October 10, 2023

SF: October 2023 Market Stats

By Compass

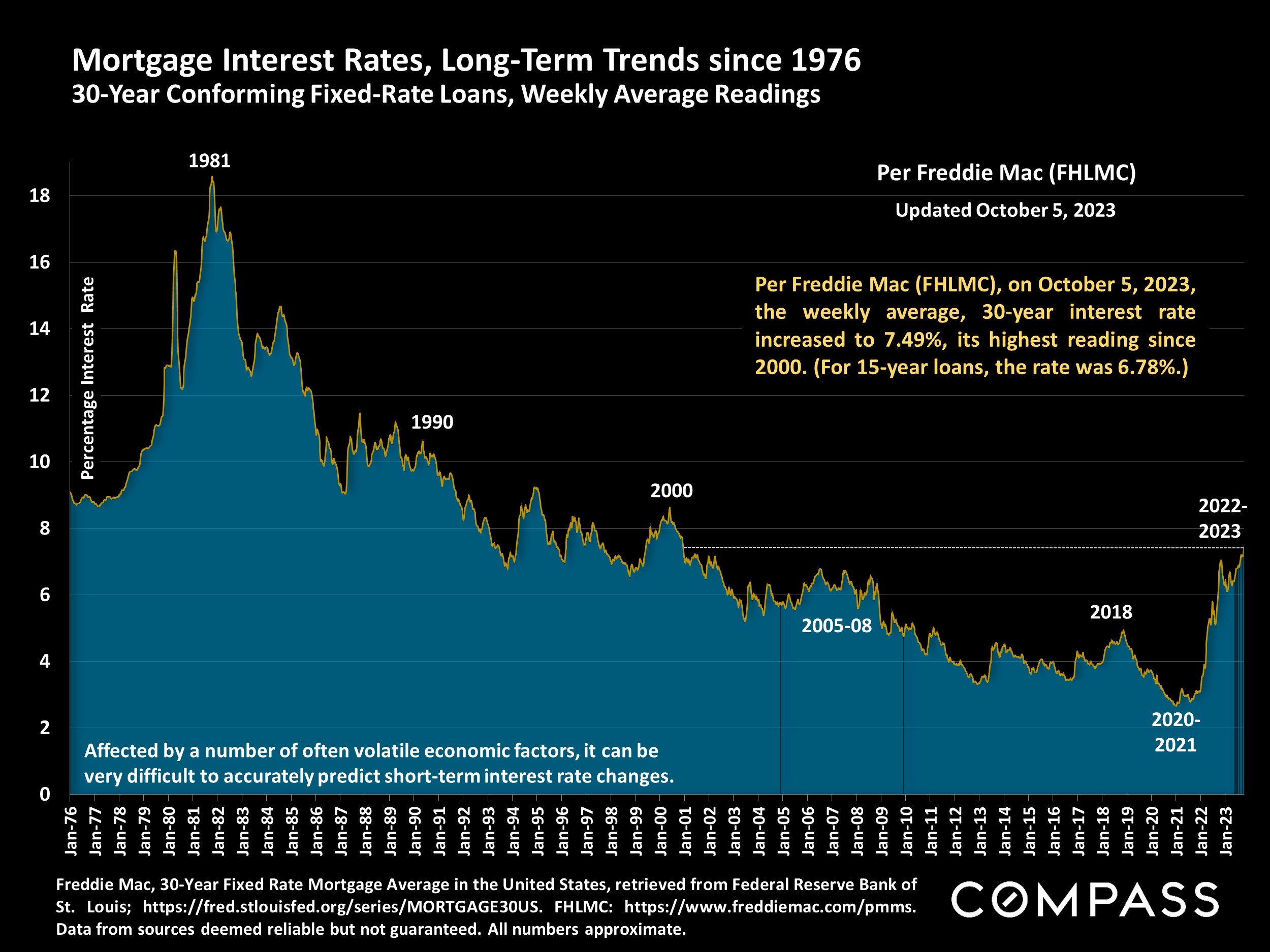

Economic indicators have been challenging since the fall selling season began: Interest rates continued to rise through early October and stock markets generally continued to fall from mid-summer, YTD highs. Markets remain volatile and hard to predict, often reacting negatively to positive economic news (such as employment numbers) as they wait for new inflation numbers and try to parse the possible reaction of the Fed. Any definitive impacts on real estate of these recent developments, should they continue, won't substantially show up until Q4 data begins to become available, and, of course, volatility also means that indicators can turn around quickly.

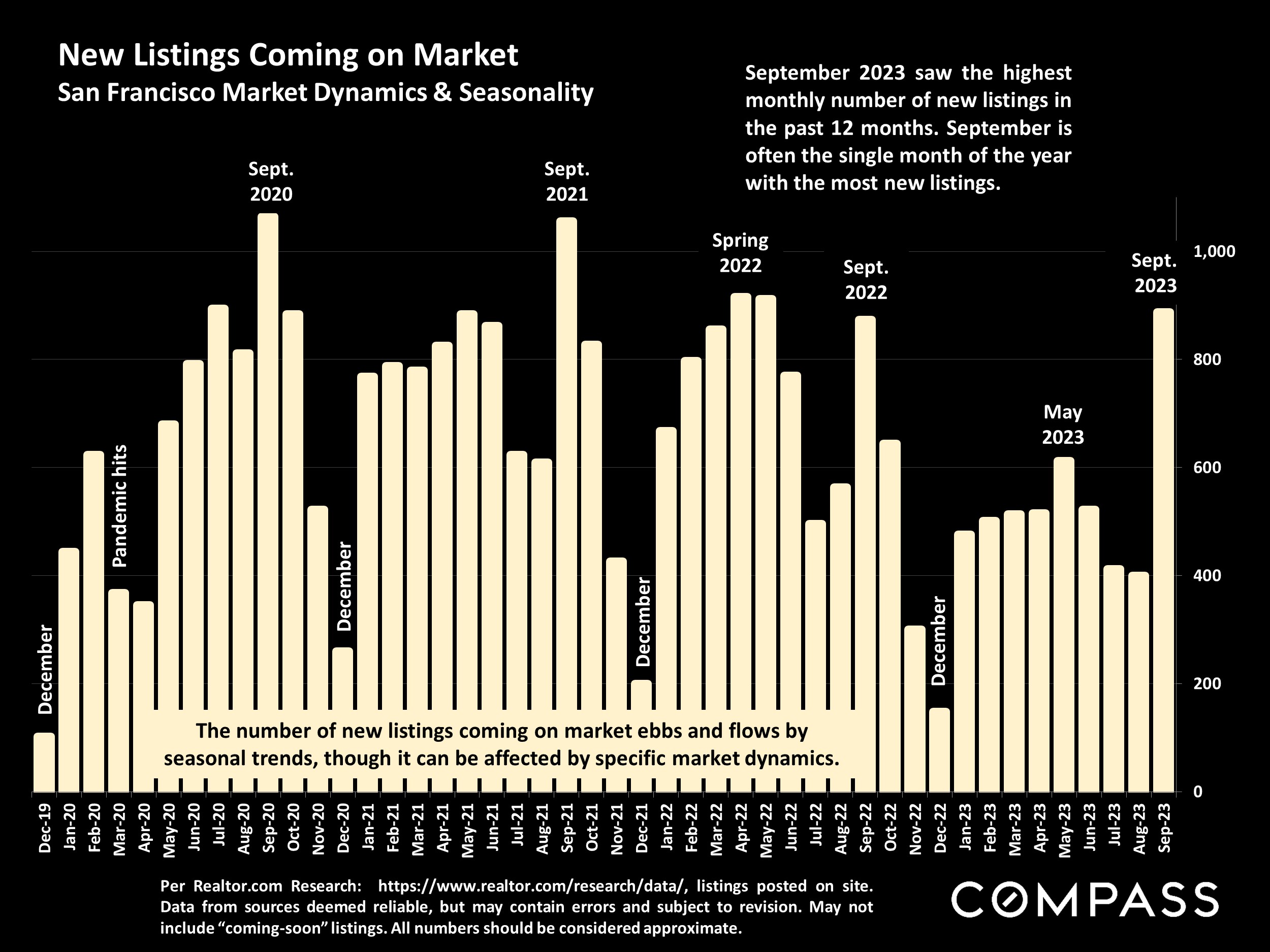

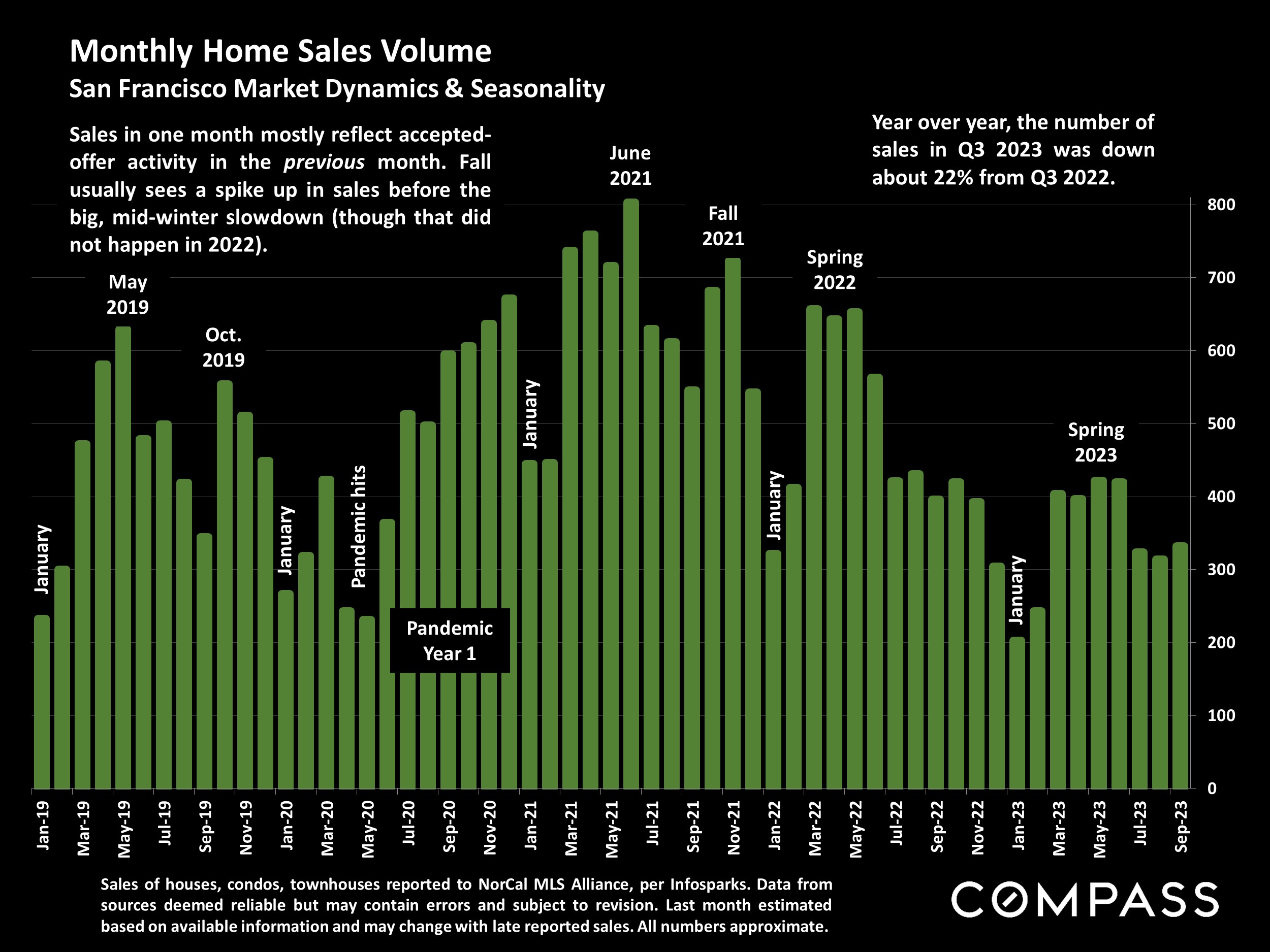

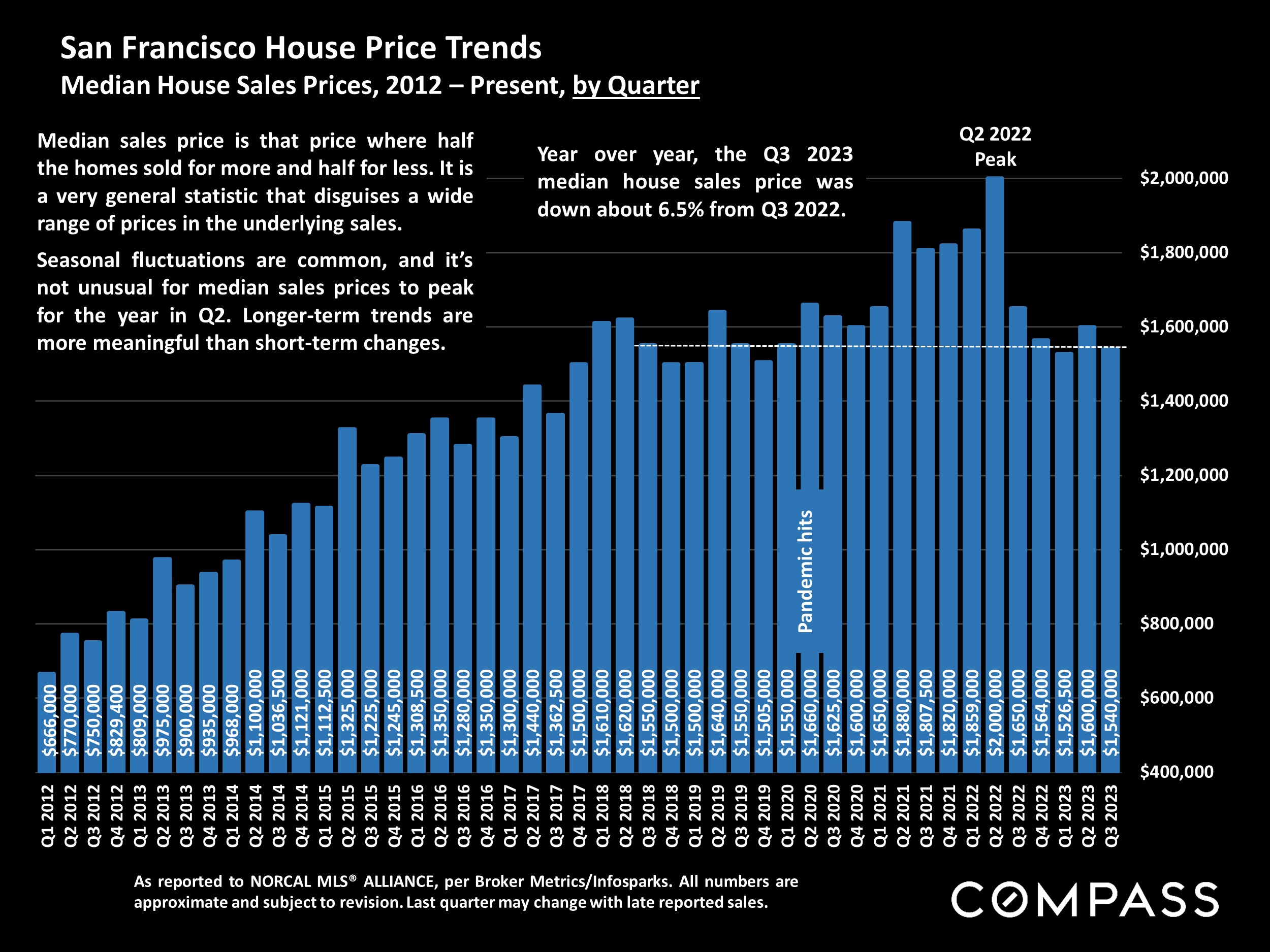

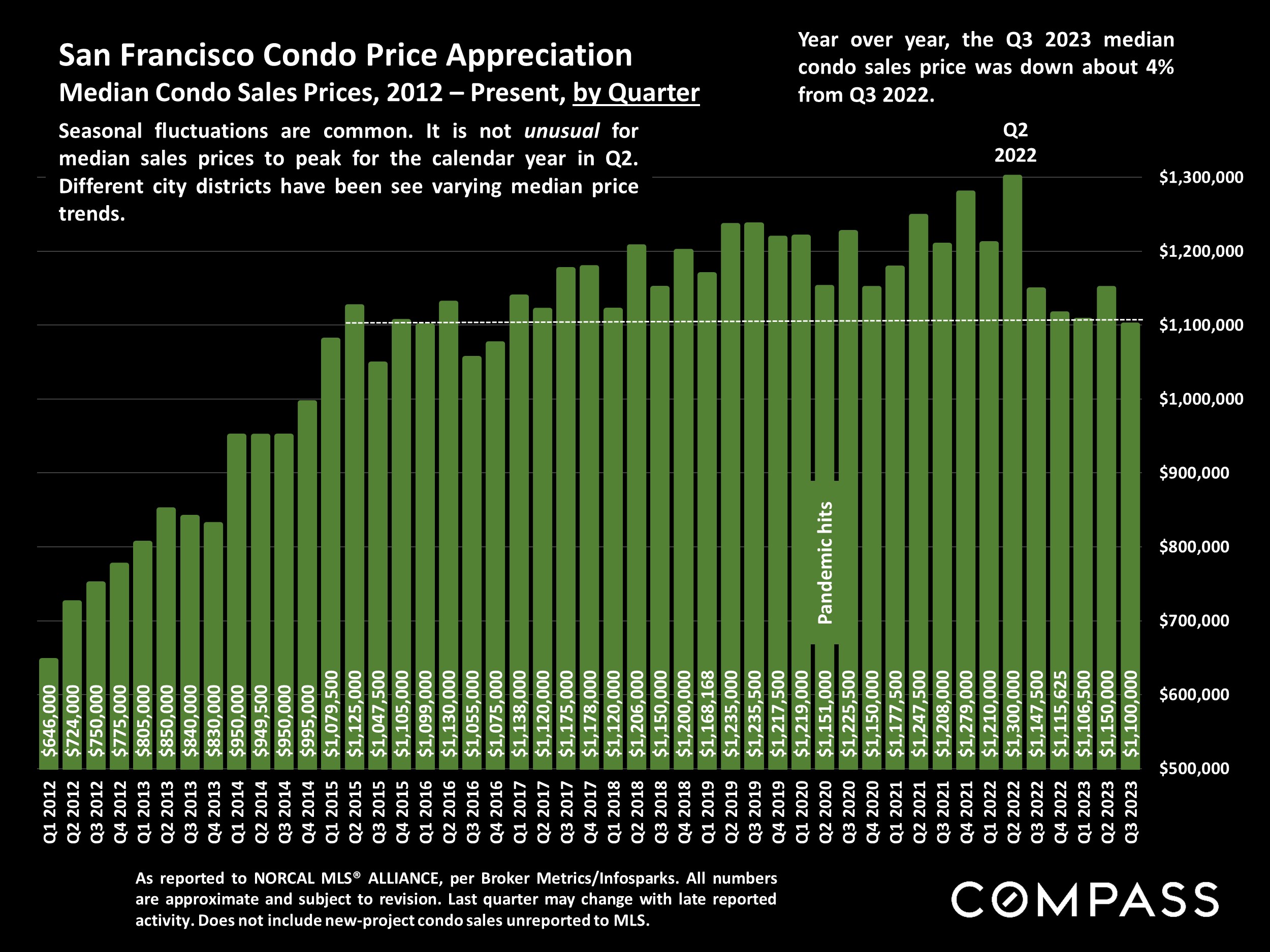

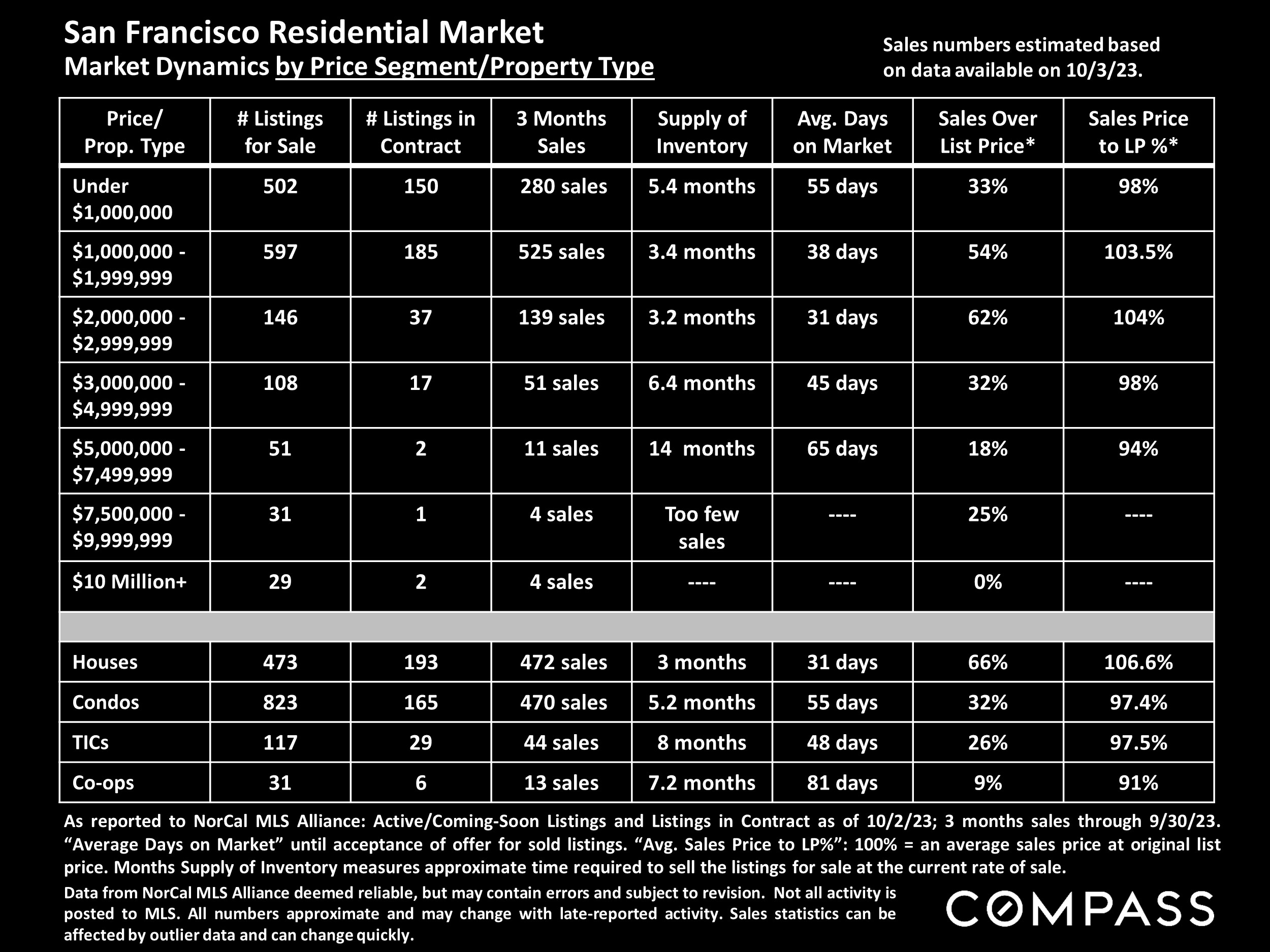

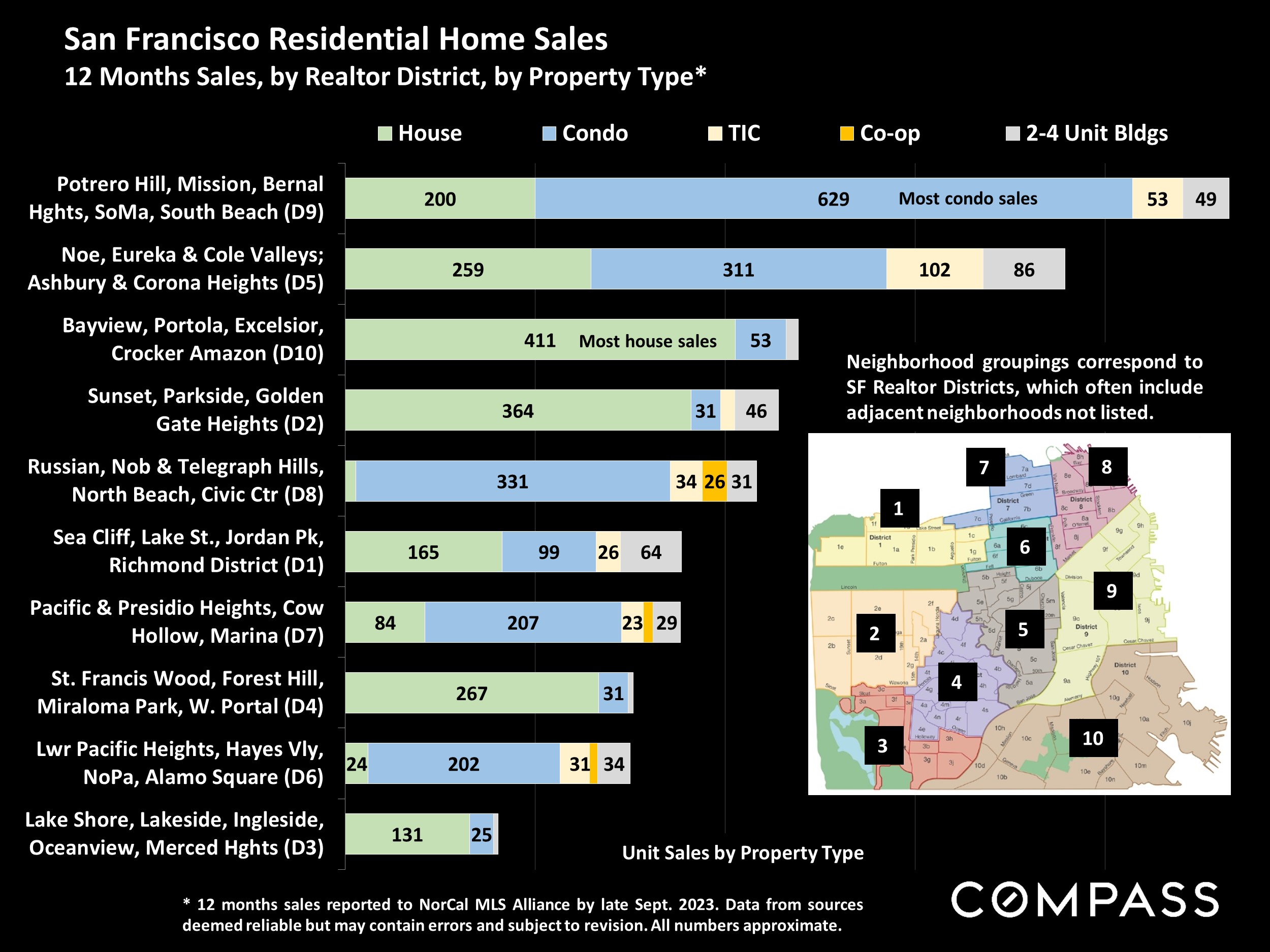

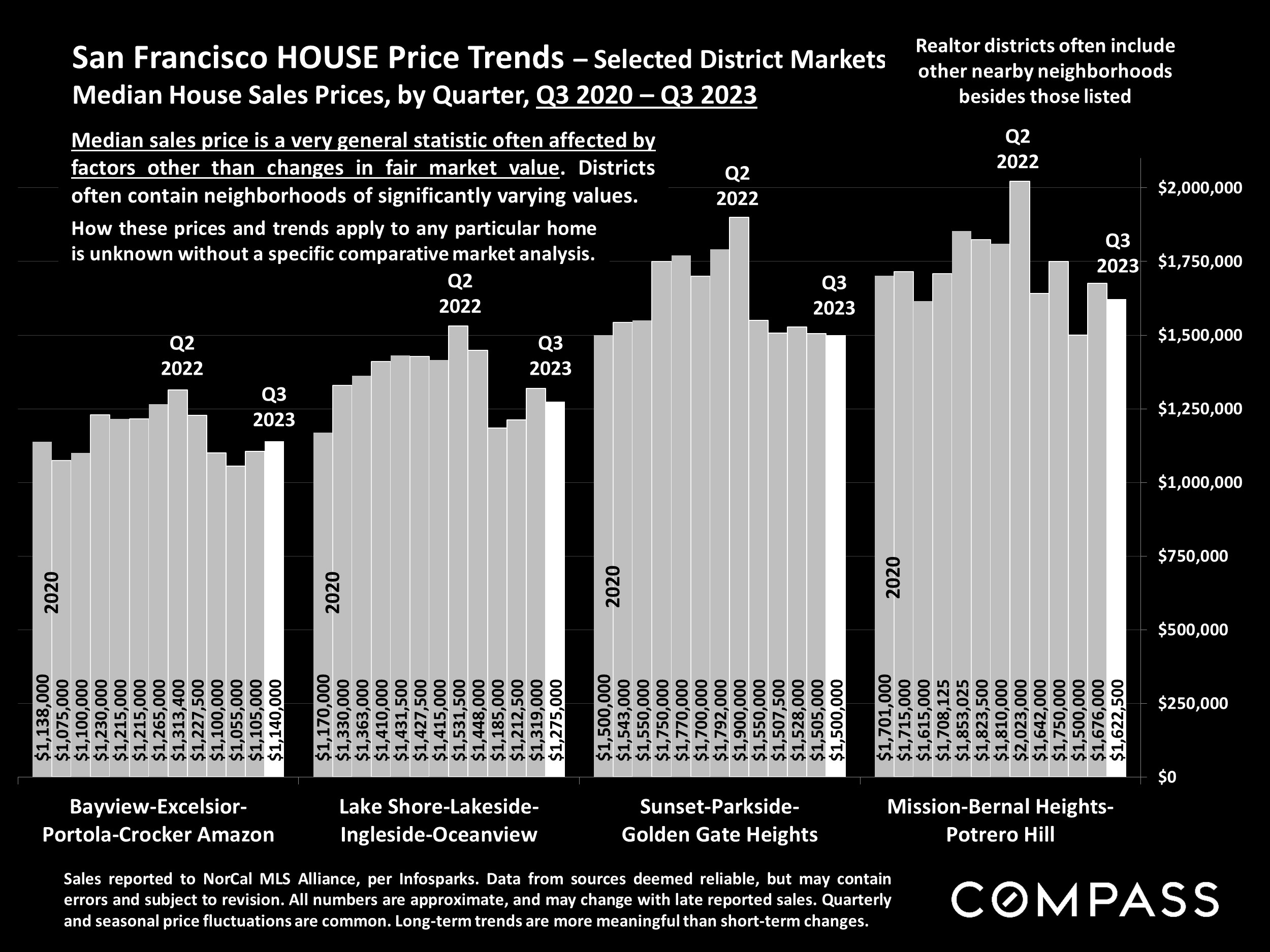

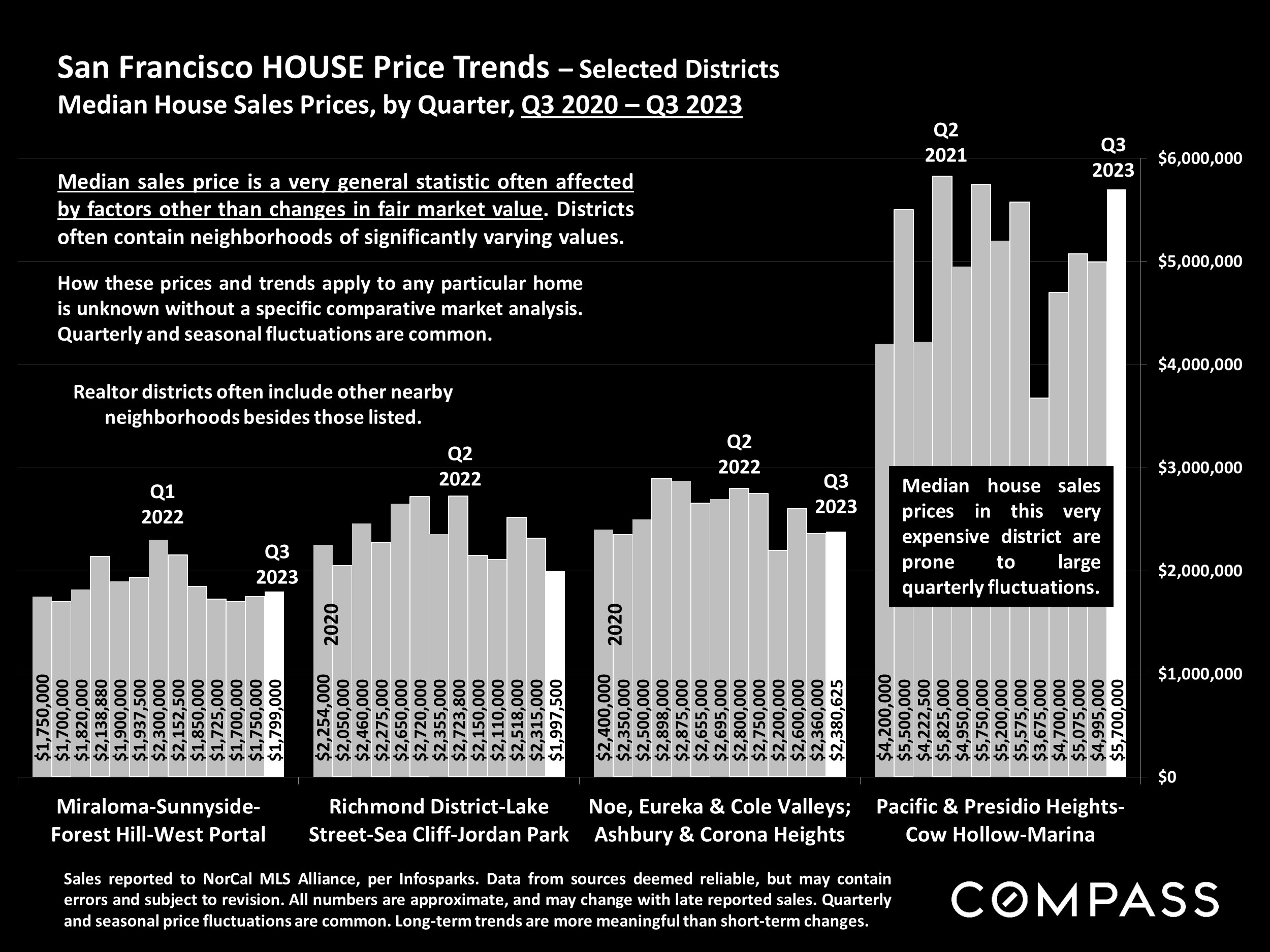

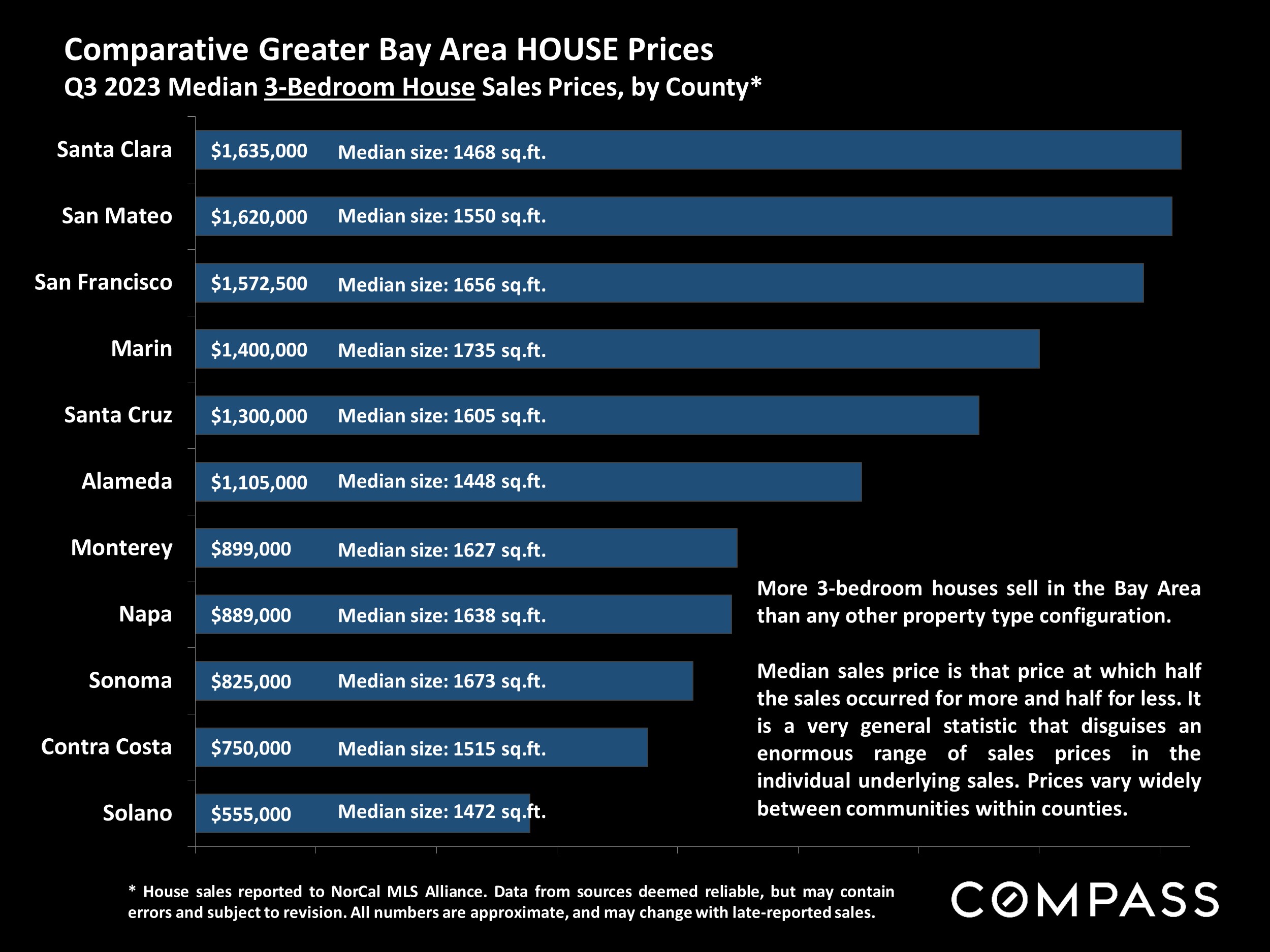

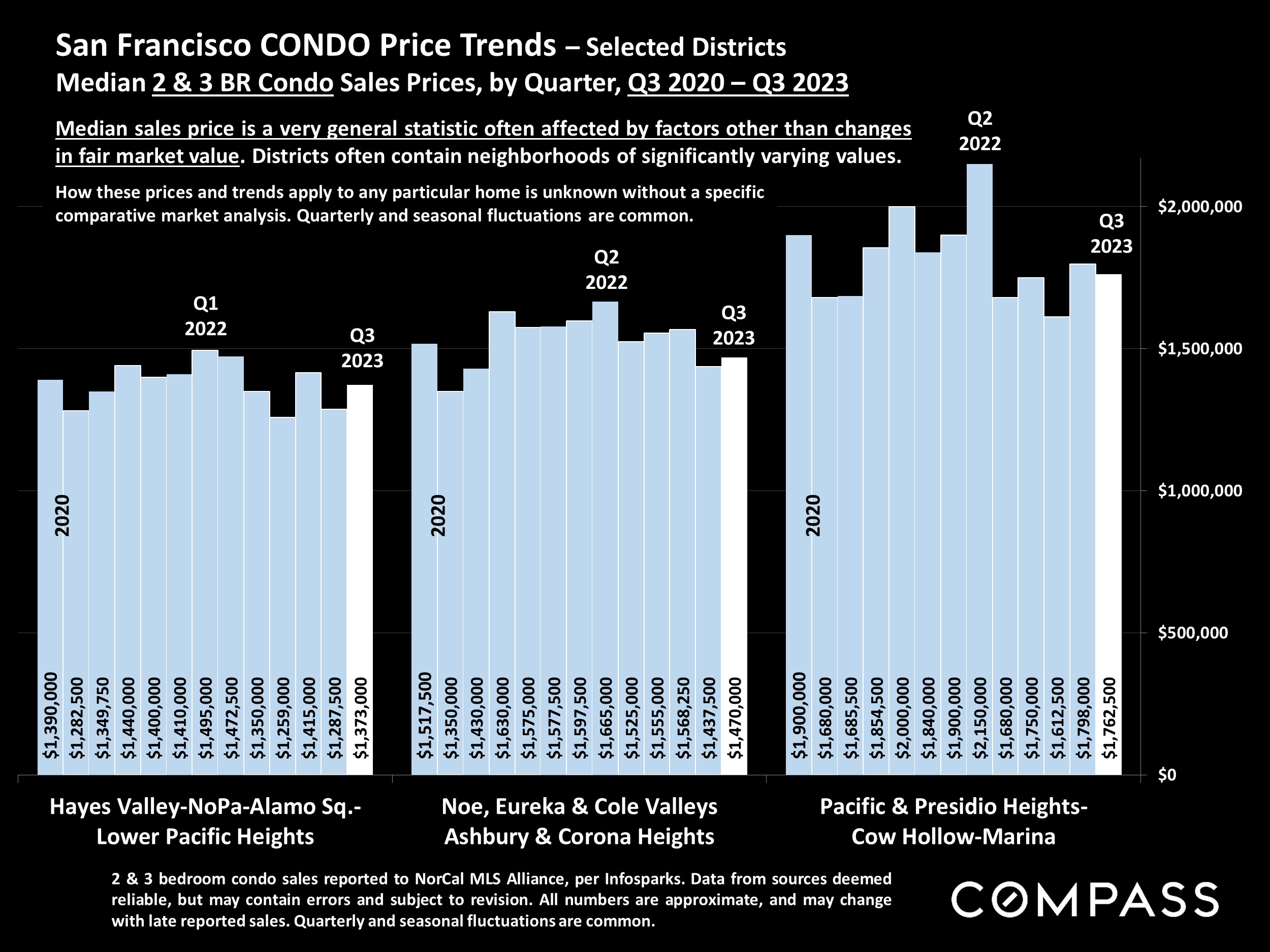

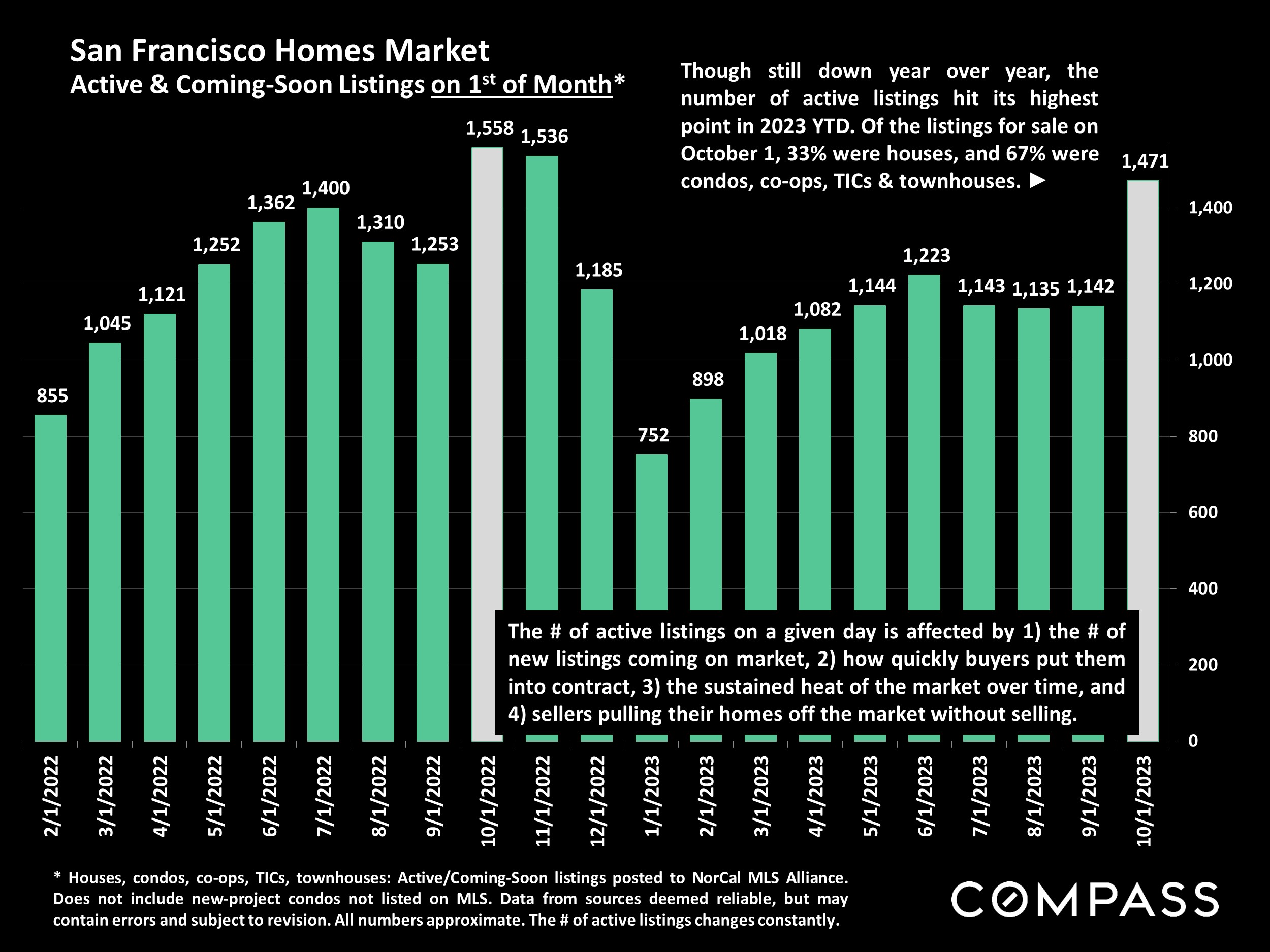

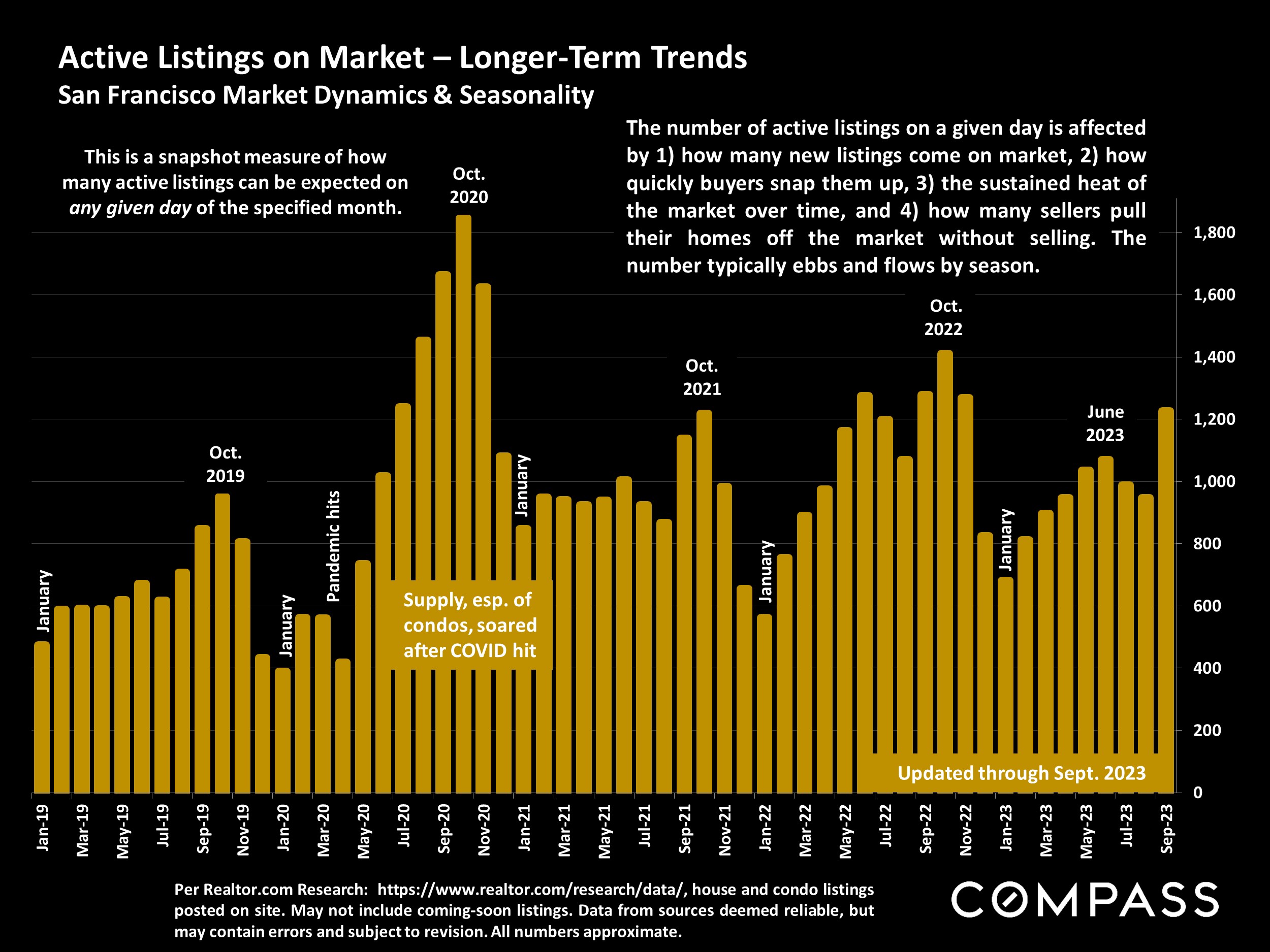

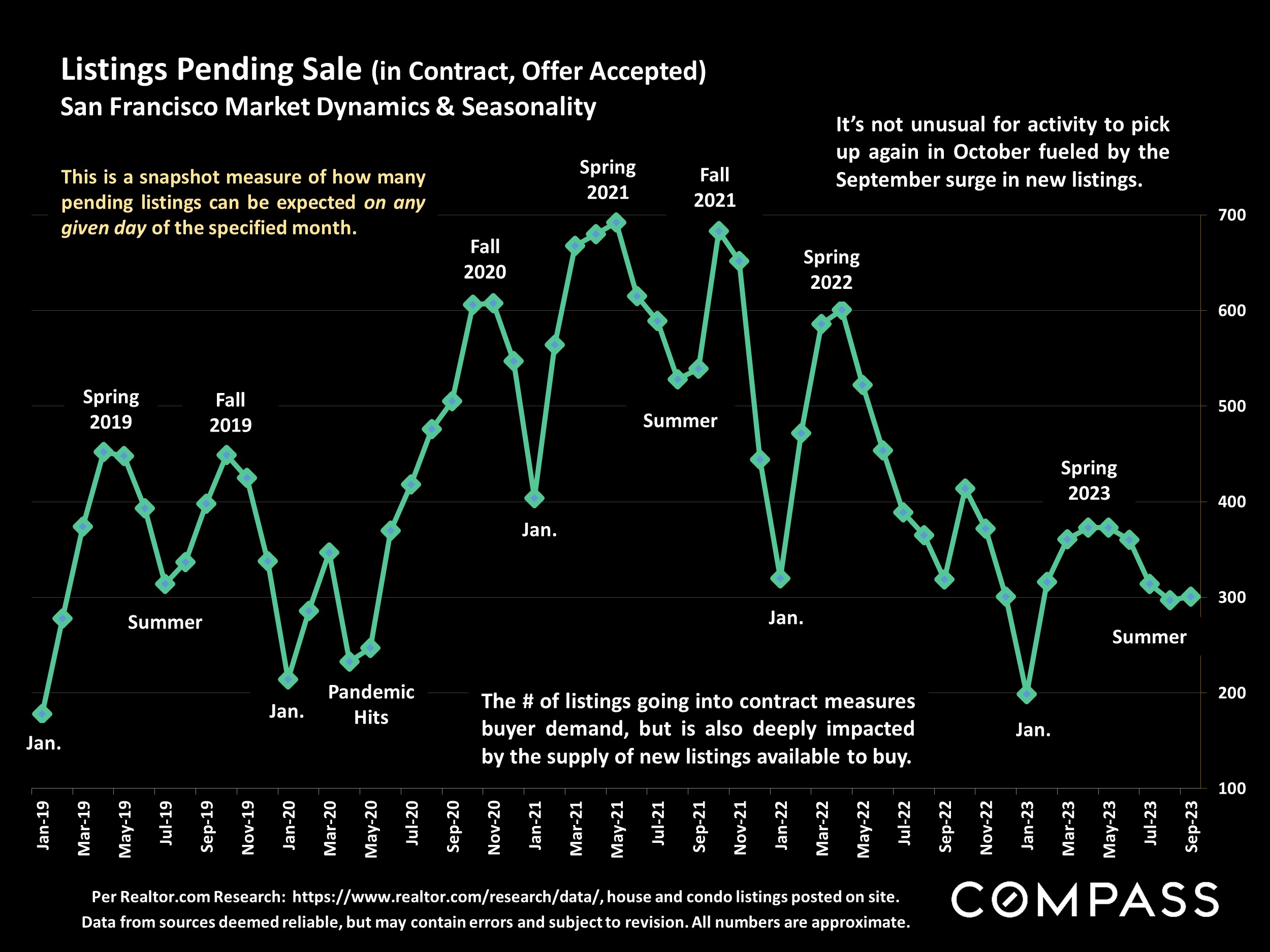

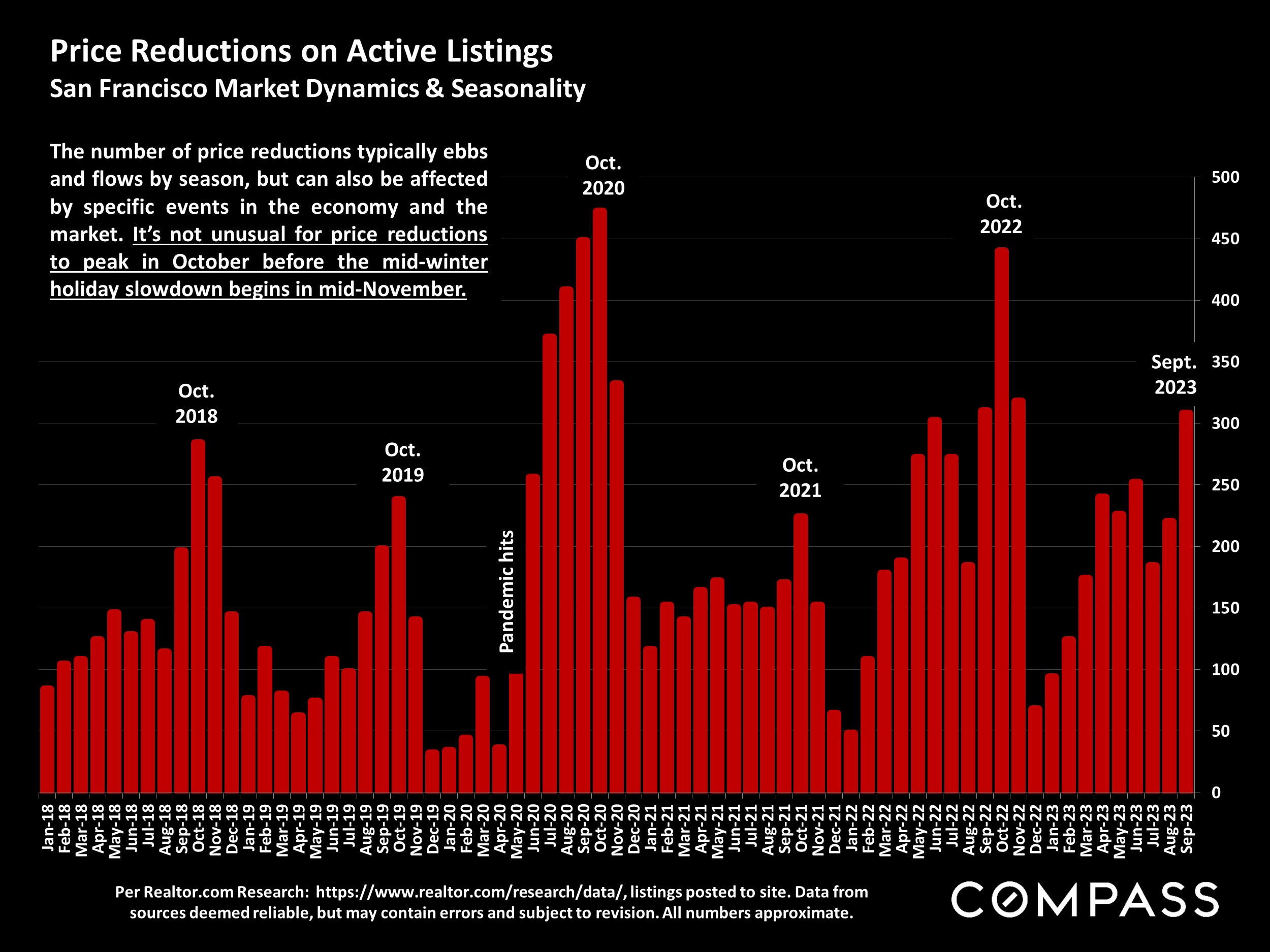

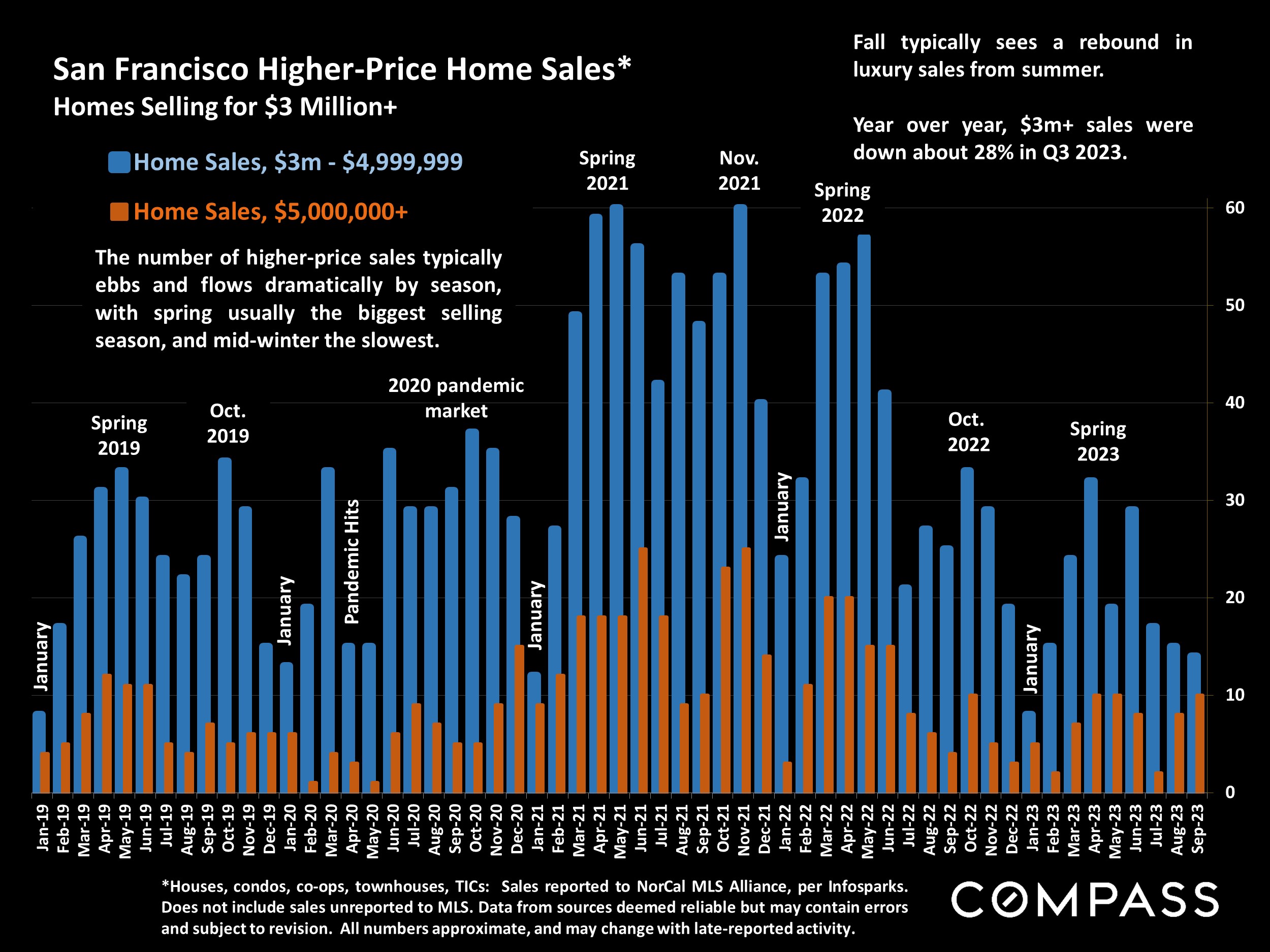

In the meantime, the Q3 median house sales price was down about 6.5% from Q3 2022, and the median condo price down about 4%, but we expect the year-over-year price declines to disappear in the coming months. The number of new listings jumped dramatically in September and the total supply of listings for sale just hit a YTD high: This may lead to a substantial increase in sales in October. Supply and demand dynamics remain stronger for houses than for condos, and the downtown condo market is softer than condo markets in other districts of the city. Year over year, the number of home sales in Q3 was down about 22%.

The CA Association of Realtors® (CAR) recently issued their initial 2024 market forecast:

"California housing market will rebound in 2024"

CAR forecast: Existing, single-family home sales will increase in 2024 by approximately 23 percent, and the CA median home price is expected to climb by 6.2%. The average 30-year, fixed mortgage interest rate is projected to decline to 6%. Housing supply will remain below normal despite a 10% to 20% increase in active listings, as market conditions and the lending environment continue to improve. [However] the percentage of CA households able to purchase a median-priced single-family dwelling will remain very low by long-term standards. CAR Chief Economist, 9/20/23

Want to learn more about Bay Area market trends?

Let’s connect! With relationships and networks across the city, there are a variety of ways I can help you make informed real estate decisions. Call, email, or text – I’m here to help.

Contact