November 8, 2024

SF: November 2024 Market Stats

By Compass

A Substantial Rebound in Market Activity

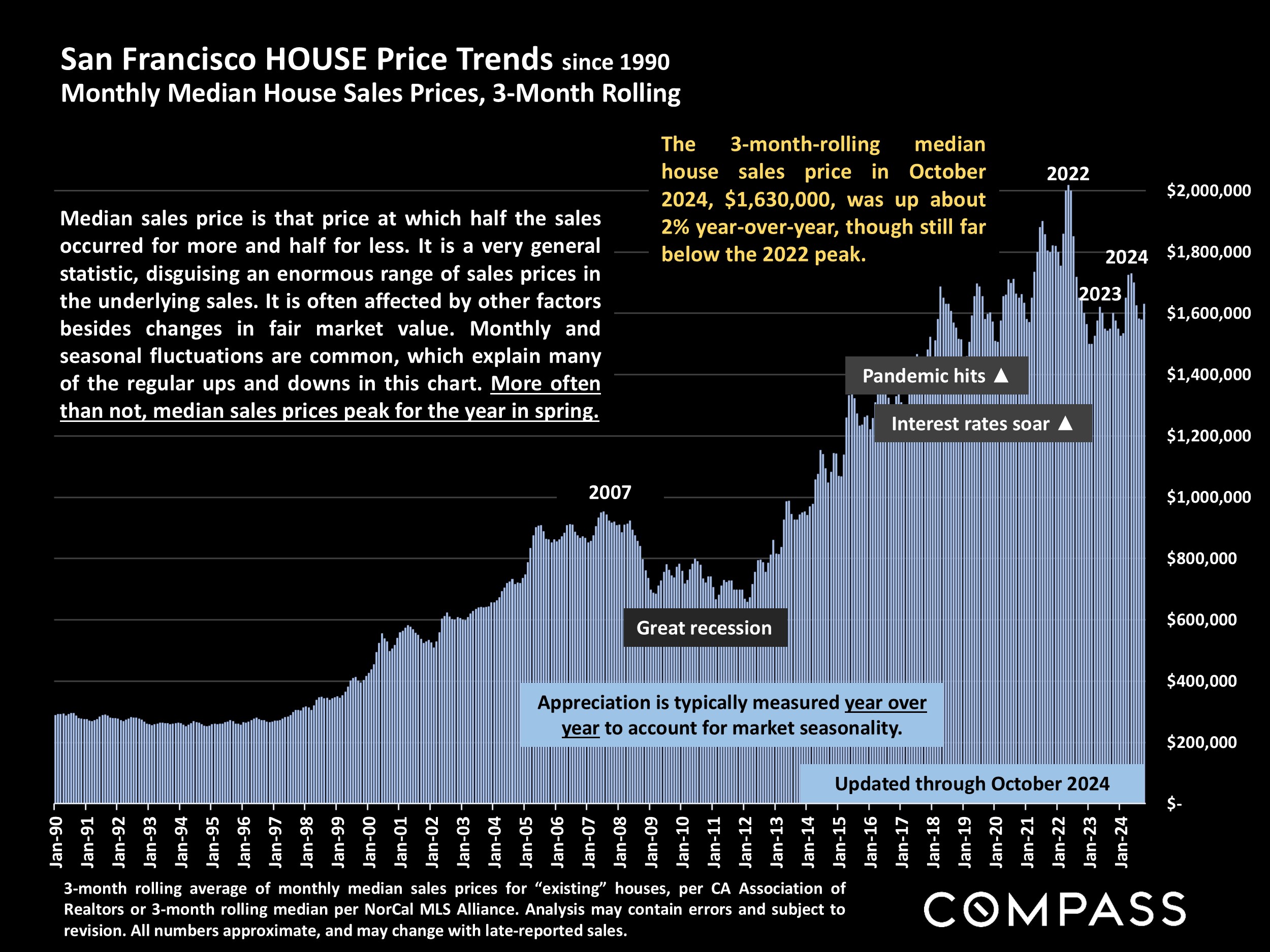

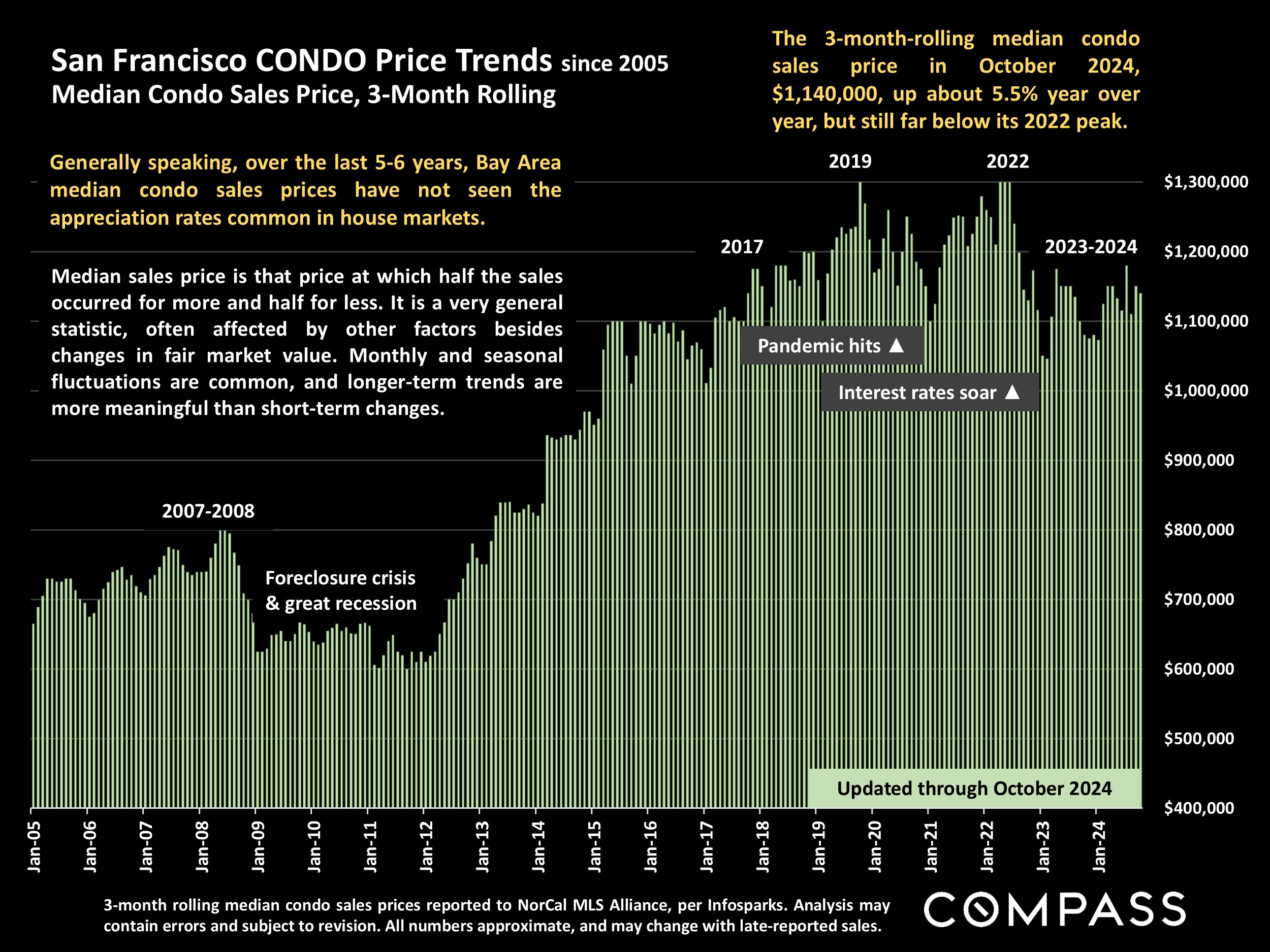

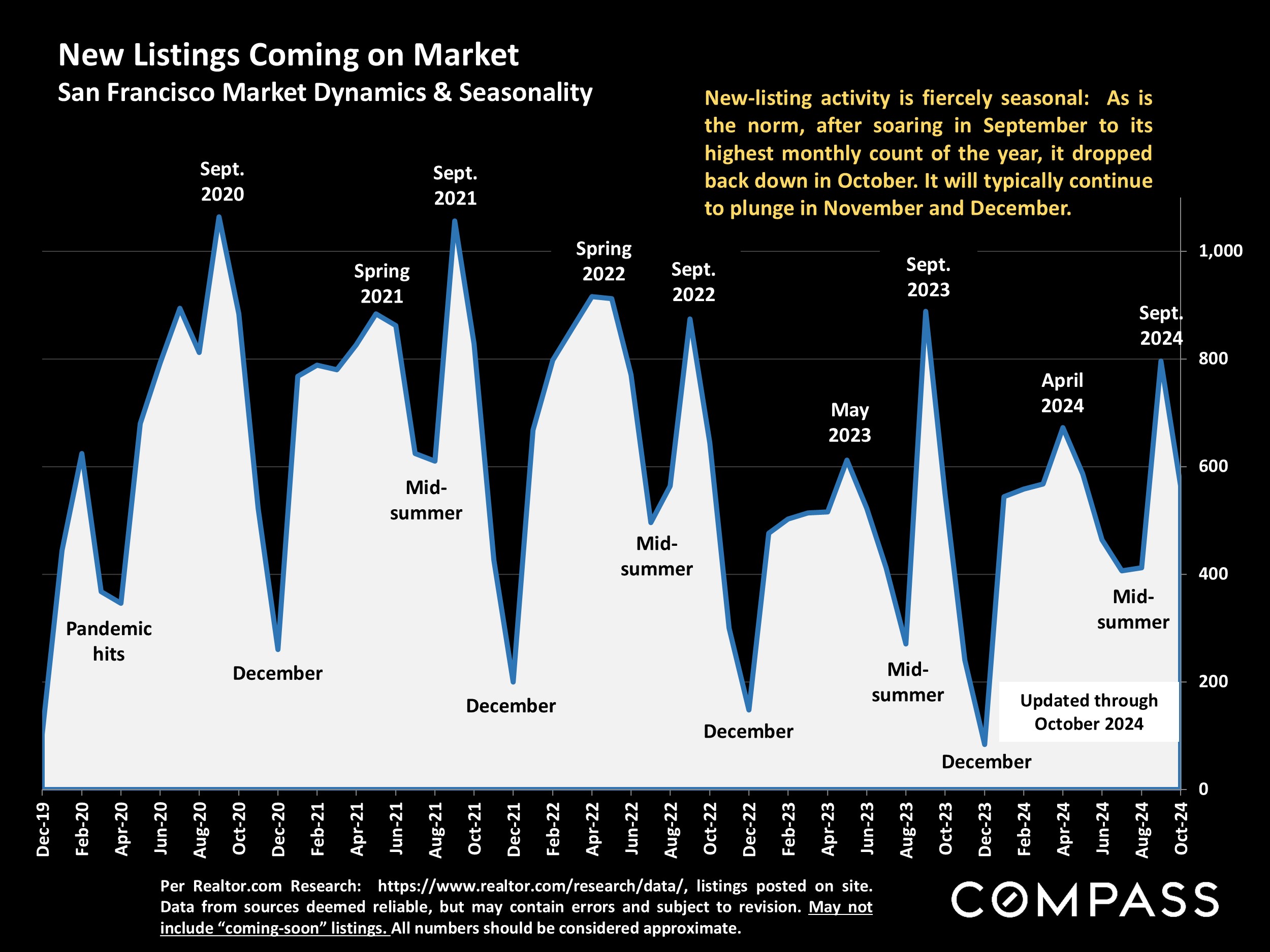

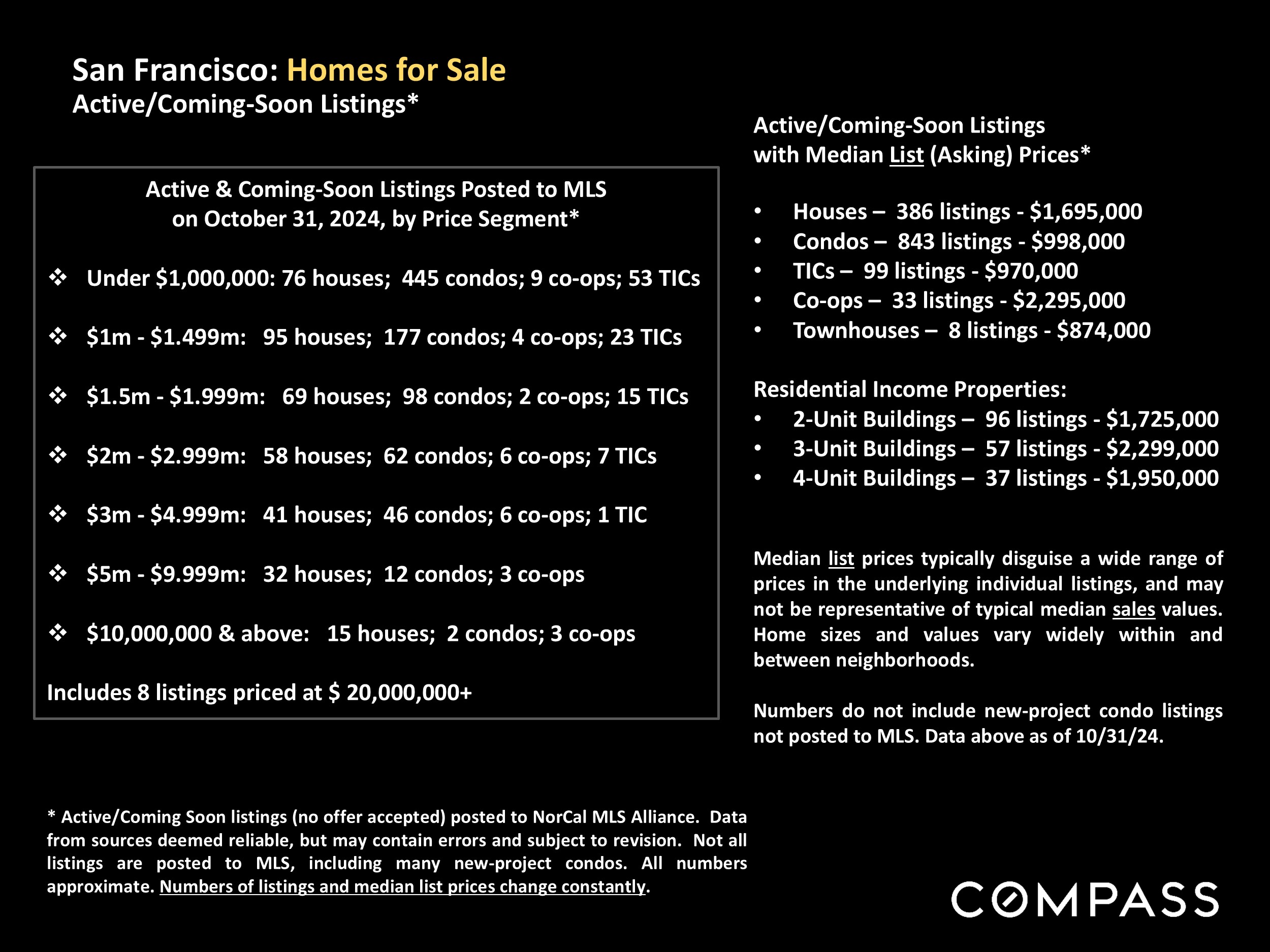

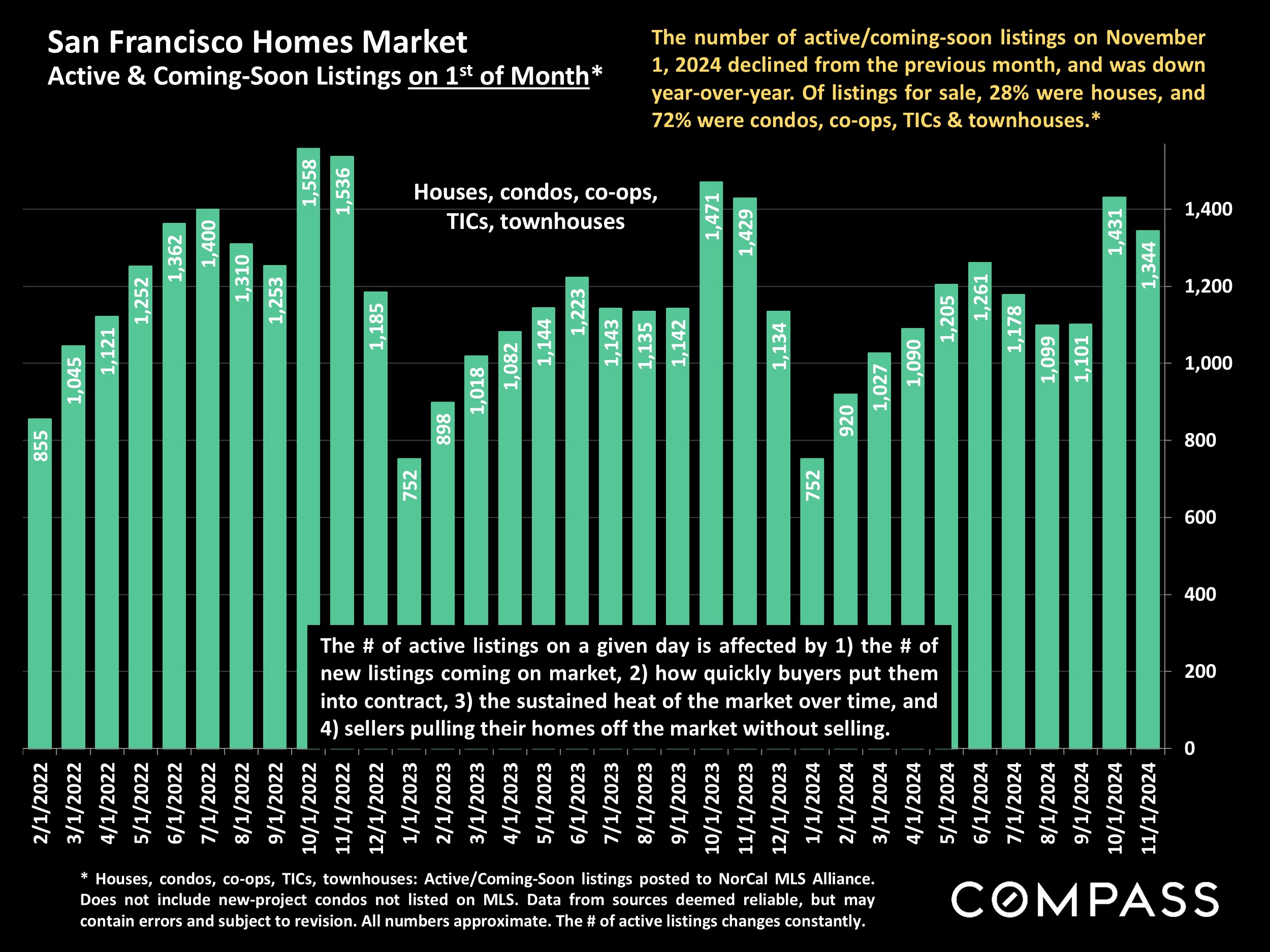

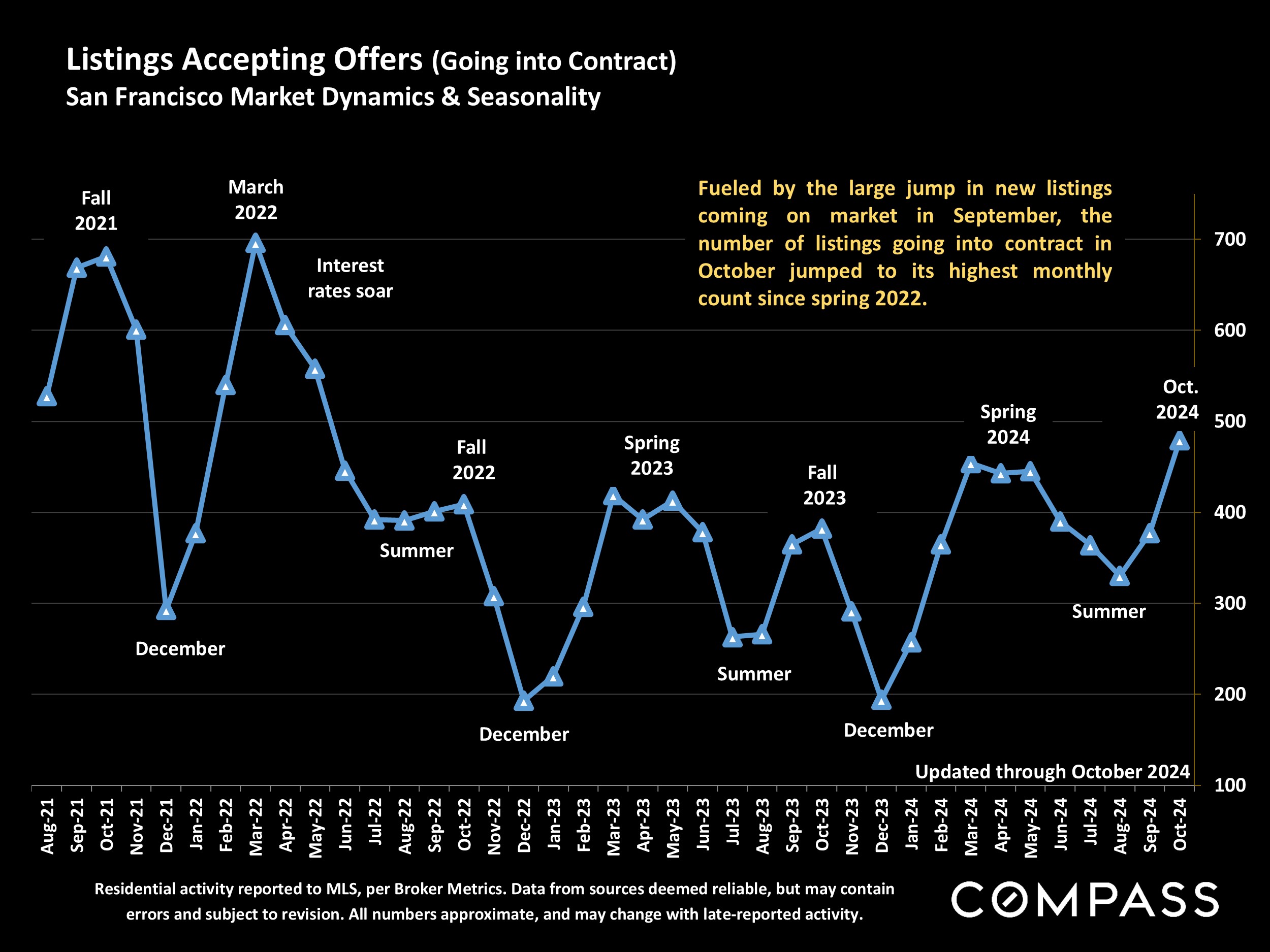

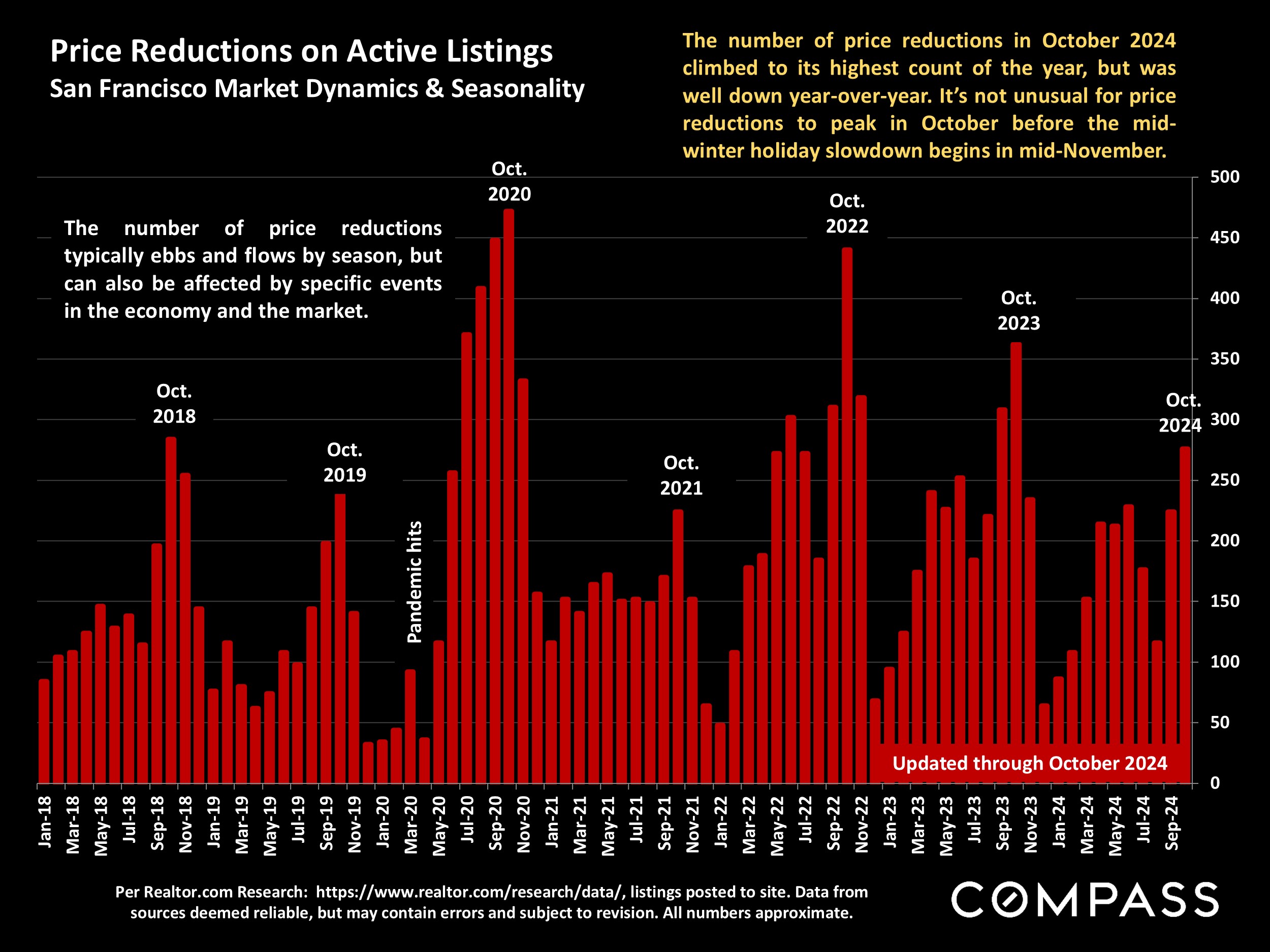

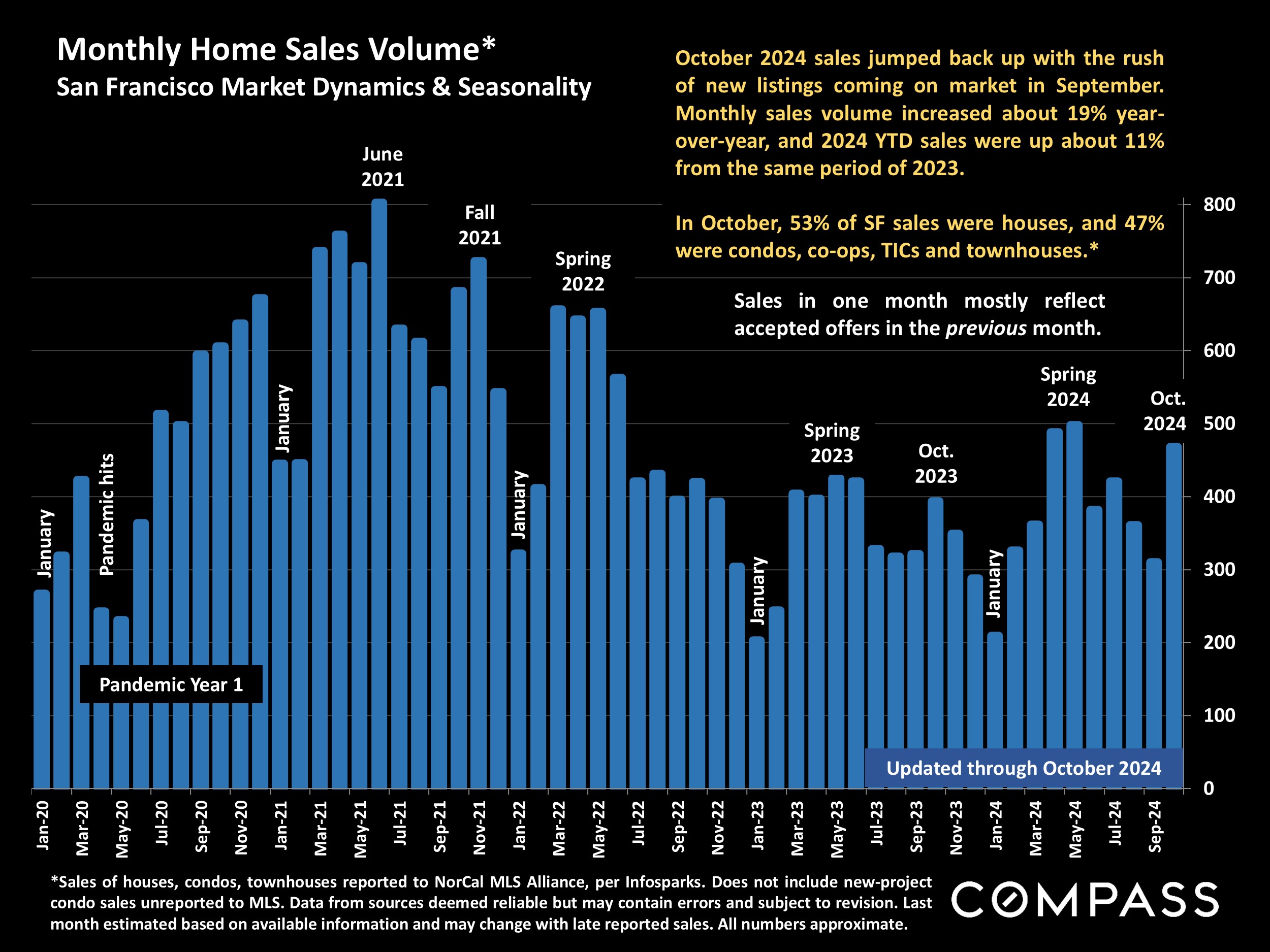

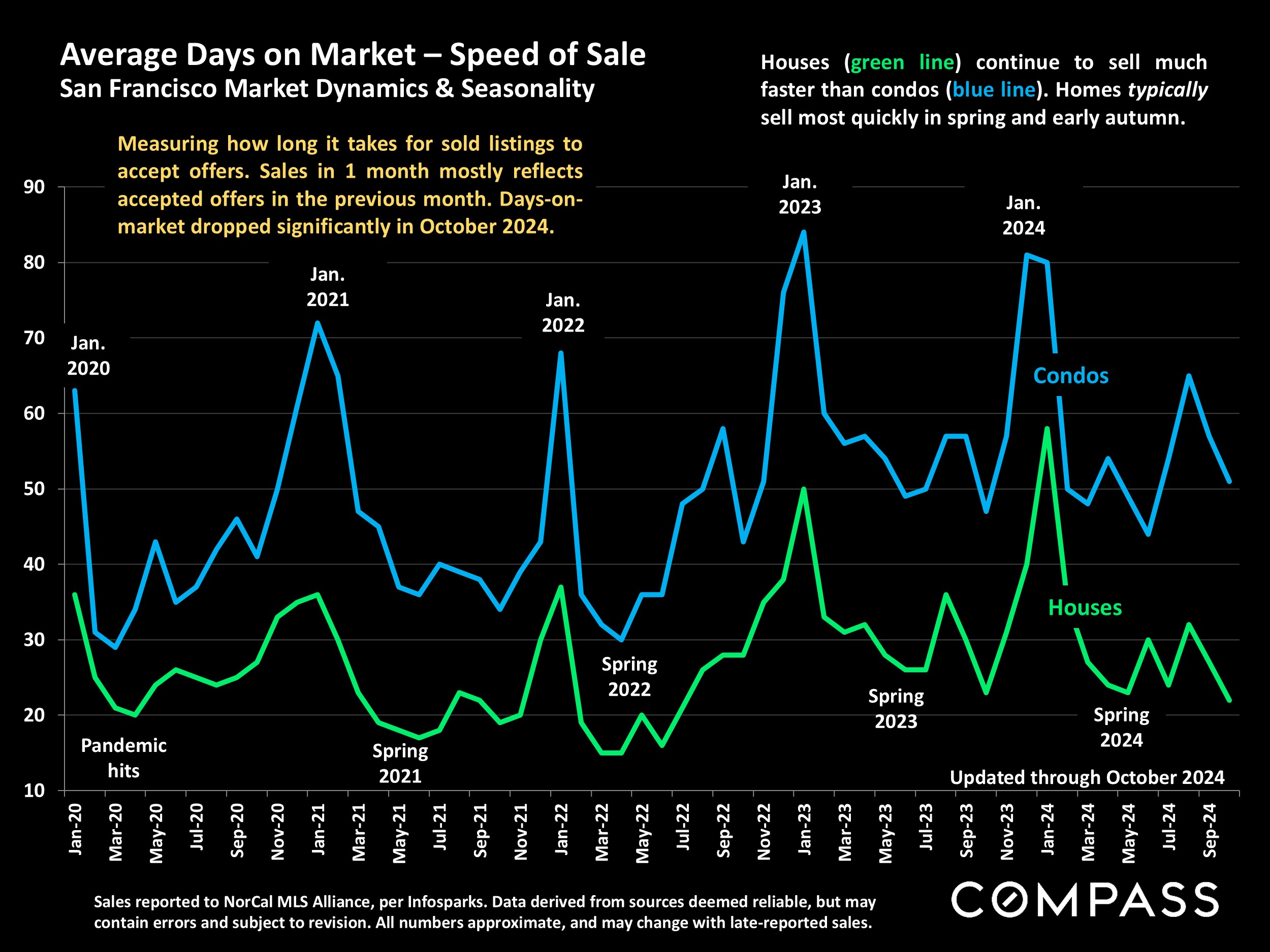

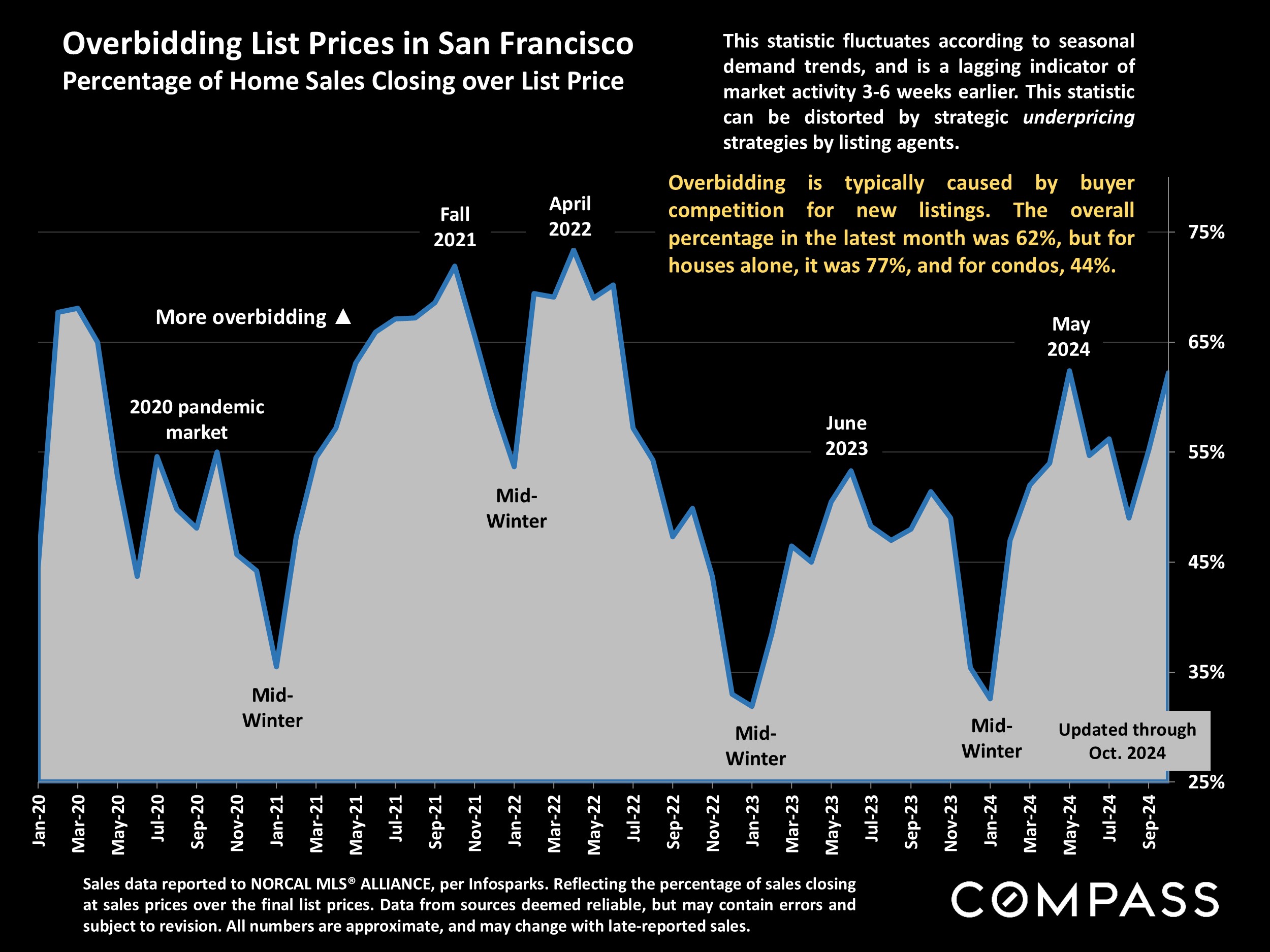

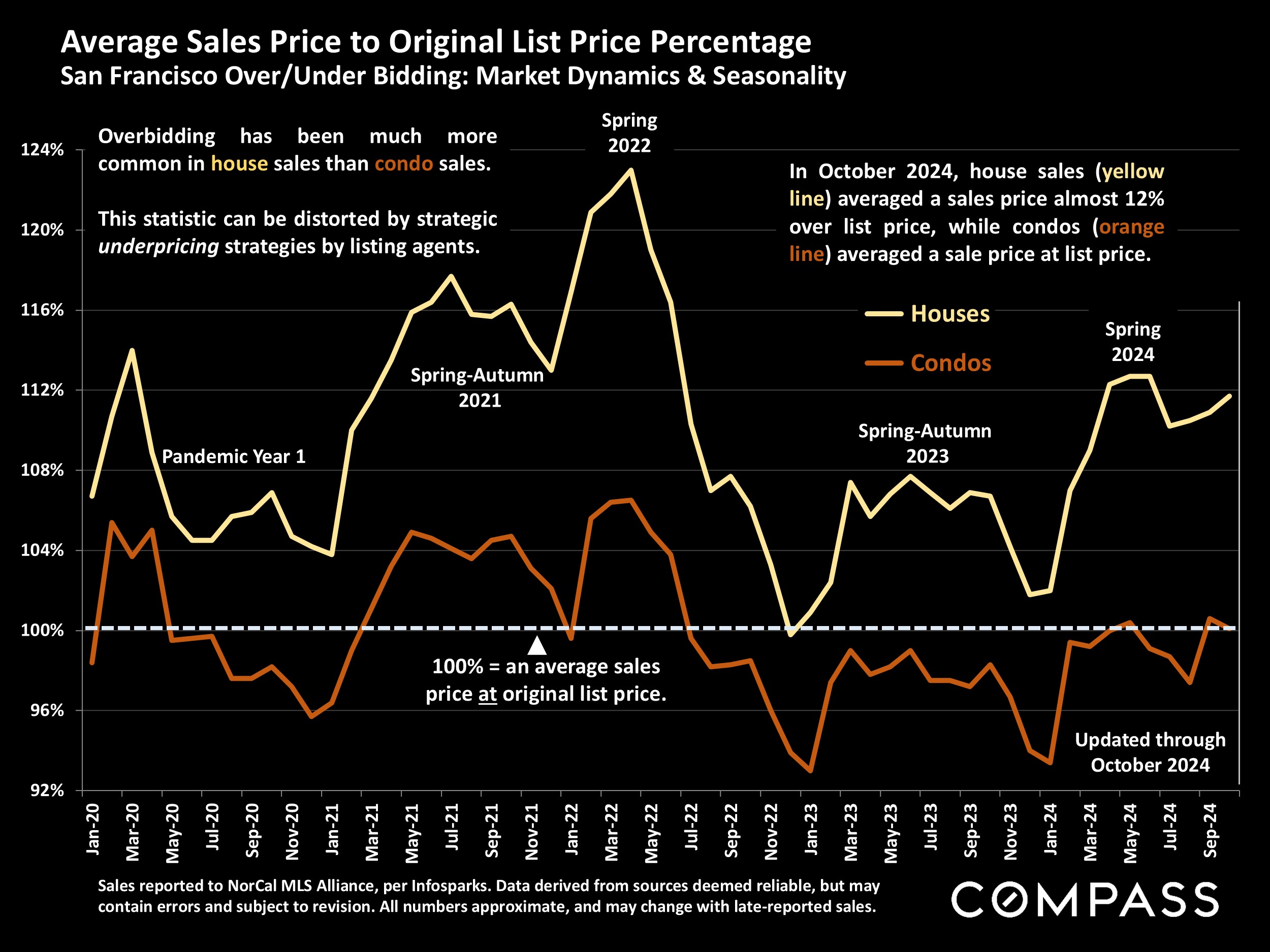

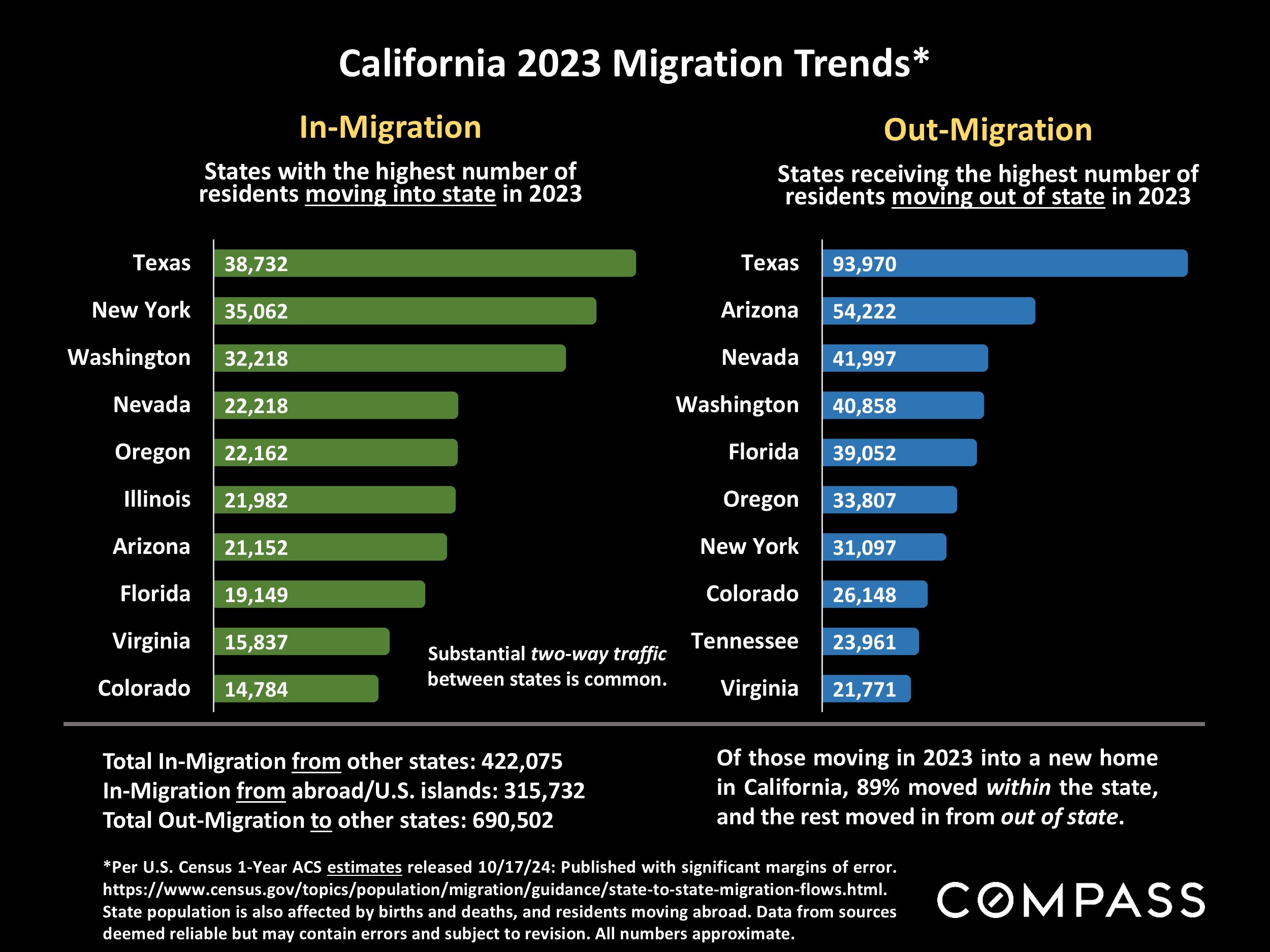

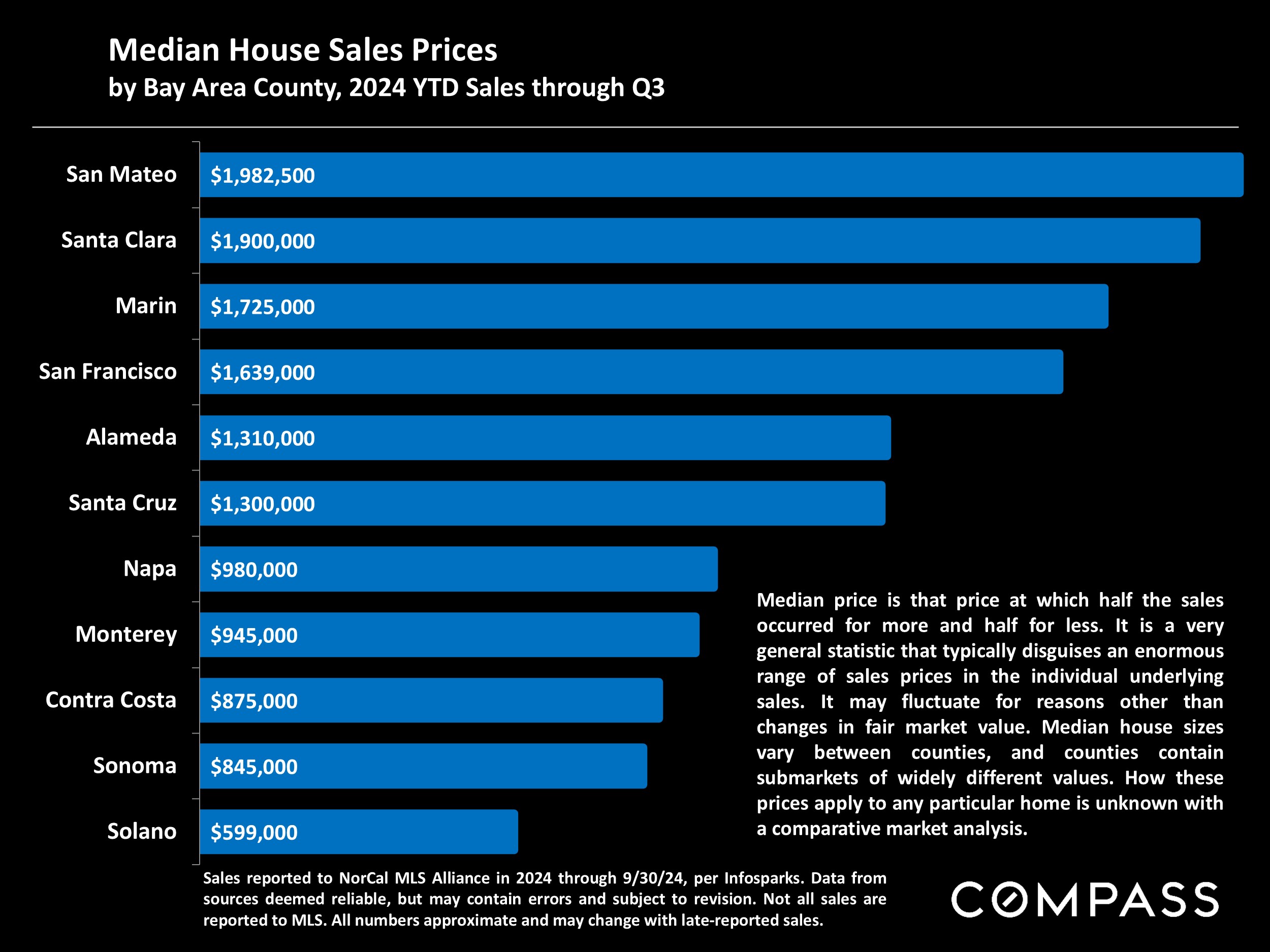

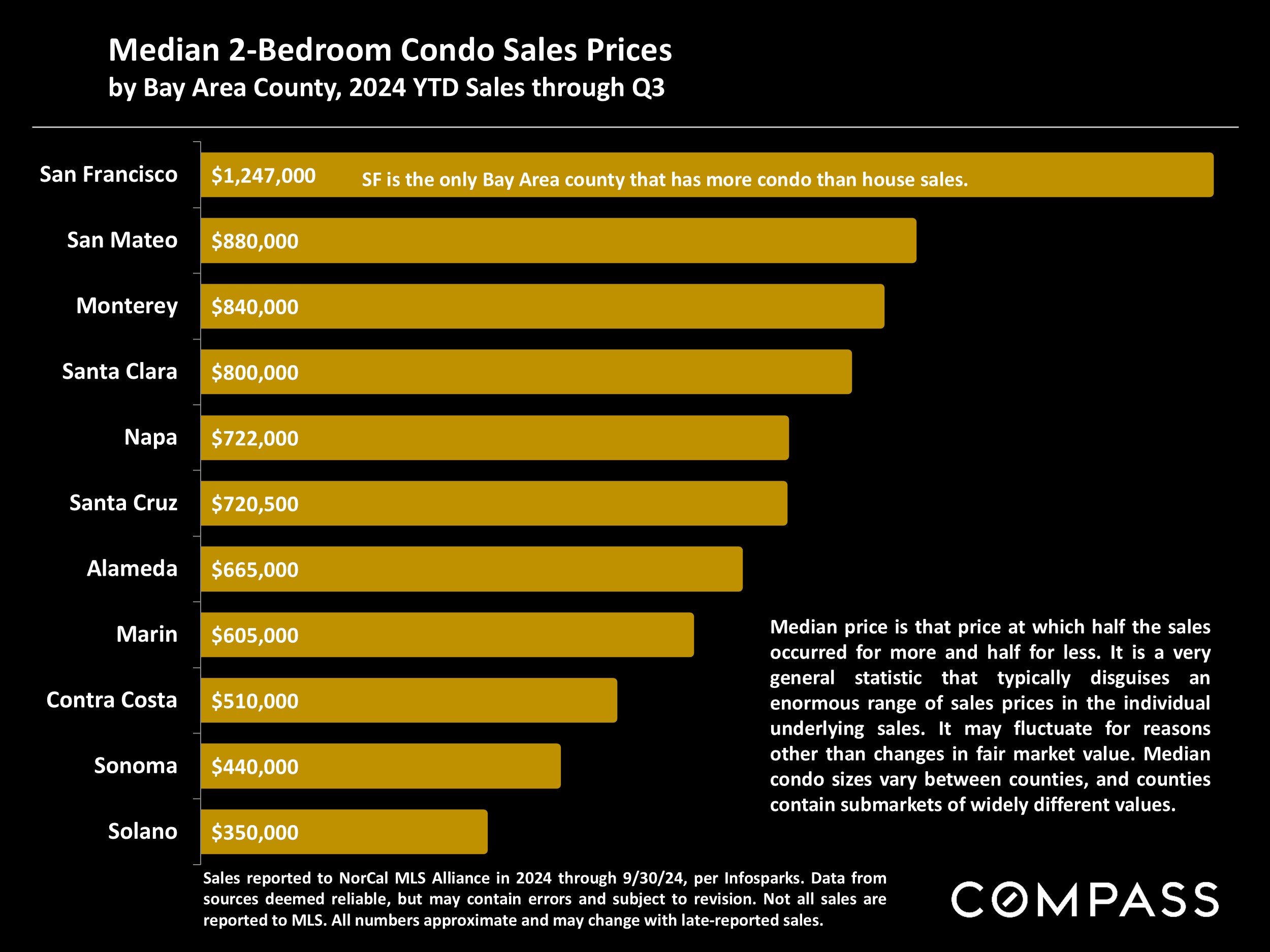

Year over year, median house and condo sales prices were up in October 2024, 2% and 5.5% respectively. Fueled by the large jump in new listings in September, sales activity - as measured by the number of listings that went into contract - hit its highest point since spring 2022. The absorption rate, which measures buyer demand vs. the supply of homes for sale, hit its highest percentage since spring 2022. Monthly sales volume was up 19% year-over-year, and year-to-date sales were up 11%. Days-on-market declined and overbidding increased. The number of price reductions in October 2024 climbed to its highest count of the year - the typical seasonal trend - but was well down year-over-year.

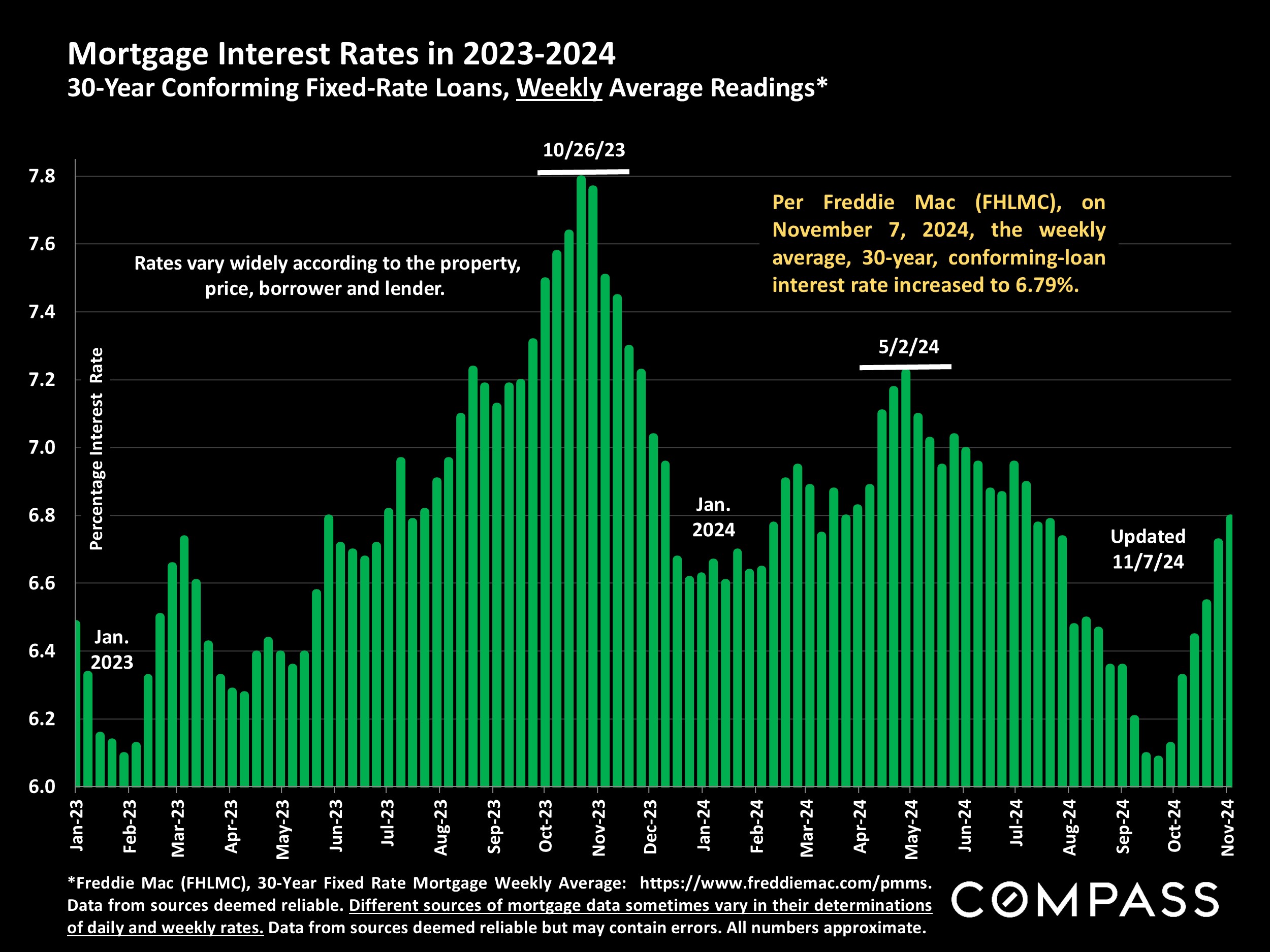

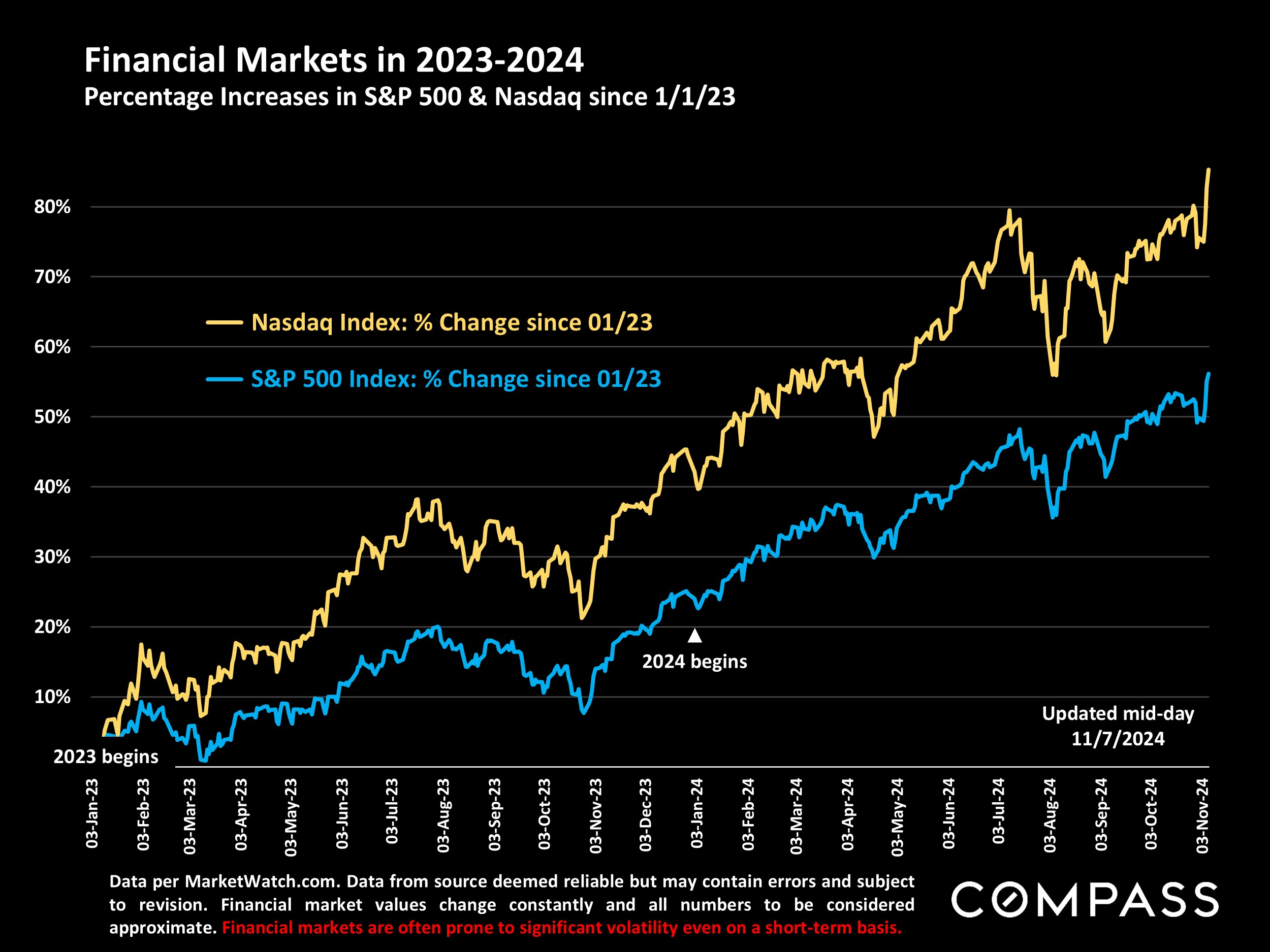

Interest rates continued to rise in October and early November, but, as of November 6th, all 3 major stock market indices were at record highs. These 2 financial indicators - the first one typically having negative implications for buyer demand, and the second one positive - may pull different market segments in different directions in the coming months.

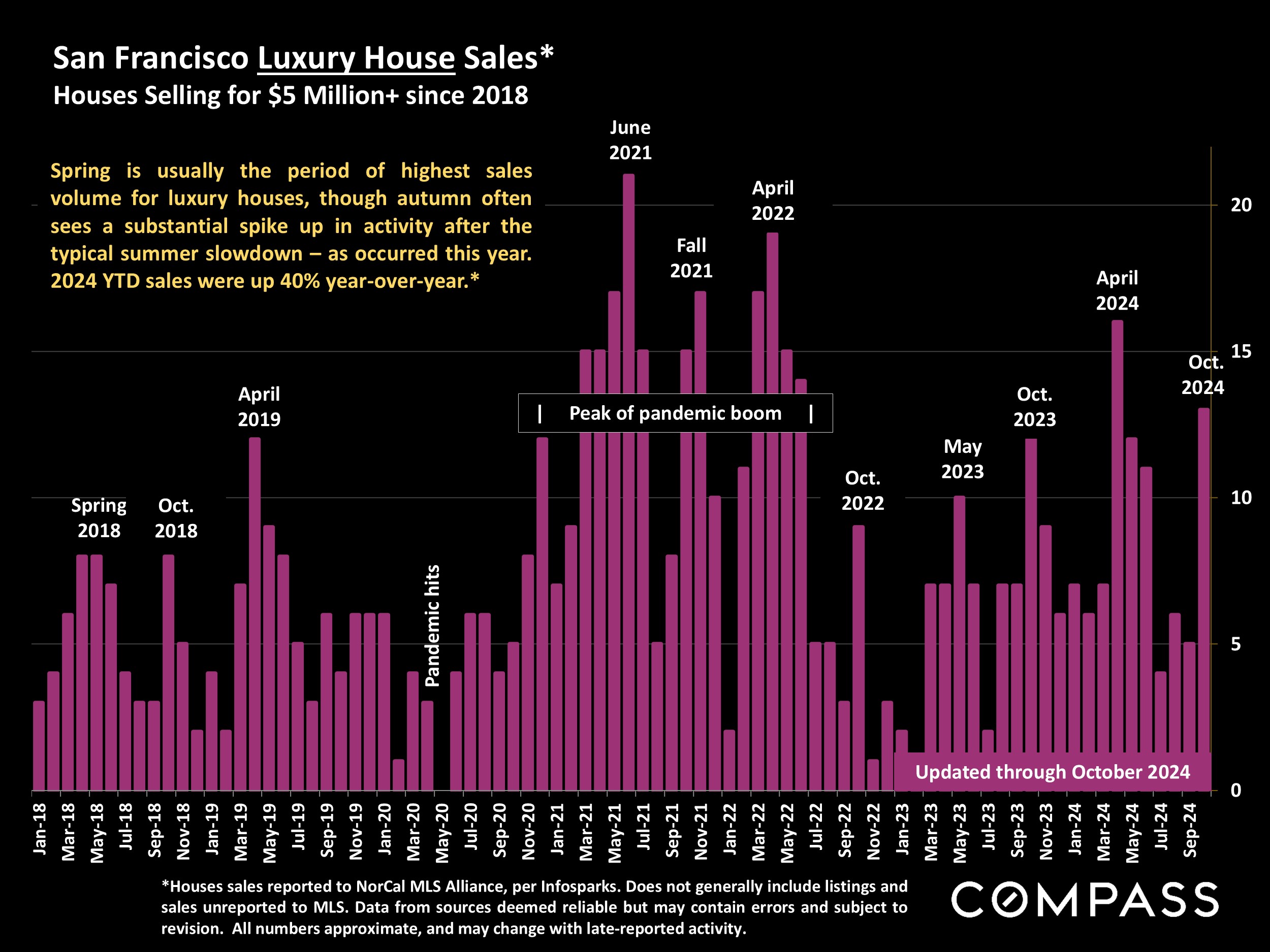

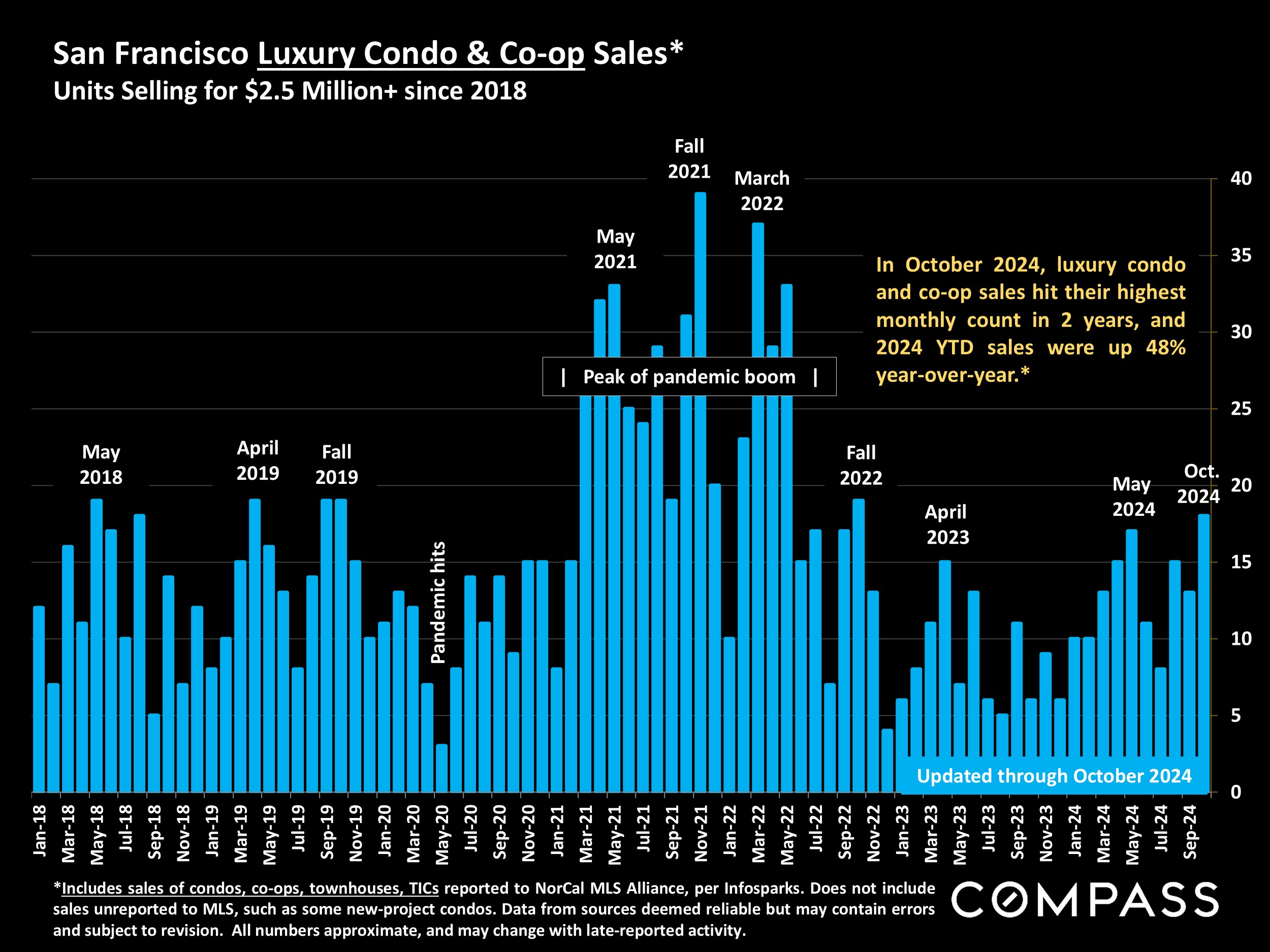

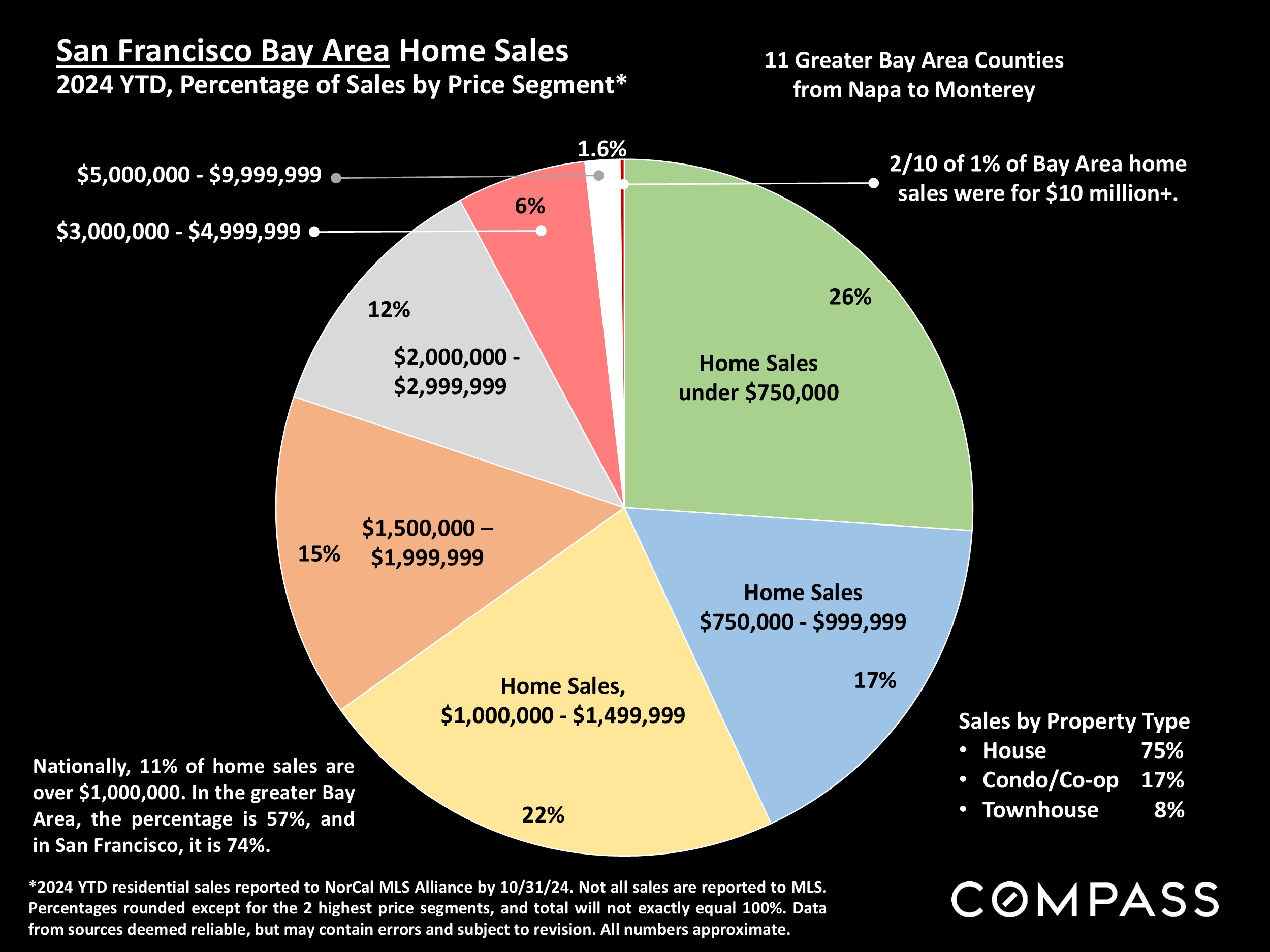

Luxury house and condo sales rebounded in October, and in 2024 year-to-date sales of luxury houses ($5 million+) were up 40%, and luxury condo and co-op sales ($2.5 million+) were up 48%. Possibly reflecting 2024's soaring stock markets, increases in luxury home sales have far outperformed the overall market this year.

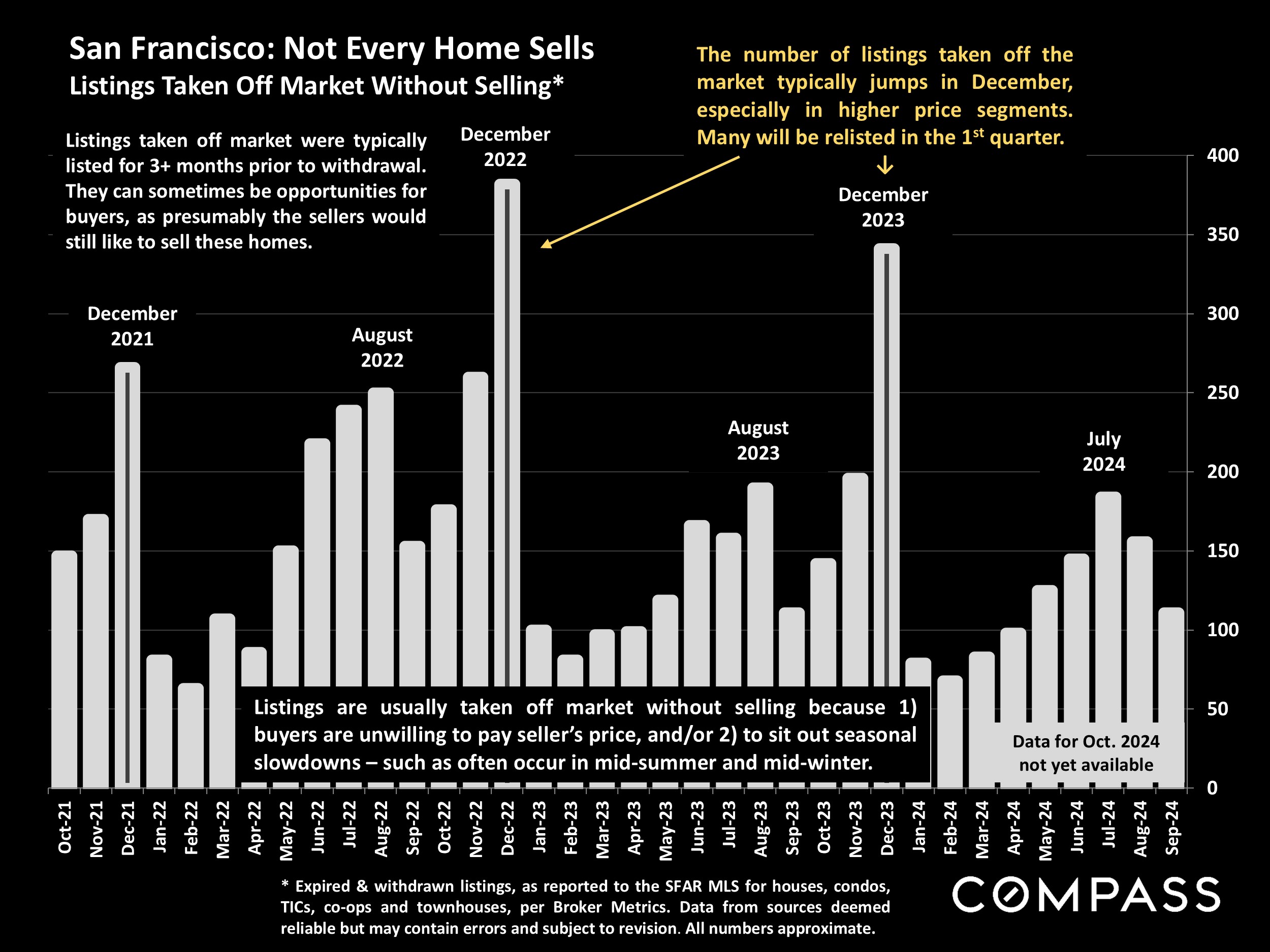

Listing and sales activity, as well as virtually all the standard metrics of demand, typically cool dramatically in November and December, and the number of unsold listings taken off the market usually jumps, especially in higher price segments. Still, the next 2 months can be an excellent time for buyers to negotiate more aggressively to make some of the best deals of the year.

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact