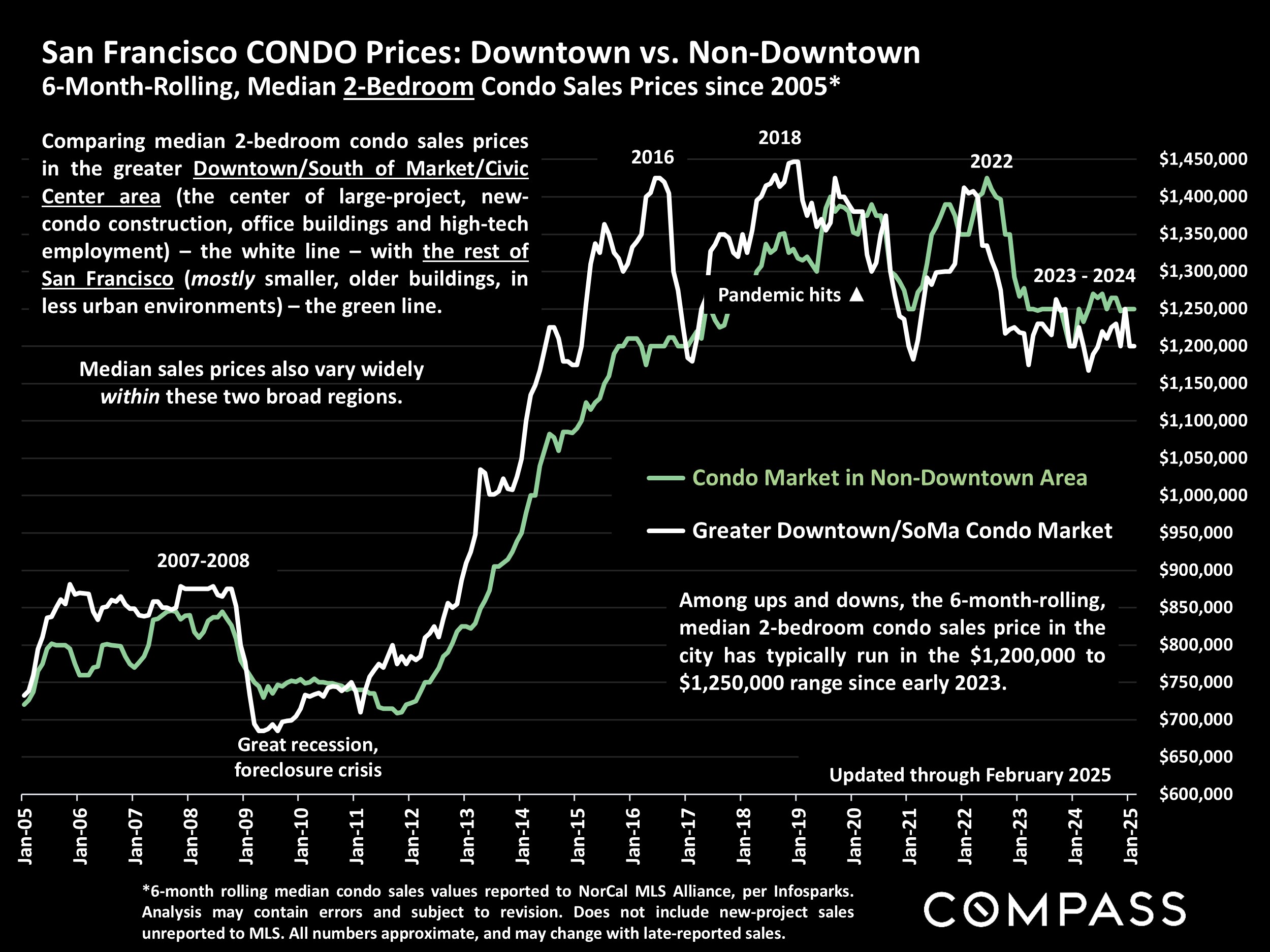

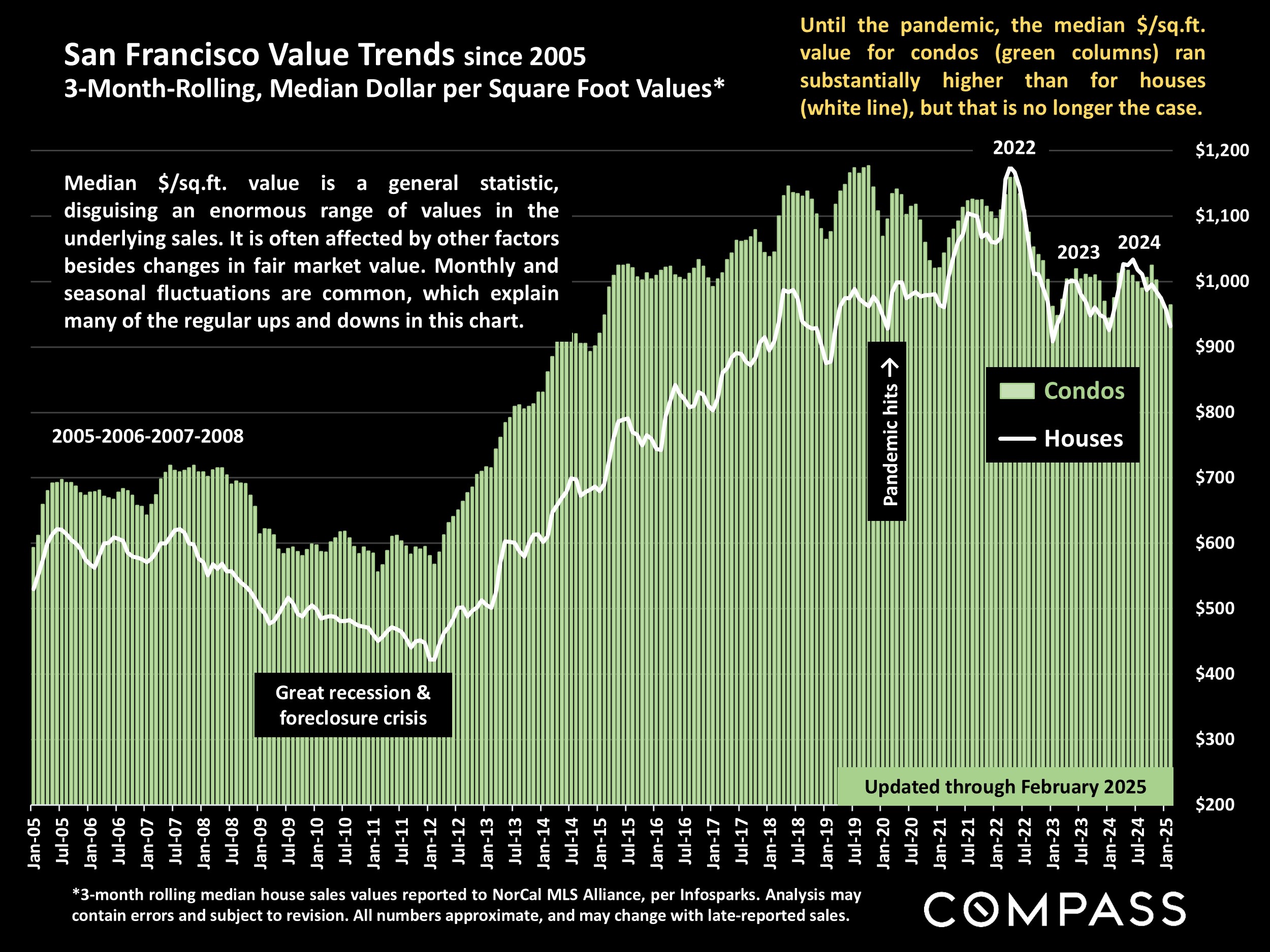

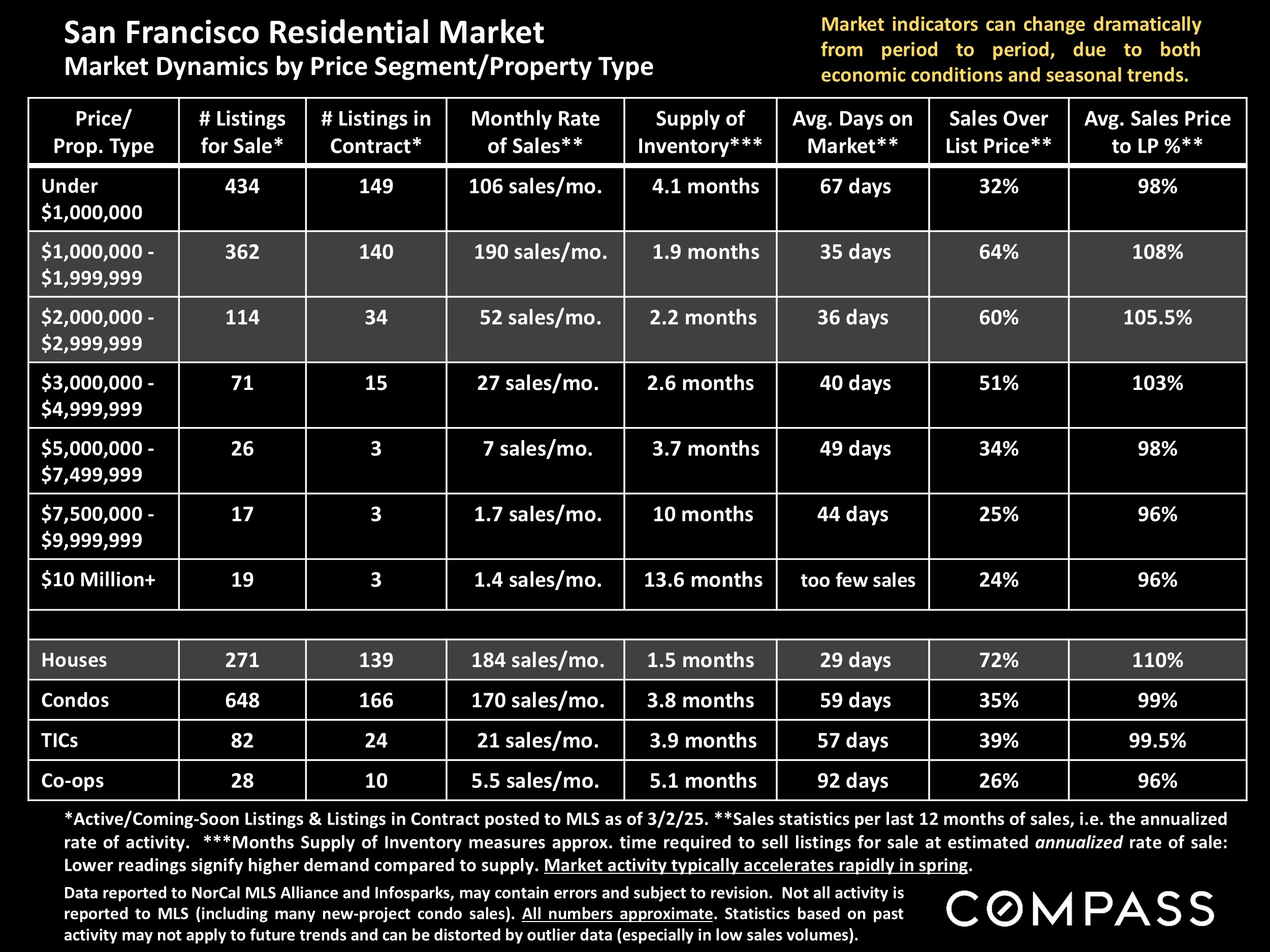

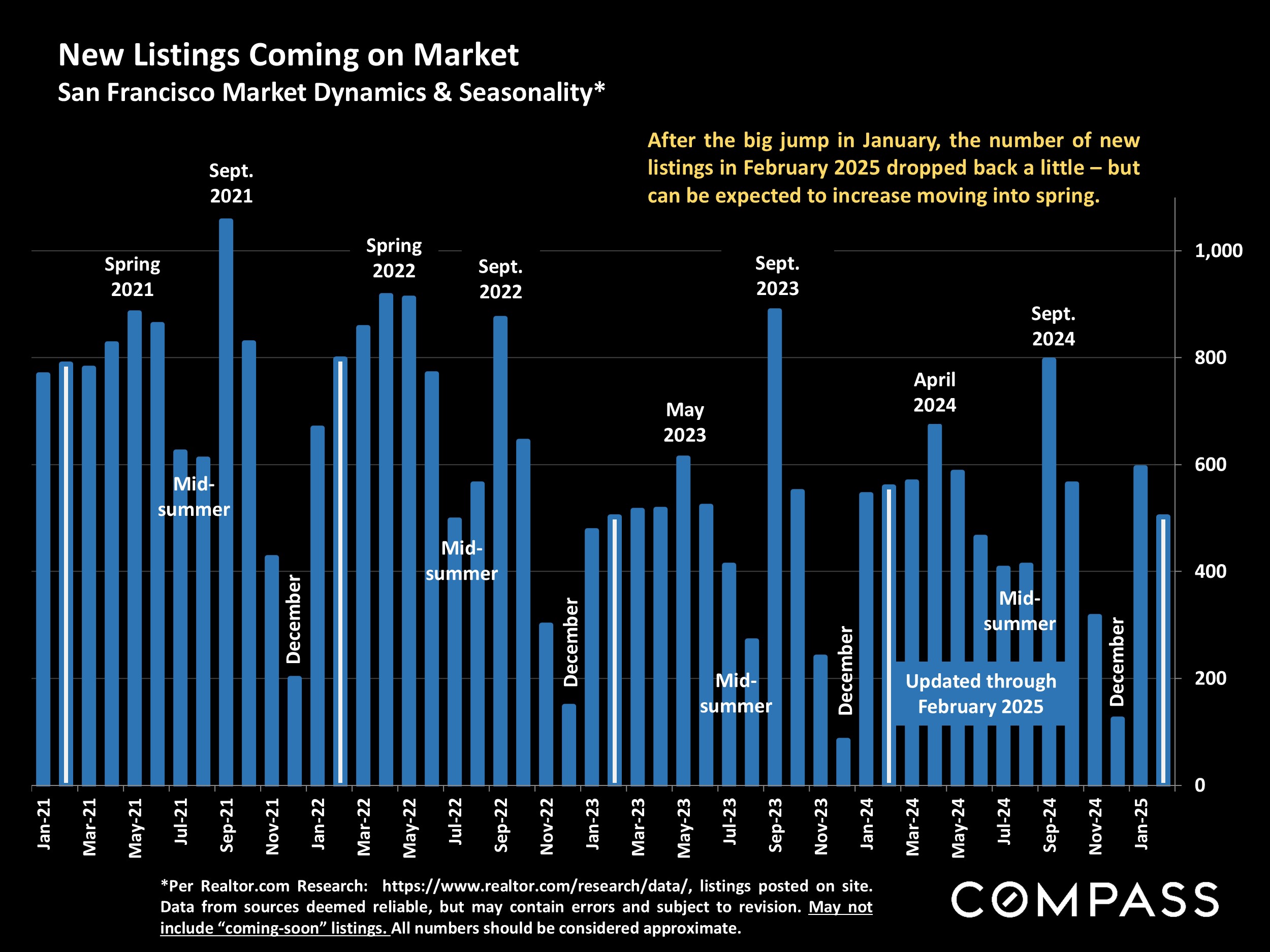

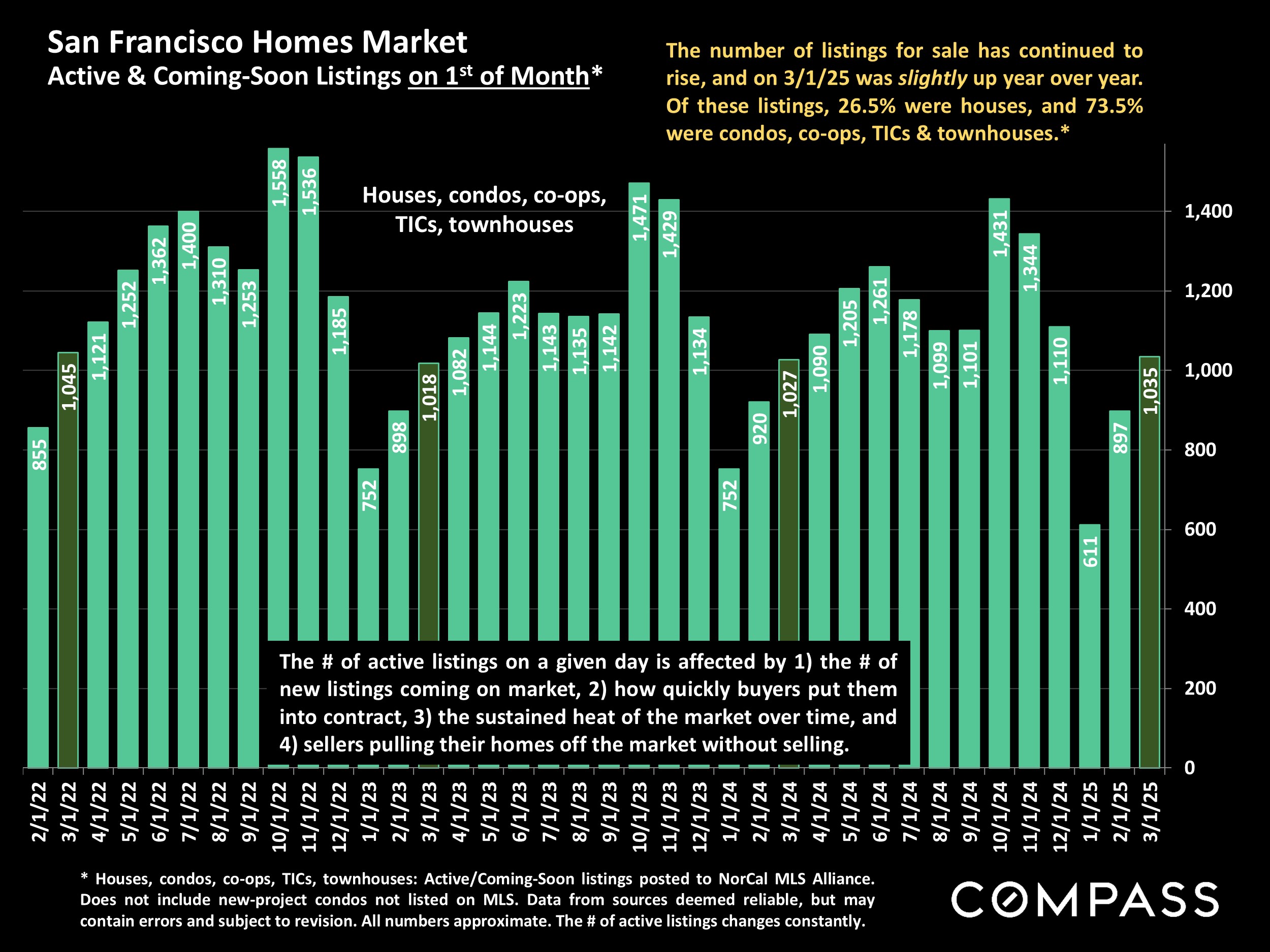

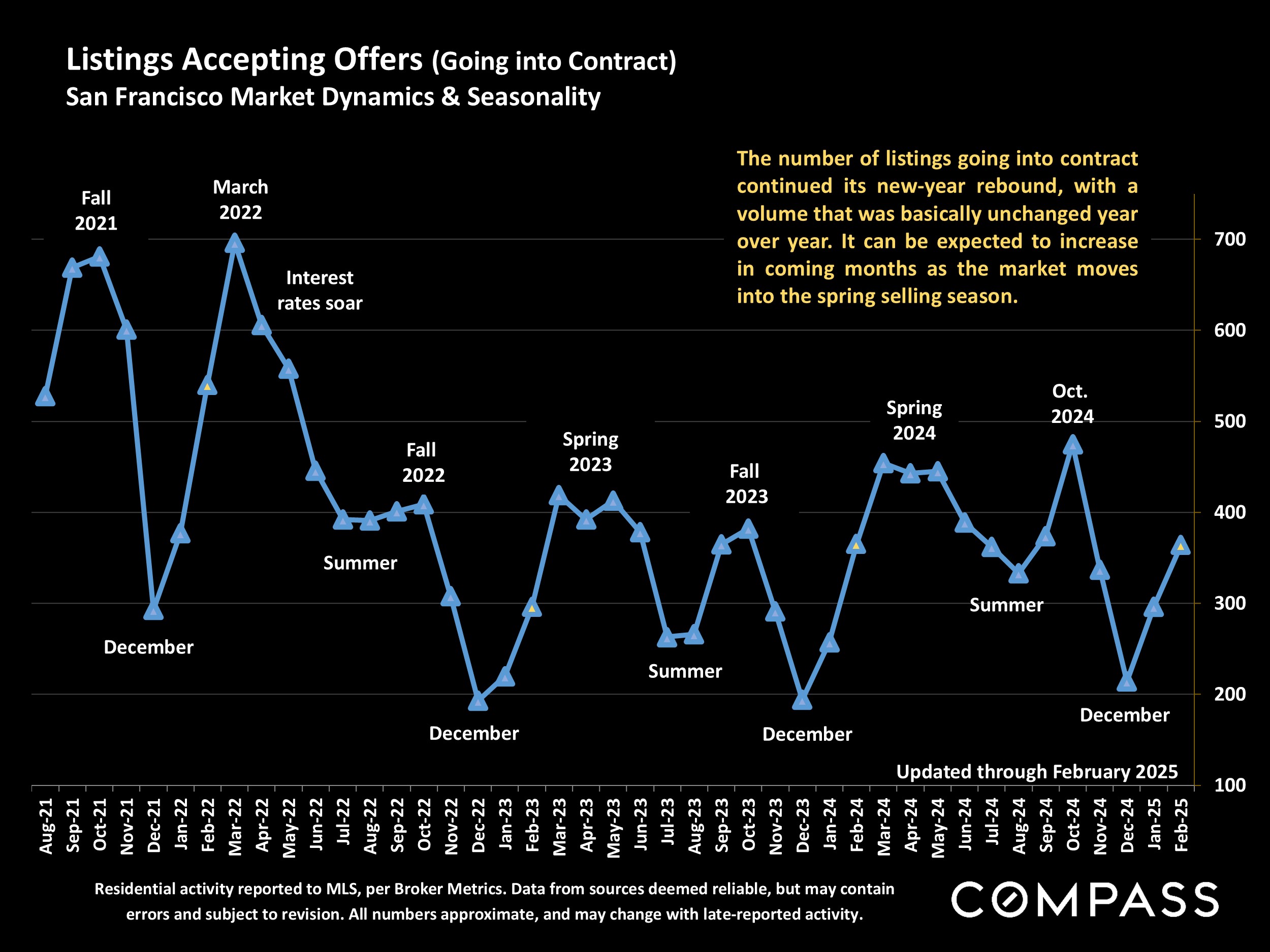

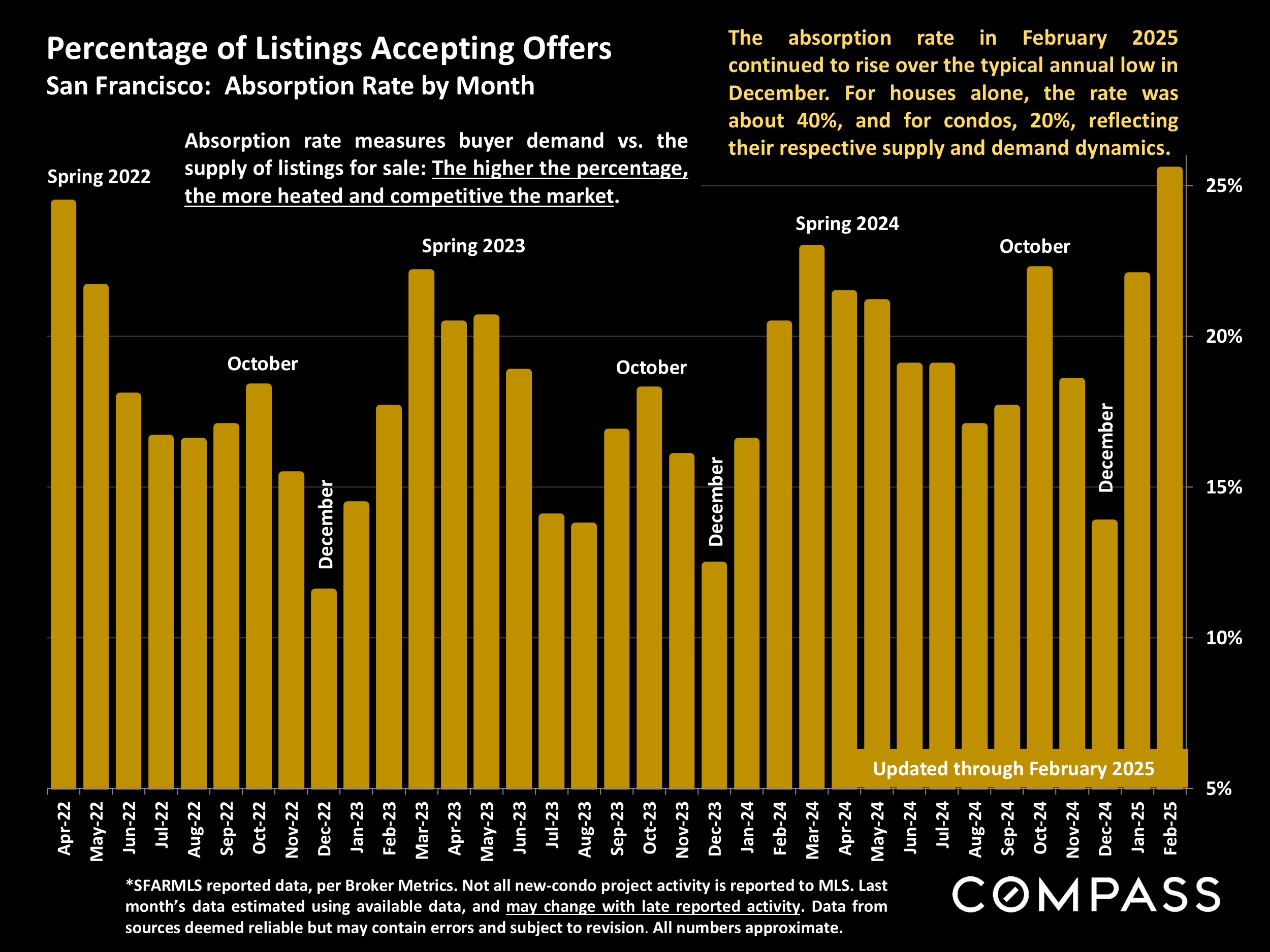

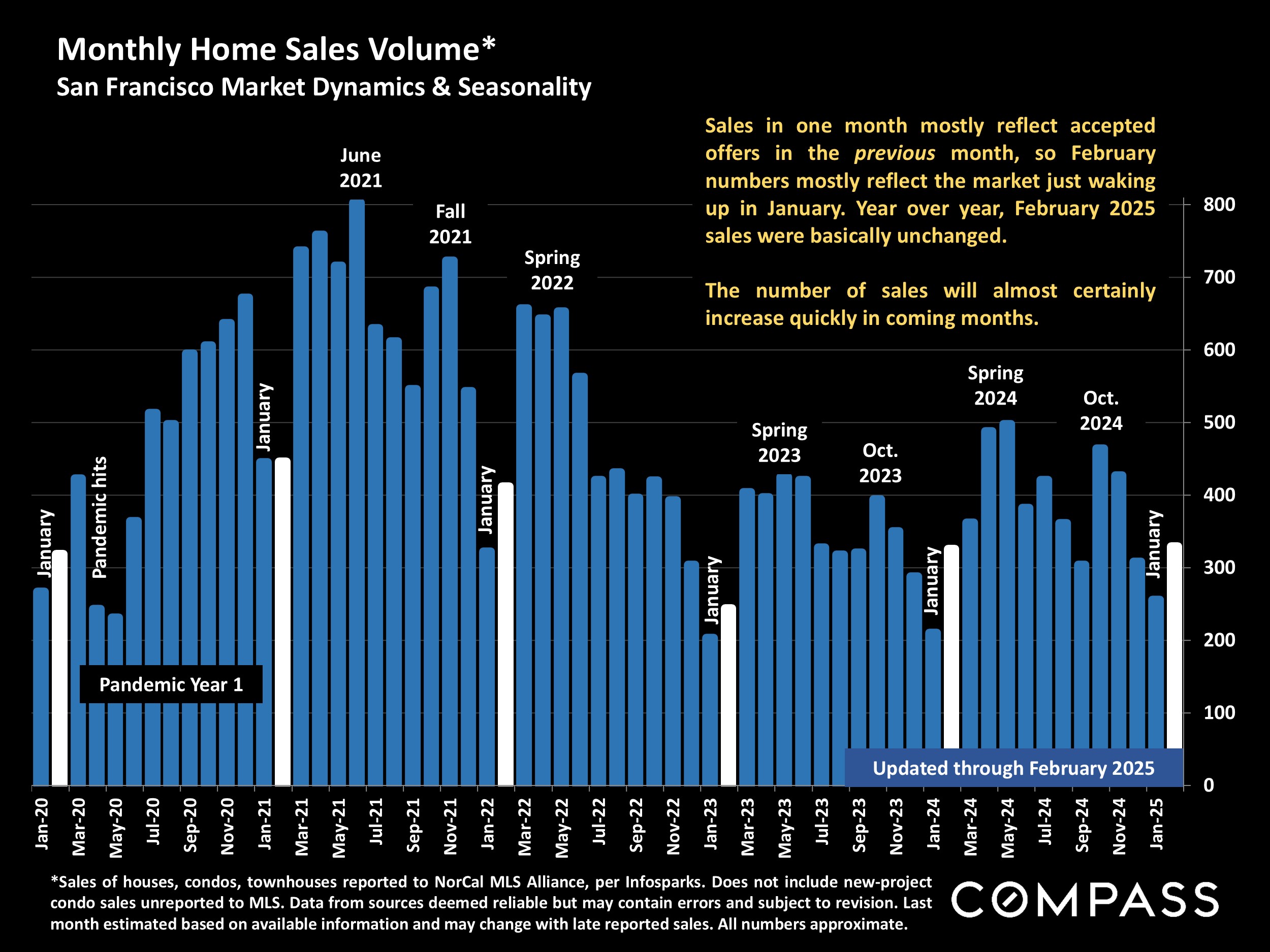

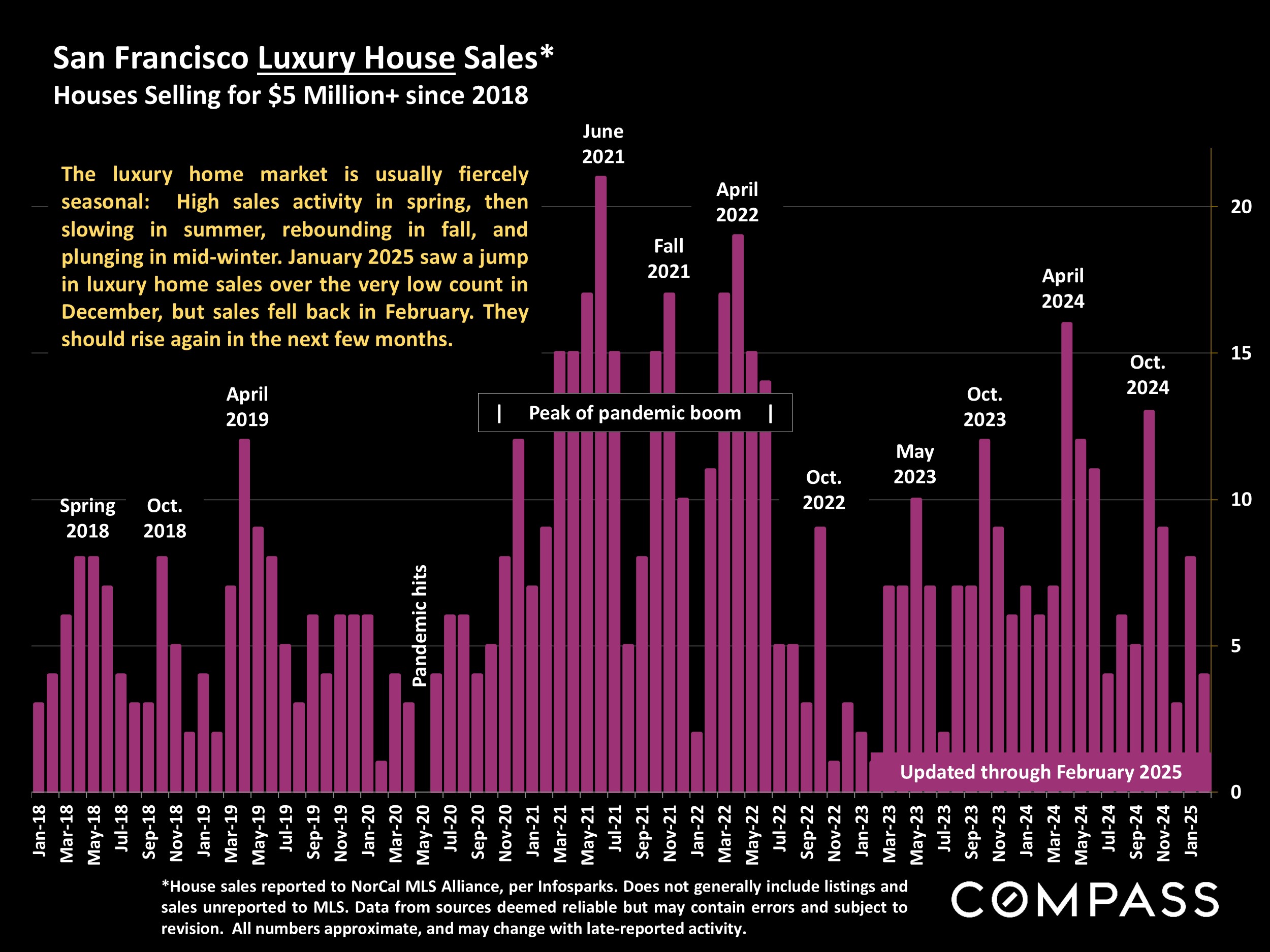

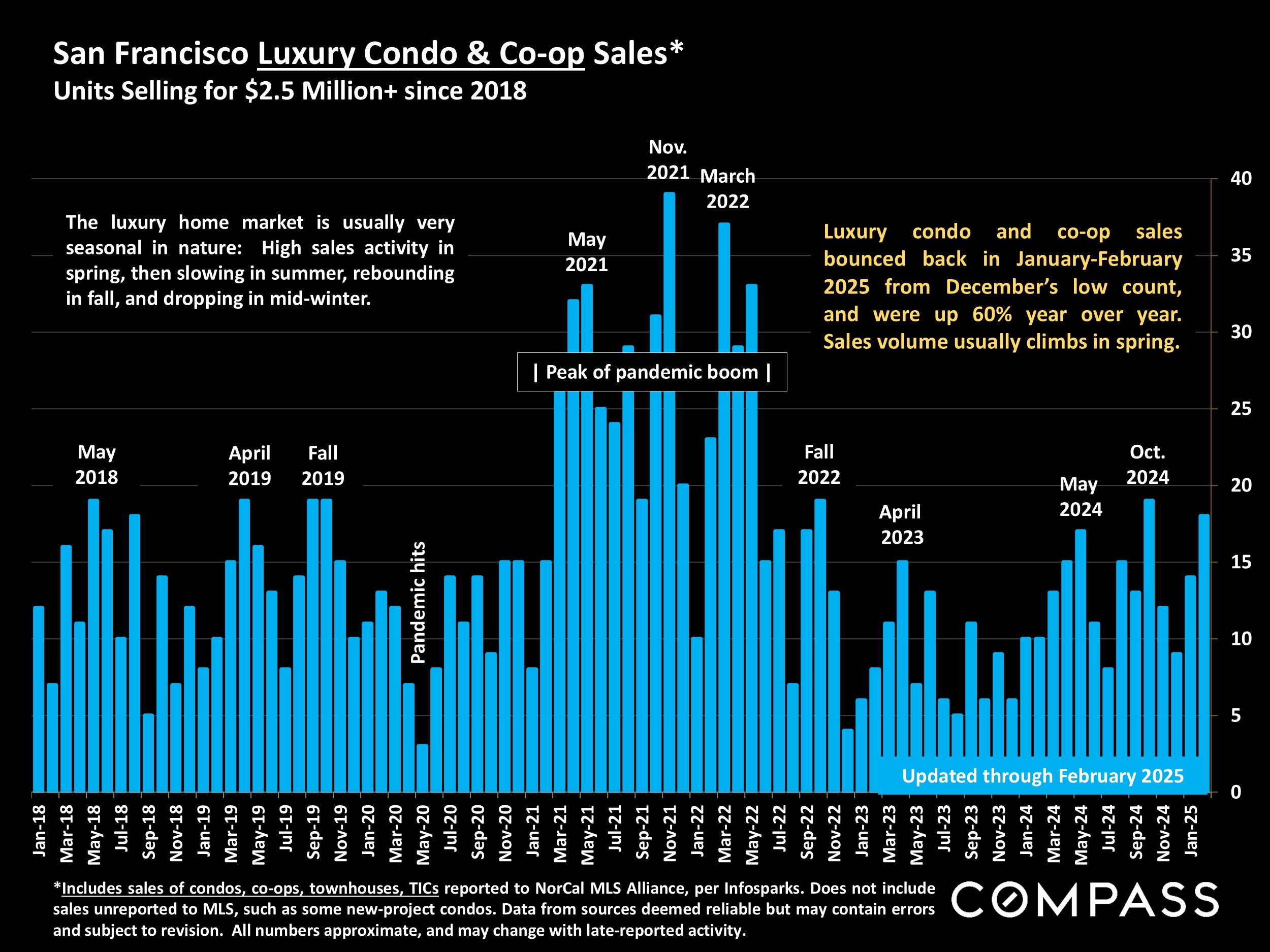

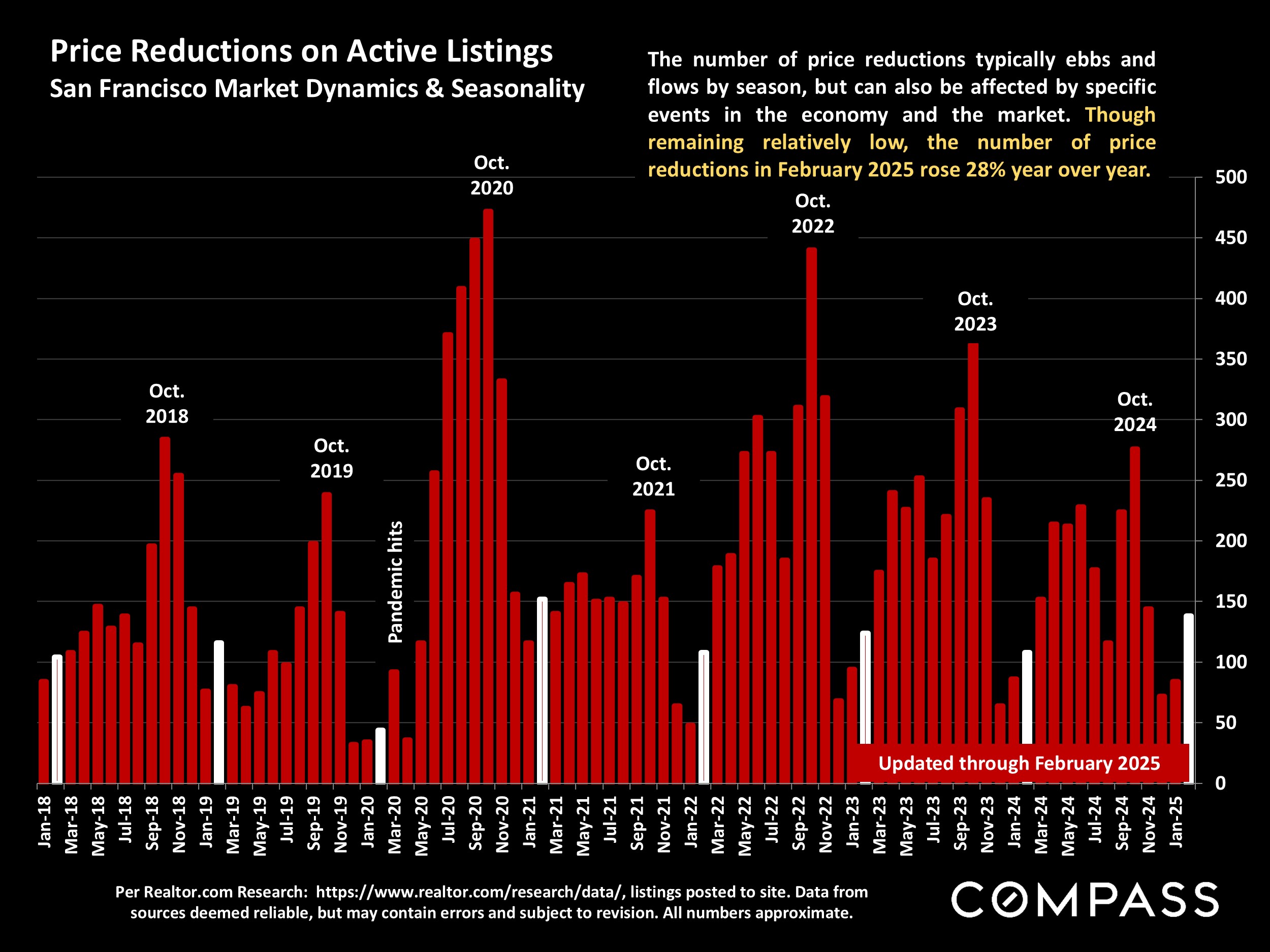

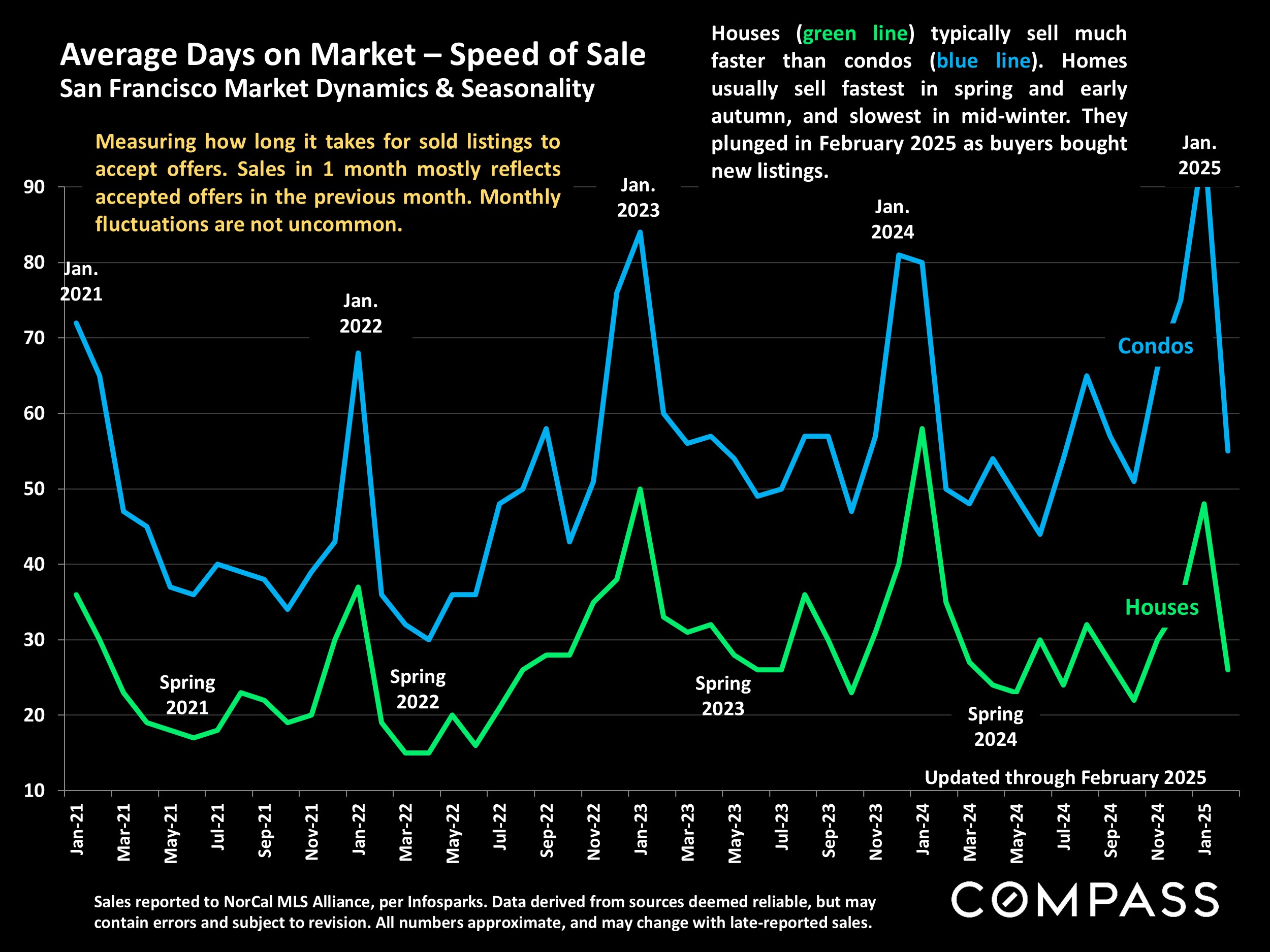

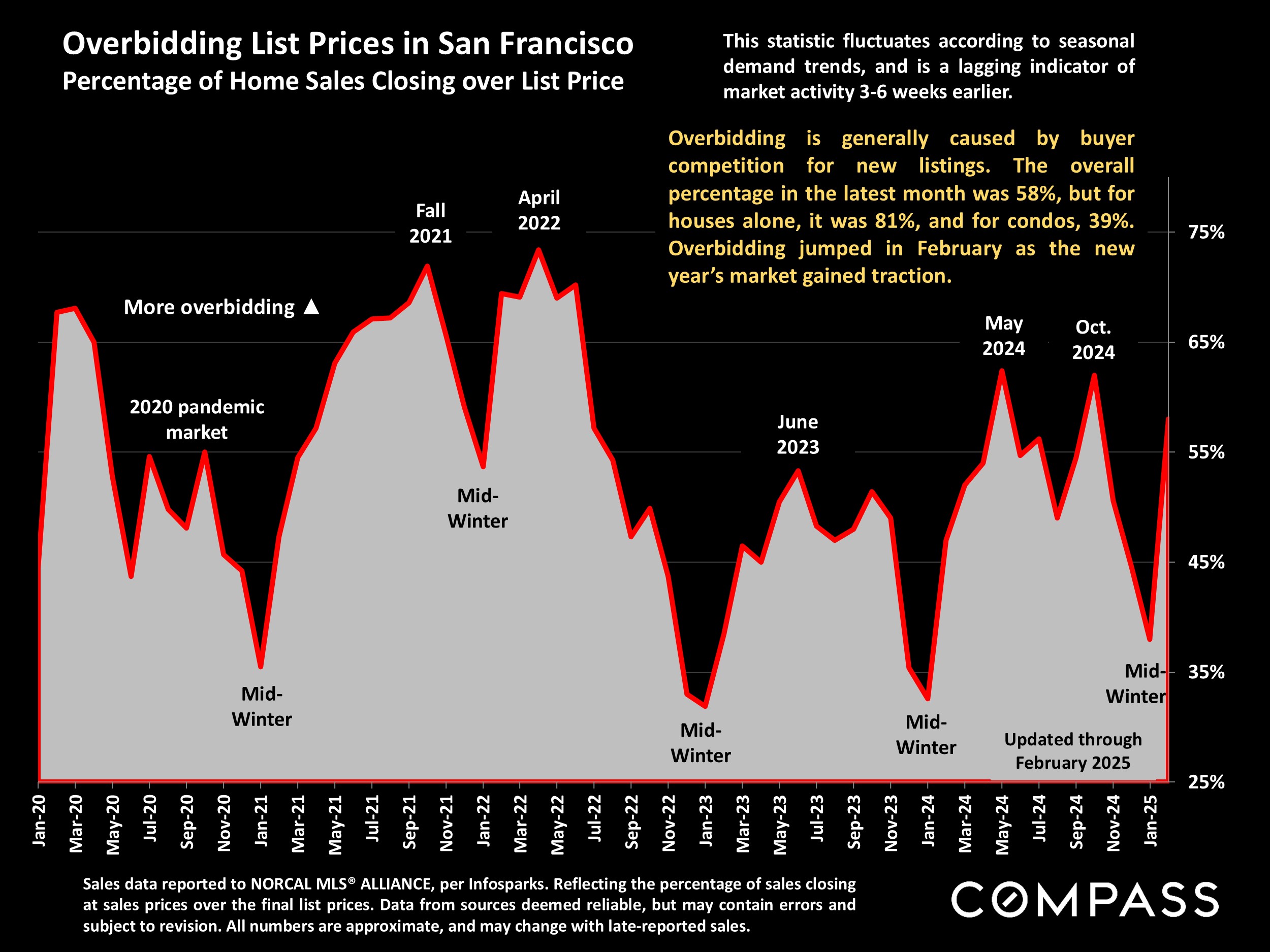

Market activity and demand - as defined by listings going into contract, speed of sale, and overbidding of list price - rose in February. Unlike other Bay Area markets, San Francisco has not seen a substantial increase in the number of homes for sale: The inventory of listings has remained relatively stable on a year-over-year basis for the past 4 years. As has been the case since the pandemic, the house market continues to be more heated than the condo market, though luxury condo/co-op sales jumped dramatically in the first 2 months of 2025.

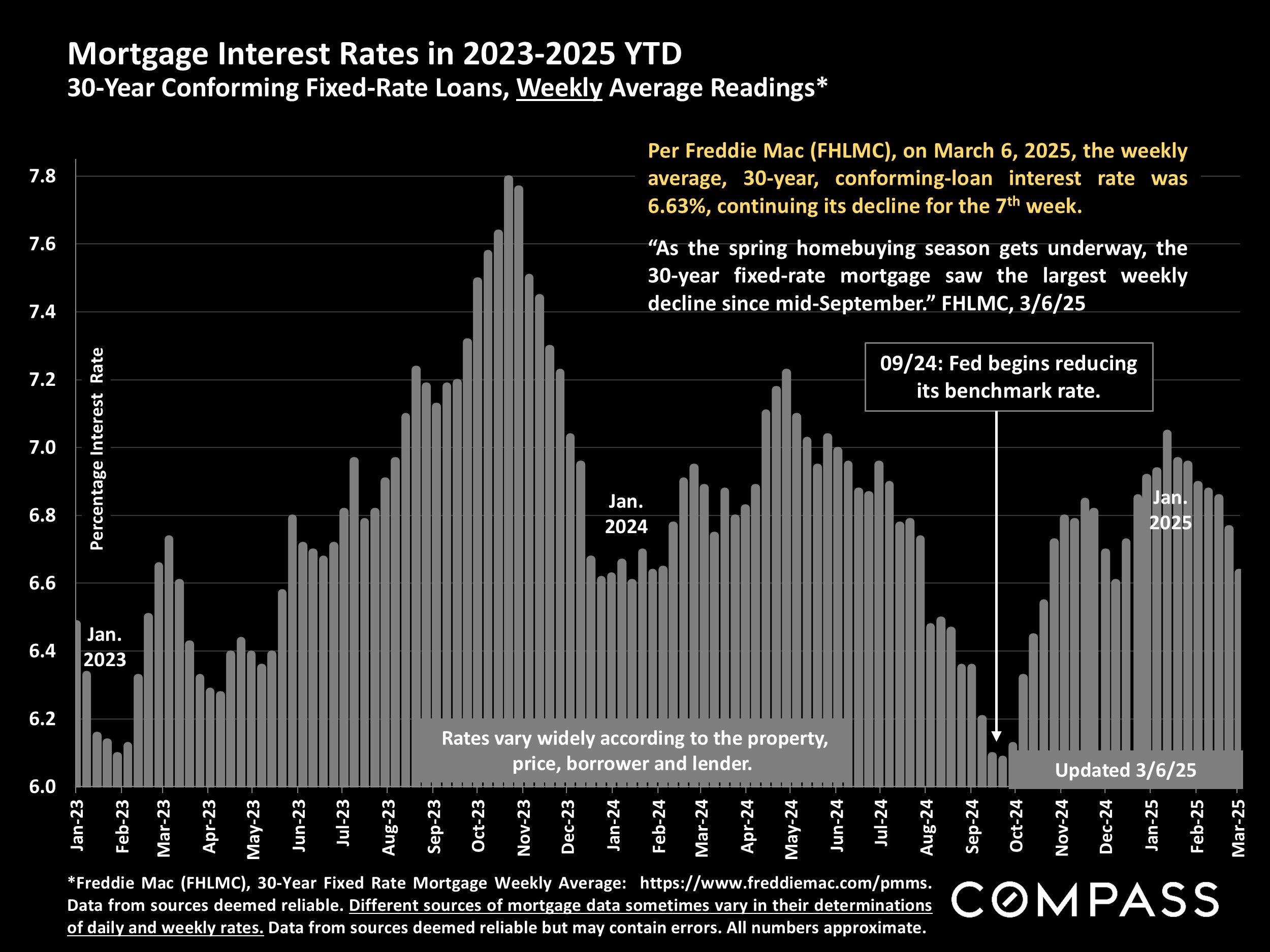

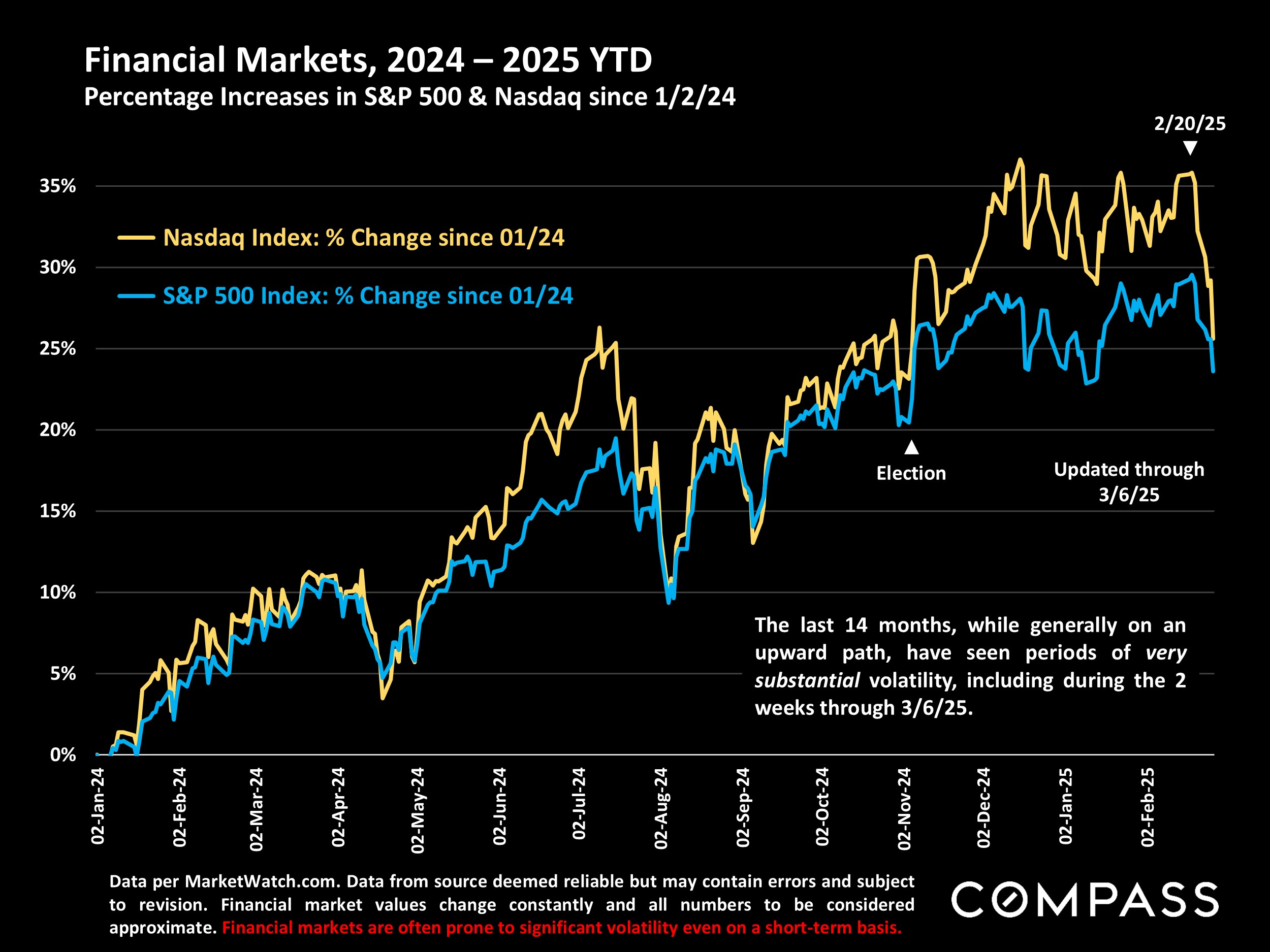

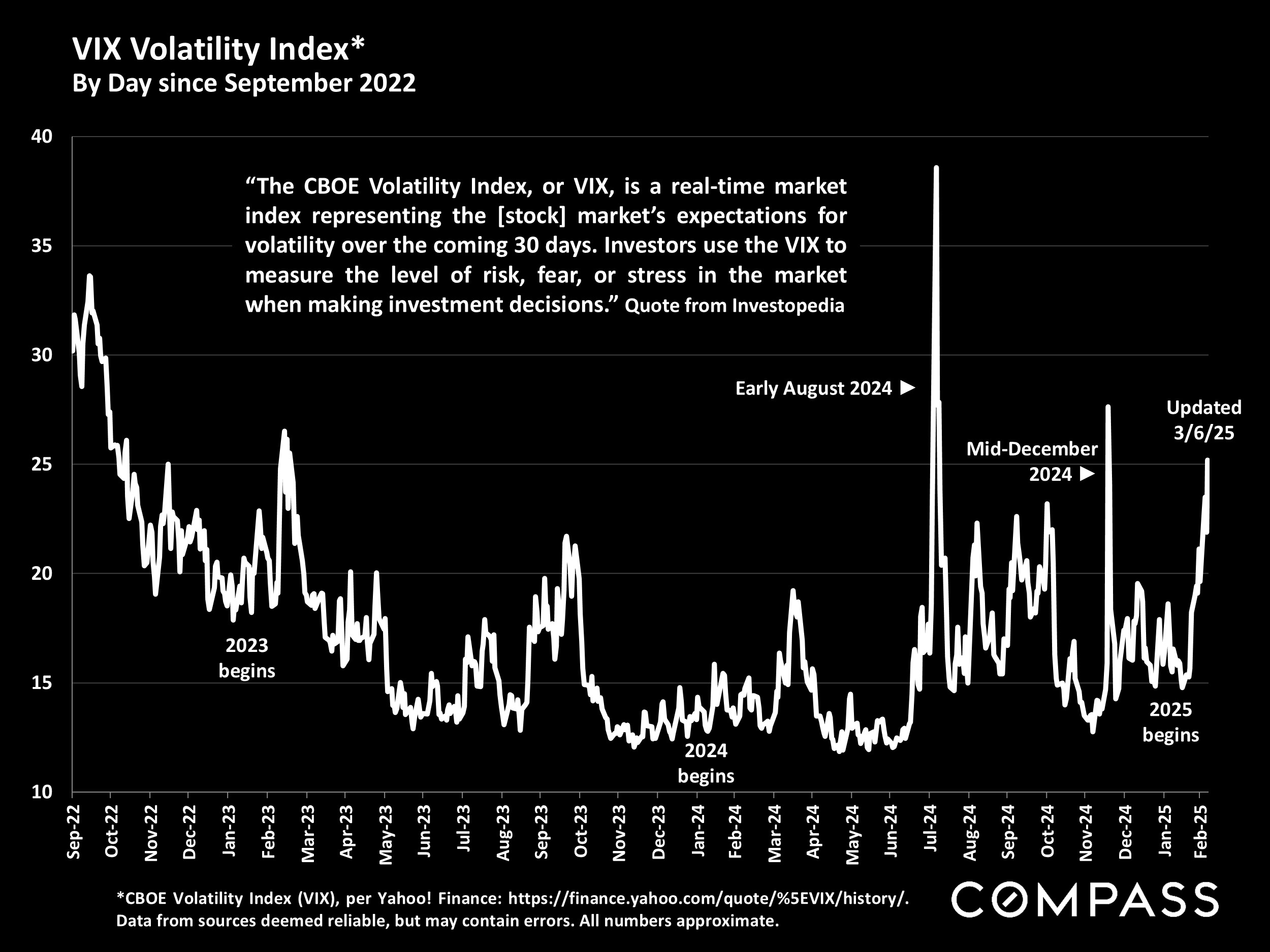

As of the first week of March, the latest inflation reading ticked up for the 4th month; the Fed kept its benchmark rate unchanged; interest rates fell for the 7th week; and stock markets saw 2 weeks of significant declines. National and international politics continue to be characterized by constant and unpredictable change and enormous uncertainty. And consumer confidence in February dropped across all age, income and wealth groups as expectations for personal finances and both short-term and long-term economic conditions all declined (per the University of Michigan's February "Surveys of Consumers").

We are now moving into the spring selling season, typically the most heated of the year, and not unusually seeing the calendar year's highest median home sales prices.

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact